Mortgage Fraud: Too Big to Jail – Bank of America’s Sweetheart Settlement with US Department of Justice

The $16.7 billion price tag is a deception. A majority of the money is either tax deductible or designed to support BoA while costing it nothing. Forbesmagazine noted that the actual cost is “minimal compared with the relief of having a major piece of outstanding legal risk moved into the rearview mirror.” It wrote that the bank will only be hit with a $4.5 billion dollar setback in third-quarter earnings.

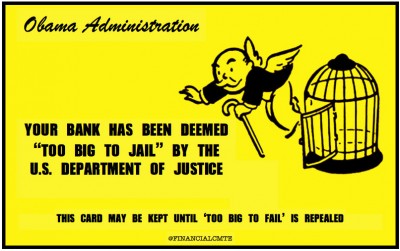

In exchange, the bank’s top executives will be virtually immune from prosecution. The settlement follows several other back-door agreements between the Obama administration and Wall Street’s top banks, including JP Morgan Chase’s $13 billion settlement, which had been the largest before yesterday’s announcement.

US Attorney General Eric Holder described the deal as a “historic step forward in our ongoing effort to protect the American people from financial fraud.” He claimed that the deal would “hold accountable those whose actions threatened the integrity of our financial markets and undermined the stability of our economy.”

Wall Street investors rendered their own verdict on the deal by sending Bank of America shares up 4 percent.

The Associate Attorney General, Tony West, speaking alongside Holder, said, “This morning we demonstrate once again that no institution is either too big or too powerful to escape appropriate enforcement action by the Department of Justice.” West suggested that the key concern of the DOJ is not justice but public relations. He stated, “But the significance of this settlement lies not just in its size; this agreement is notable because it achieves real accountability for the American people.”

The deal in no way holds accountable the top bankers of BoA. For starters, the settlement does not reveal any significant facts about what happened and who was responsible for it. No individual bankers are taken to task, let alone fingered for prosecution. The deal, like its predecessors, was worked out in secrecy between the Obama administration and the bank. As in the previously record deal with JP Morgan Chase, BoA will continue to be given implicit immunity from criminal prosecution.

According to Dennis Kelleher, CEO of Better Markets, the settlement “conceals the key facts from the American people.” Kelleher continues in his press statement, “Banks do not commit crimes; bankers do. Until those individuals, including executives are held personally and meaningfully accountable, everyone should expect more crime from Wall Street.”

Kelleher asks, “How many tens of billions of dollars did Bank of America’s customers, clients, investors and others lose due to years of knowing, systemic fraud? How much did Bank of America make from its illegal actions? How many Bank of America employees, supervisors and executives were involved in or aware of the fraudulent conduct? How many still work at the bank? How much of the tens of billions in bonuses paid to those individuals was the result of the illegal conduct?”

Kelleher concludes, “DOJ allowing banks to use shareholders’ money that is tax deductible while concealing illegal conduct and individual involvement is not punishing or deterring crime. In fact, it rewards past crimes and incentivizes future crimes. Trying to trick the American people into thinking they are tough on crime while Wall Street laughs all the way back to the bank is not justice. It creates an indefensible double standard of justice: one for Wall Street and one for everyone else.”

The actual money Bank of America will pay is far less than as advertised by the Obama administration. The $16.7 billion is split up between a $9.56 billion cash settlement and a little more than $7 billion in mortgage relief.

The Financial Post ran an article Wednesday asking how much BoA would actually pay. “The answer,” the paper wrote, is “almost certainly not that much.” The Post noted that while the “figures make sensational headlines for the Justice Department…the true cost to companies is often obscured by potential tax deductions and opaque accounting techniques.”

When it comes to the money set aside for home relief, the Post writes, “Some relief comes from actions that do not cost the banks anything, including making loans in depressed areas or reducing the principal of mortgages owned by outside investors.”

Much of the money tagged to help homeowners will go to programs the bank is already engaged in, because it better ensures the banks will profit off of its customers in the long term. For instance, the Post notes that in JP Morgan Chase’s deal, the bank was told to provide $2 billion worth of principal reductions before the start of 2018. However, between 2009 and 2012, the bank forgave $10 billion on its own volition because it benefited the bank in the long term.

A large portion of the $9.56 billion cash settlement will be tax-deductible. In the case of JP Morgan Chase, Salon Magazine estimated in 2013 that in its $13 billion dollar settlement, the bank’s actual incurred cost was “closer to $2.74 billion.” If one applied the same rate to Bank of America’s settlement, the bank would only be paying $3.52 billion.

No major banking executive has gone to jail for the massive mortgage fraud that provoked the collapse of the world economy in 2008. The DOJ has not launched any criminal prosecutions in connection with the subprime mortgage fraud at the center of the 2008 crash. Attorney General Eric Holder told the Senate in 2013 that it is “difficult to prosecute” the major banks because if the DOJ did bring a criminal charge it would “have a negative impact on the national economy, perhaps even the world economy…”

Meanwhile, the speculative practices behind the collapse in 2008 continue unabated, fueled by massive inflows of cash from the Federal Reserve.

The three top US banks held over $60 trillion in derivatives at the end of 2013. This is a 30 percent increase compared to the start of the crisis. The vice chairman of the FDIC recently wrote in a report, “There have been no fundamental changes in their reliance on wholesale funding markets, bank-like money market funds, or repos, activities that have proven to be major sources of volatility. And, when failure is imminent, no firm has yet shown how it will access private sector ‘debtor in possession’ financing, a critical element in restructuring a firm.”

No comments:

Post a Comment