| Who Controls our Government? The Psychopathic Corporate Elites of America |

|

By Richard Gale and Dr. Gary Null Global Research, March 03, 2014 Progressive Radio and Global Research |

|

Url of this article: http://www.globalresearch.ca/who-controls-our-government-the-psychopathic-corporate-elites-of-america/5371627 |

Is

it only me or is there something fundamentally flawed with the people

who are running our government, including the autocrats, technocrats and

bureaucrats who number in the hundreds of thousands. Does it bother you

that the Wall Street banks and major corporations, many of our academia

and religious institutions and our medical, military and intelligence

gathering complexes, Big Pharma and Big Insurance have their needs met

at the expense of everyone else? They control our government. We don’t.

Instead we fear our government.

They tell us, “Trust

us. We know what to do and how to fix all of our crises.” Okay we trust

you. They say we are for peace, democracy and freedom. But everywhere we

look they are colonizing and militarizing foreign countries with over

960 military bases with a budget of 1.6 trillion going to numerous

corporations to keep American imperialism afloat. At the same time,

there have been massive home foreclosures, repossessions, for-profit

prisons stuffed to the brim with inmates for minor crimes, and the now

reappearance of debtor prisons in 27 states. We are graduating students

who are functionally illiterate.They say trust us, unemployment has decreased to 6.7 percent. And we say that the real number is 24 percent due to the millions who no longer receive compensation and have stopped looking for work. They say lower taxes. We say why don’t you pay what you owe instead of getting accountants to fudge the numbers in order to pay zero tax. They say that the economy is booming and the stock market is reaching record numbers. We say is that because you are loaning to small businesses? Is that because you are helping new companies to jumpstart manufacturing again in the US, or is it because you can go to the fed to be bailed out at zero interest? They say trust us, we need more law and order. And yet, private banks and corporations have been fined tens of billions of dollars for being serial repeaters crimes and never go to jail. On the other hand the average person gets caught jaywalking and can be thrown into the slammer. They say they are uncertain whether or not global warming is real. And we say we have had 120,000 extreme weather events globally in the past year and the scientific consensus around the world is that global warming is very real and a global threat to humanity’s future. They say they believe in protecting our rights for our freedom of speech, but then our government monitors anyone who is critical of Washington policy and major corporations. They say we need Obamacare. We say there is nothing in Obamacare to prevent disease nor any provisions to enhance a person’s survival if they have a disease. The US is the sickest developed nation in the world and the pharmaceutical giants and insurance companies are perfectly happy to keep it that way. They say we should not have rules that limit globalization nor hinder free market casino capitalism. And we say look at NAFTA, the outsourcing of jobs overseas, which collapsed American industry, and the ghettoization of America’s cities like Detroit, Compton and Camden. They say we should not give welfare to the lazy and nothing should be socialized. We say major corporations reap 200-300 billion a year in corporate welfare. When they succeed citizens don’t share in the profits. When they fail we are forced to pay for their ineptitude. They encourage us to watch television and shop because it is good for people and the economy. And we say our life is more substantial than a reality show. And why is there no honest effort by the media to know what it means to be a person suffering today. They say, we are doing everything for your benefit; however when whistleblowers come forward they are immediately demonized and prosecuted. We are bothered by this and much more, because behind all the corruption, lies and deception there is no viable solution to the nation’s increasing economic disparity and the rise in unemployment, poverty and depression. Our education policy makers welcome us to their institutions. They convince us they will help our children master the art of critical thinking so they will be more empowered to live authentic, constructive and meaningful lives. Yet to the contrary their expertise has been limited solely to teaching children how to take exams and behave as programmed robots. Many of our educational leaders refuse to join protests over the takeover of schools by immoral business privatizers, which goes to show academia is nothing more than a handmaiden of the corporate industrial complex. Our leaders tell us that they want the nation to be energy independent and this can be done safely and efficiently while also addressing the increasing challenges of climate change and global warming. And we trust them. But to the contrary their cards have been stacked to abet the fossil fuel moguls and hydrofrackers who without remorse contaminate and destroy the environment while depleting precious water resources upon which communities depend. And then even in the aftermath of Fukushima, we are told believe that nuclear power is a clean, safe and green alternative. We constantly hear from our politicians that the US is the greatest democracy in the world and they are fully devoted to keep it as a “shining light on a hill.” But then, as we have learned from Edward Snowden and other courageous whistleblowers, none of the politicians trust the American people. Otherwise there would be no incentive or reason to conduct massive covert spying and surveillance on every aspect of our lives. As well as militarize the police to assure that demonstrators are dealt with the needs of Big Business and Big Government They tell us we have medical freedom of choice. But if we don’t want to treat our children who suffer from cancer with their toxic chemotherapy drugs and radiation, they take the children away. And where is the choice in declining a vaccine when state governments mandate vaccination in our school systems? After they tell us we have a bill of rights and our Constitutional rights are protected, they then turn around and take away habeas corpus which allows them to search and seize anything they want. In addition they can harass and arrest those who they fear. The media repeatedly claims it is fair and balanced; yet all of their guests and so-called experts are corporate propagandists whether from think tanks, foundations or academia.

They

tell us we are the wealthiest and most financially stable country in

the world. The nation has a $15 trillion GDP. However against that there

are exponential amounts of debt including $17 trillion to the federal

debt, $6 trillion for state debt, $125 trillion for corporate debt,

$10-15 trillion for personal debt, about a trillion each for credit card

and student loan debt as well as unfunded liabilities at over $128

trillion. So our real total debt is over $293 trillion. In effect, the

US is worse off than Greece or Spain. In fact, the US is virtually

bankrupt as the most indebted nation on the planet

We were repeatedly

being told that an Obama presidency would be the most open, transparent

administration in presidential history. However, everything in this

White House has been the exact opposite, with more documents being

classified secret than any other administration. Increasingly the

administration has stripped away government from the people and handed

it over to a corporate oligarchy.

Is the problem, therefore,

we the people? Are we at fault for having been seduced by those in power

to sell us blank bill of goods, drugs, products and policies that are

more harmful than beneficial? Are we at fault for having deceived our

selves by being convinced that their illusion is the truth? Or is the

elite, the best and brightest in Wall Street, Washington and throughout

the top stories of the multinational corporate networks, the real

obstacle to a promising future for all? Are the oligarchic elite,

including corporate Democrats and corporate

Republicans in all branches of government, not in fact a special

breed of psychopath with no moral compass, striving solely to maintain

their power, control and wealth? In this article we explore this

phenomena with two leading experts on the psychopathic nature of our

CEOs, business leaders and politicians who rule America from their

residences on Psycho Street.

Several

decades ago, finding an individual with strong psychopathic

characteristics serving in an executive function at a major Wall Street

bank or multinational corporation would have been almost unheard of.

During the Great Generation following the Second World War, most

people’s entire careers were often with a single company or firm. They

climbed through the ranks based upon seniority and time spent at the

firm. Because corporations and banks were more stable then, it was

therefore incumbent that business leaders be psychological stable as

well.

Today

that has all changed. Given the dramatic deviations within high finance

and large corporations, the business culture and ethics have

degenerated and given way to a landscape of classical psychological

derangement. The advent of radical deregulation, the rise of our present

free market and the neoliberal capitalist paradigm has made way for a

new dominant economic system that is fundamentally amoral, as Jerry

Mander has elaborated upon in The Capitalism Papers: Fatal Flaws of an

Obsolete System. Within an amoral system we would expect to find

chairmen, CEOs and executives who are also amoral and callous about the

financial decisions and policies they make and that consequently have a

profound deleterious impact on the lives of others.

Several

studies investigating the psychopathic nature of our private industrial

and financial systems and the executives leading these institutions

have shed light on the underlying causes of our national economic woes

during the past five presidential administrations. Percentage estimates

of high level corporate executives who can be clinically diagnosed as

psychopathic vary. Psychopathology for the general population is

approximately one percent.

However, among the

wealthy and power elites, estimates range between four percent (Dr.

Robert Hare, an expert in criminal psychology at the University of

British Columbia) to ten percent (Sherri DeCoveny, a former investment

banker now researching psychological disturbances in the finance

community). Welsh journalist Jon Ronson, author of the bestseller The

Psychopath Test, claims the percentage is even higher. Psychologist

Clive Boddy at the Nottingham University has devoted his research to

studying corporate psychopaths. In his book Corporate Psychopaths As

Organizational Destroyers, Boddy argues that it was the psychopathic

behavior of the financial elite that brought about the economic collapse

in 2008. His research also indicates that those with the most

psychopathic tendencies are promoted fastest through the corporate

ranks. And it is well known that the risks for crime and illegal

activity is far greater among psychopaths than the general population.

Investigations

into many companies, such as Enron, Goldman Sachs, Lehman Brothers,

AIG, JP Morgan, Freddie and Fannie, MF Global, HSBC Bank and others have

uncovered widespread, systemic crime. In a survey of 500 senior

executives in the US and UK, 26 percent observed firsthand wrongdoing in

the workplace, and one in four believed it was necessary for

professionals in the financial sector to engage in unethical and illegal

conduct in order to be successful. Sixteen percent stated they would

commit insider trading if they were certain they could get away with it,

and 30 percent said that the pressures to maximize on compensation

plans were an incentive to break the law. These statistics provide

evidence to just how deeply ingrained psychopathic qualities have become

institutionalized in our financial industry. They validate the former

Goldman Sachs employee, Greg Smith, who has written and spoken publicly

about the disturbing psychological characteristics among his colleagues.

And wasn’t it Goldman Sachs’ Chairman Lloyd Blankfein who rhetorically

asked an interviewer with the London Times, “Is it possible to have too

much ambition? Is it possible to be too successful?” Blankfein has

publicly stated he doesn’t believe there are or should be caps on either

personal ambition or compensation and reward for personal ambition.

So when a study

conducted by Vanderbilt University finds that psychopaths frequently

have an abnormality in their neurochemical dopamine levels, which

contributes to a narcissistic drive for personal reward at any cost and

to engage willingly in risky behavior that benefits themselves while

injuring others, we can better understand why unlawful conduct is

commonplace among high powered traders, fund managers and their

executive bosses

Dr.

Christopher Bayer is a psychoanalyst who has earned the title of the

Wall Street Psychologist after thirty years counseling and treating

financial executives, CEOs, venture capitalists, hedge fund execs,

traders, Wall Street lawyers and their families in Manhattan. He is

intimately aware of the self-destructive and devastating psychological

damage being caused by those deeply immersed in high finance culture,

and is blunt about the epidemic of psychopathic personalities running

throughout America’s corporations and firms. During a conversation with

Dr. Bayer, he noted that psychopaths lack the capacity to experience

empathy. “They don’t experience guilt. They don’t experience anxiety.

They are driven, hyper vigilant and on Wall Street most of it is about

power and control.” He estimates that among his Wall Street clients,

this is the norm. “It’s about seduction. Show me the money. It’s the

opiate of western culture and this is what I glean from my patients.”

The Vice President of the National Association of Chiefs of Police, Jim Corey, collected data on personality traits common to specific professions, primarily looking at superficial charm, an exaggerated sense of self-worth, glibness and lying, lack of remorse, and manipulation of others. These are common traits of psychopathic killers, but Corey also found them common among many politicians. The problem that arises is whether or not the entire system within which private corporate industries and our federal government function and progress is now programmed to be psychopathic. Has corporate culture now de-evolved to such a degree where psychopathology has been legalized and above the law?

Today

it is not so much that people believe our CEOs and politicians act

without empathy or compassion regarding the well-being of average

citizens, especially towards those in dire poverty, but rather whether

or not our entire system is psychologically deranged. Psychopathology

has become fully institutionalized as a legitimate way of doing business

and making policy decisions. The Supreme Court decision on Citizens

United, which ruled that corporations and banks are “persons,” was a

further step infecting our entire politics and society with a serious

mental disorder that has steadily contributed to the US’s widening

inequality gap, class struggle, and Americans’ loss of democracy and

freedom of speech.

Joel

Bakan is an internationally recognized legal scholar at the University

of British Columbia specializing in Constitutional and economic law. The

award-winning documentary film The Corporation was based upon his

bestseller The Corporation: The Pathological Pursuit of Profit and

Power. When I last spoke with Professor Bakan, I asked him about the

kind of corporate personality the Supreme Court ruled in favor of. “The

corporation,” he said, “is legally programmed to always serve its own

interests. Its directors and managers have a legal obligation always to

put the financial interests of shareholders above all other interests.

It breaks the law with impunity if it can get away with it.”

The

problem lies less in the fact that Wall Street and multinational

presidents and CEOs are psychopaths. Rather according to Bakan, “we’ve

created an institution that attracts psychopaths and that incentivizes

psychopathic behavior.” If we can imagine putting JP Morgan or Monsanto

on the shrink’s couch, analyze the way these firms think and function,

how they are programmed, they would be diagnosed as psychopathic. Bakan

believes this is the current state of private industry. A bank’s

collective control and power is unfathomable to the average person.

Executives believe they are untouchable and their astronomical wealth

enables them to act with complete freedom and without regard for the

consequences of their actions.

Dr.

Bayer takes these firms’ socio-political dominance further.

“Corporations existentially are like feudal fiefdoms,” he said. “They

are countries with regulations and laws unto their selves. International

corporations can commit crimes and do certain things, and then relocate

their headquarters and be off the hook in terms of legality,

extradition, and penalty.”

Back in the late 19th

century, large industries, such as the railroad and telegraphy

companies, discovered that being thoroughly self-centered was an

effective way to raise huge capital to expand and further develop

productivity. However, to keep the industrial moguls such as the

Rockefellers and Carnegies within bounds, the government instituted a

regulatory system. Joel Bakan explained that this was a way to “hedge it

in by all the different laws that ensure that these industries don’t

overrun public interest in having a health society, clean environment,

and human and workers’ rights.”

With

the election of Ronald Reagan, the regulatory system began to be

dismantled while leaving the inherent psychopathology of these

corporations not rehabilitated. When Glass-Steagall was repealed and the

Future Commodities Trading act was approved under Bill Clinton by

psychopathic financial giants in his administration, “we basically let

the psychopath off its leash,” says Bakan. “We’ve let it run amok. We’ve

taken away all the constraints that were in place.” The illusion that

deregulation would improve the economy from the top down is as

irrational as giving a crack addict more cocaine to reduce his habit.

Now Wall Street firms and large corporations can essentially

self-regulate, which is the same as saying there is no regulation at

all. Bakan poses the question, “would you ever ask a psychopath to

self-regulate himself?” But that is exactly what we have today and the

consequences are self-evident as we witness the erosion of

Constitutional rights and the emergence of a distinctly postmodern

police state indoctrinated to protect corporate interests over the needs

and demands of the American public.

The idea that Wall Street

and policy experts surrounding the president are among the “best and

brightest” in America is a deceptive ruse of propaganda spin. When Dr.

Bayer applies his evaluative model to his Wall Street patients, the

bottom line is that the revenues they generate and who they succeed in

influencing in order to protect the firm’s interests is all that

matters. The prestige of a person’s alma mater, ZIP code and family

background is of little consequence. Speaking about Manhattan’s

financial community, he described it as “an insane den of elitism and

money mongrels, frankly, and people are competitive and actually believe

they are special.”

The

TARP and subsequent taxpayer bailouts of the banking industry during

the Bush and Obama administrations may be one of the largest economic

crimes ever committed by American presidents. These bailouts are

indicative of just how dysfunctional and subservient to the power elite

our nation has become. Since the 2008 derivative collapse, the economic

gap has steadily widened and the middle class is sinking to its lowest

point in history.

British

epidemiologists Kate Pickett and Richard Wilkinson have shown that

there is a strong correlation between a nation’s unhealthy obsession

with economic growth and swelling inequality. This in turn has led to a

cascade of social crises, increasing the incidence of scourges including

mental illness, violence, addictions and much more. And it has been the

richer countries, particularly the US, which have been overrun by an

oligarchic, corporate elite who believe austerity is a solution towards

economic stability. Joel Bakan holds the view that “Societies that have

large disparities and inequalities of wealth are societies that quickly

become dysfunctional. There is a pathology behind inequality; that is,

when people have the power of wealth they don’t feel the necessity of

being tied to community. And when they don’t feel that necessity, they

lose their natural sense of empathy, which I think in a way is a

survival sense.”

“In part, we’re empathetic,”

Prof. Bakan continued, “because we understand that we may be in a bad

position some day. We may be diving in dumpsters. So we need to create a

society that ensures that people aren’t diving in dumpsters and that

when people fall through the cracks, they’re protected because we may be

there some day.”

“But

when you’re very rich and powerful, you don’t believe you may be there;

so, it makes sense that you would lack that sense of empathy. And when

you look at the austerity measures in Europe and increasingly in North

America as well, the morality behind it is disgusting.”

What

is even worse is that these same psychopathic corporatists serve as the

primary advisors to the President and elected officials. At the state

level, the GOP aligns readily with the Koch Brothers, perhaps two of the

most ideologically fanatical individuals in the US’s billionaire club.

The same can be said for many of the advisors who revolve through the

circular door between Washington and Wall Street.

Several

years ago I interviewed and filmed Jordan Belfort, the former stock

trader portrayed by Leonardo DiCaprio in the movie The Wolf of Wall

Street. Belfort spoke about the insanity behind the lack of ethical

decisions rampant throughout the financial industry and the instant

gratification of a select elite who are willing to destroy everything

for short term profits in order to accumulate massive amounts of wealth.

Belfort shared one noteworthy example: the former Treasury Secretary

Robert Ruben who “lobbied to ease limits on derivatives and was

instrumental in getting derivatives traded on Wall Street in an

aggressive way.” What does Ruben do after completing his stint as a

politician in Clinton’s administration? “When no longer Secretary of

Treasury,” Belfort continues, “he goes down to Wall Street, gets on the

board of Citibank, convinces them to plunge head first into these

derivatives that he just deregulated and makes $500 million by most

accounts. And then he bankrupts what was once the largest bank in the

world.” To this day government officials have not made any effort to

investigate and indict Ruben for reckless, unconscionable behavior. His

foolhardy acts have devastated the livelihoods of countless people. A

common psychopathic criminal would be placed behind bars immediately for

far less misconducts than Ruben and his Wall Street cronies.

The

sickness behind the entire system is that it rewards such behavior and

patronizes the ability to create power and wealth rather giving

preference to efforts that raise the standards of living for everyone,

in particular those who have minimal opportunities for social progress

without the assistance and protection from government. However, the

problem is more systemically entrenched than simply having a bunch of

psychopathic personalities sitting in high executive positions. Joel

Bakan has explained that “the problem is not so much that we allow

people to get away with breaking the law. It’s that we create laws that

allow people to get away with doing things that are horrific. And what I

mean by that is that it takes us back to the issue of how deregulation

combines with the law of the corporation. The law of the corporation

basically says it is your legal duty to exploit and to plunder in order

to create wealth for your shareholders. The law of the regulatory state

used to say, “but you can’t do this or that.” It no longer says that.

So, in effect, what used to be illegal behavior that is certainly

morally wrong, whether it meant creating unsafe environments for

workers, creating an unsafe factory or insider trading are no longer

illegal.”

“It

is law and order for poor people who might steal a popsicle from a

corner store. Three strikes and you’re out. But for corporations, the

legal restraints on their activities have been diminishing rapidly since

the 1980’s, and our entire political culture is hostile to the notion

that government should regulate corporations with well enforced laws.”

Former

investment banker Sherree DeCovney has stated that she has “come to

know many psychopaths, from Ponzi-schemers to book-cooking corporate

executives. They are always charming and narcissistic. They display

wonderful glib senses of humor and spin the truth like a roulette

wheel.” Clive Boddy explains that psychopaths “take advantage of the

relative chaotic nature of the modern corporation.” Under these

circumstances they are able to clothe themselves in a veneer of charm

which makes “their behavior invisible.” They are able to take full

advantage of circumstances for their firms and personal

self-aggrandizement while simultaneously feeling no remorse over the

consequences of their decisions and consistently deny any personal

responsibility for how damaging their acts may have been.

An

aura of charm and charisma is one distinguishing trait corporate

psychopaths have in common—think Goldman’s Lloyd Blankfein, JP Morgan’s

Jamie Dimon, Robert Ruben or Monsanto’s Hugh Grant. Likewise, firms’

public relations arms reimagine corporations in a glowing, positive

light. Joel Bakan suggests that “the largest problematic myth today is

the notion that corporations can be good and socially responsible. To

me, that is like the charm of the psychopath because they actually can’t

be those things just as a psychopath can’t. They can’t be responsible

to society when their required imperative and structure is to be

responsible only to their shareholders.” For this reason, he concludes,

their ability to create a sense of themselves that is very charming is

one reason why people buy into the “sheer lunacy” of the entire system.

In

our conversation, Christopher Bayer noted that average Americans are

vulnerable to being seduced. They want to believe what they hear and be

charmed. “We all have the capacity to surrender and turn over our

thinking and our will to people who we find charismatic and charming,”

says Bayer. Such likeability “is an insanely powerful force in human

interaction. We are all vulnerable to selling our souls to the devil. I

see this every day in my practice.”

“There

is an attitude structure among plutocrats. They don’t look at the rest

of us as valid, equal, worthy human beings. They take financial

inventory constantly. They measure worth in terms of their portfolio

size. I hear this constantly in my practice. This is at the root of how

they see the world. They don’t have empathy. They can’t relate to it.

The attitude structure is if you’re not a multimillionaire, then you’re a

failure, there’s something wrong with you and you’re not a worthy human

being. This is the guts of the psychology of it and they just can’t

relate to it.”

This

is the dividing line that separates the psychopaths running Wall

Street, the multinational corporations, private military contractors and

Washington from everyone else who desires a more just, equitable and

sustainable nation and world. The psychopath lacks the ability to care

for the stranger. This is why Jordan Belfort warns that their

coldhearted behavior, void of any redeeming morals and ethics, destroys

everything. As long as such people are placed in charge of banks and

firms that control so much of our economic lives, and we continue to

elect legislators and presidents based upon charm rather than true

integrity and moral substance, the US as a nation is destined to

continue on its long descent into psychopathology and towards a future

of narcissistic bliss for an oligarchic elite and immense suffering for

everyone else.

|

| Disclaimer: The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible for any inaccurate or incorrect statement in this article. |

---BREAKAWAY CIVILIZATION ---ALTERNATIVE HISTORY---NEW BUSINESS MODELS--- ROCK & ROLL 'S STRANGE BEGINNINGS---SERIAL KILLERS---YEA AND THAT BAD WORD "CONSPIRACY"--- AMERICANS DON'T EXPLORE ANYTHING ANYMORE.WE JUST CONSUME AND DIE.---

Thursday, November 5, 2015

American taxpayers spend nearly $10 million a day fighting ISIS

Smoke billowing from the Baal Shamin temple in Syria's ancient city of Palmyra © Welayat Homs / AFP

48

The Pentagon has spent nearly $4 billion fighting Islamic State

across Syria and Iraq since operations began a year ago, according to

statistics released this week. The average daily cost of the campaign is

$9.9 million, or $6,785 a minute.

A colossal $3.7 billion in expenses have been racked up since the campaign began on August 8, 2014 up to August 15 of this year.

President Barack Obama authorized a bombing campaign against the Islamic State (IS, also known as ISIS/ISIL) last year, sending 3,400 American soldiers to Iraq to advise and train Iraqi forces.

Since Operation Inherent Resolve began, the US and its coalition allies say they have conducted a total of over 6,000 airstrikes in the region. Of those strikes, nearly 4,000 have been made in Iraq and nearly 2,500 in Syria.

Pentagon statistics claim those strikes have damaged or destroyed more than 10,000 targets, including tanks, Humvees, staging areas, and oil infrastructure. If the total cost of the campaign to date is calculated based on actual damage, those strikes cost an estimated $400,000 per successful hit.

Pentagon officials maintain that the year-long campaign has had some success, enabling Iraqi forces to reclaim some areas, but strategic cities like Mosul and Ramadi remain under IS control, and the airstrikes have done little to uproot the terror group’s hold in Syria.

In a press briefing at the end of July, Marine Corps Brigadier General Kevin J. Killea, chief of staff for Operation Inherent Resolve, said the campaign has made progress.

“This is not the same fight as it was when it started, and I look at that based on the effects that we have had on ISIL,” Killea told reporters.

“They are much more territorial, meaning they’re defending more than they’re on the offensive. Their attacks are smaller, they are more focused, and they’re less enduring.”

“All you have to do is look at the gains that have been made on the ground recently to see that there is an effect, and there is progress,” he added.

The cost of the campaign against IS has been released as the Pentagon’s inspector general is investigating allegations by a Department of Defense whistleblower that intelligence regarding the success of the campaign was altered, according to a report published in the New York Times.

The investigation started after at least one civilian analyst working for the Defense Intelligence Agency alleged that officials coordinating the anti-IS campaign at US Central Command are “improperly reworking the conclusions of intelligence assessments” that are later handed over to top policy-makers, including President Obama.

Speaking on the condition of anonymity, officials told the Times that the investigation is trying to establish if military officials changed the conclusions of drafted intelligence assessments before passing them on. If the allegations turn out to be true, it might explain why assessments of the military campaign’s effectiveness vary greatly.

President Barack Obama authorized a bombing campaign against the Islamic State (IS, also known as ISIS/ISIL) last year, sending 3,400 American soldiers to Iraq to advise and train Iraqi forces.

Since Operation Inherent Resolve began, the US and its coalition allies say they have conducted a total of over 6,000 airstrikes in the region. Of those strikes, nearly 4,000 have been made in Iraq and nearly 2,500 in Syria.

Pentagon statistics claim those strikes have damaged or destroyed more than 10,000 targets, including tanks, Humvees, staging areas, and oil infrastructure. If the total cost of the campaign to date is calculated based on actual damage, those strikes cost an estimated $400,000 per successful hit.

Pentagon officials maintain that the year-long campaign has had some success, enabling Iraqi forces to reclaim some areas, but strategic cities like Mosul and Ramadi remain under IS control, and the airstrikes have done little to uproot the terror group’s hold in Syria.

In a press briefing at the end of July, Marine Corps Brigadier General Kevin J. Killea, chief of staff for Operation Inherent Resolve, said the campaign has made progress.

“This is not the same fight as it was when it started, and I look at that based on the effects that we have had on ISIL,” Killea told reporters.

“They are much more territorial, meaning they’re defending more than they’re on the offensive. Their attacks are smaller, they are more focused, and they’re less enduring.”

“All you have to do is look at the gains that have been made on the ground recently to see that there is an effect, and there is progress,” he added.

The cost of the campaign against IS has been released as the Pentagon’s inspector general is investigating allegations by a Department of Defense whistleblower that intelligence regarding the success of the campaign was altered, according to a report published in the New York Times.

The investigation started after at least one civilian analyst working for the Defense Intelligence Agency alleged that officials coordinating the anti-IS campaign at US Central Command are “improperly reworking the conclusions of intelligence assessments” that are later handed over to top policy-makers, including President Obama.

Speaking on the condition of anonymity, officials told the Times that the investigation is trying to establish if military officials changed the conclusions of drafted intelligence assessments before passing them on. If the allegations turn out to be true, it might explain why assessments of the military campaign’s effectiveness vary greatly.

How Daily Fantasy Is Changing the Game ~ hehe no bet~in or gam~bling go~in ON here folks ,move along :O LOL 'it's' all just an "fantasy" ...fuck~in A man .........who's finger IS that ...that's UP my ...ass :o $$$ Oh ? ummm

Seven-figure paydays, complex

statistical algorithms, congressional inquiries, suspicions of insider

info, and yes, all those advertisements. Daily Fantasy Football’s main

competitors—FanDuel and DraftKings—are now entwined with the NFL

experience. But with multiple controversies converging at once, will it

stay that way?

Ronda Churchill for Sports Illustrated

BOSTON — Saahil Sud, perhaps better known by the screen name “maxdalury,” welcomes me into his apartment with a soft hello and a handshake. It’s not until much later that he reveals that the 24th floor penthouse, with a breathtaking view of Downtown Boston, was previously rented by Rajon Rondo of the Celtics. I follow him to his computer lab with a couch, some choice Yankees and Rangers memorabilia from the ’90s, three computer screens and two flat-screen TVs.

This two-bedroom condo is where Sud, 26, made north of $1 million during Week 3 of the NFL season playing daily fantasy football.

Analytics go a long way for the Amherst College grad, who expects to gross more than $5 million this year as the top-ranked Daily Fantasy Sports (DFS) player in the world (according to RotoGrinders.com). But intuition is the icing on the cake. In Week 3, Sud, who enters hundreds of lineups every week, chose Packers receiver Randall Cobb in all of his lineups—a rare move for a DFS pro, and one that carries a big risk considering the unpredictability of a single-game performance by a single player. Sud reaped the rewards after Cobb grabbed seven catches for 91 yards and three touchdowns on Monday Night Football.

Sud calculates the decision to feature Cobb was worth seven figures. “I usually go with analytics, but I also take more risks than others,” Sud says. “I know that this was the right decision to maximize my profit, as long as I am comfortable with the risk.”

Meanwhile, Cobb, who received a long-term contract befitting a star receiver this past offseason (with most of it loaded into bonuses), likely got in the neighborhood of $100,000 (base salary plus game-day roster bonuses), before taxes, in his weekly paycheck. Told of Sud’s windfall after a Packers practice this week, the fifth-year wideout was incredulous.

“What? Hey, man, I’ve got to start collecting my money from these guys,” he joked. “If I’m on your team and I’m making you money, I need a paycheck for that. Help me out, man!”

Everybody, it seems, wants a cut of the millions of dollars changing hands in this budding, newly visible and, up until now, barely regulated world of daily fantasy sports. Yet DFS finds itself at a crossroads. As ads from the industry’s top two competitors, FanDuel and DraftKings, have inundated the airwaves during the first month of the NFL season, challenges to DFS’s legality (most states do not consider DFS gambling) from lawmakers threaten to slow the massive, seemingly endless cash flow. Some would-be players have shied away, intimidated by the statistical skills and large capital of pros like Sud. And a new threat, one originating within the walls of the two competing companies, has shaken confidence in the fairness of the games themselves.

FanDuel and DraftKings are now each valued in the neighborhood of a billion dollars, and are backed by the NBA, MLB, major broadcasters and some NFL owners, among others. Half the teams in the NFL also have advertising deals with DFS sites. Recent developments raise the question: Has DFS grown too fast for its own good, or just fast enough to survive?

* * *

About 200 yards from Sud’s apartment is the red brick office

building that houses the DraftKings offices. It’s visible from Sud’s

living room.

He swears it’s a coincidence; and jokes that the DraftKings bosses think he’s plugged into their office wifi.

But to see why the industry finds itself embroiled in controversy, DraftKings need look no further than its own office. Eyebrows were initially raised during Week 3, when DraftKings content manager Ethan Haskell inadvertently posted data on ownership trends for the site’s Millionaire Maker contest before all games had begun (and therefore, all lineups for all games had been locked). Ownership data is hugely valuable in DFS; from a strategy standpoint, it’s important to field a unique lineup—the fewer competitors that own a player, the more value a big performance will carry.

Haskell apologized for the mix-up and reiterated that, while he had access to the data, as a company employee he was prohibited from entering the contest.

However, Haskell was not prohibited from entering a similar contest at rival FanDuel, where he played DFS contests regularly, and where, because of similar pricing algorithms, ownership rates are often similar. Haskell has insisted that he did not use the DraftKings data to make his FanDuel entry, and the company says he didn’t have access to the data until 40 minutes after his FanDuel lineup was locked. But the optics were undeniably bad when The New York Times reported that Haskell placed second out of 22,989 entries in the FanDuel contest, taking home a prize of $350,000 on his $25 entry.

Major League Baseball, which has a stake in DraftKings, echoed the thoughts of many DFS participants: They did not think DFS site employees, some of whom presumably have access to valuable inside information, were permitted to play DFS at any site. According to ESPN, FanDuel said 0.3% of their prize money had gone to DraftKings employees—estimated to be around $6 million.

A top official at an online sports book, when briefed on the structure of FanDuel's anti-fraud unit: “Let’s just say we have a significantly larger unit in place.”The incident raised questions about the industry’s ability to regulate itself and prompted the sites to release a joint statement Monday promising a commitment to the “integrity of the games we offer.” Both companies immediately banned employees from playing DFS at any site, and have since said that prohibition will be permanent. Both companies also initiated third-party audits of their procedures.

New York State Attorney General Eric Schneiderman announced that his office planned an inquiry into both DraftKings and FanDuel. Massachusetts Attorney General Maura Healey plans on pressing both companies for additional consumer protections. California state assemblyman Adam Gray called for an informational hearing on the industry. ESPN went so far as to—at least temporarily—pull DraftKings-sponsored elements from its programming (the network continues to run traditional DFS advertisement).

Yet, DraftKings CEO Jason Robins, in an interview with The Boston Globe, bristled at the suggestion of government regulation, calling DraftKings a “very ethical company.” FanDuel declined comment on the issue of regulation.

Two days before news of the scandal broke, I visited the Manhattan office of FanDuel, where more than 40 staffers plugged away at computers. FanDuel has other offices in the U.S. and in the U.K. as well, with more than 400 employees.

Co-founder and VP Tom Griffiths said their fraud prevention team consists of six employees. The group is run by a former law enforcement officer and staffed with lawyers and ex-DFS players who investigate possible discrepancies.

That unit will surely have to grow. The MMQB reached out to several top online sports books, most of whom declined to disclose details about their security or anti-fraud teams, and how they might contrast to those in DFS. One top official at a well-known sports book said there really isn't any confidential information in the sports-betting community that would give industry employees an advantage. Another, when briefed on the structure of FanDuel's anti-fraud unit, said, “Our security team’s purpose doesn’t exactly compare to daily fantasy sites, but let’s just say we have a significantly larger unit in place to ensure online gaming is both fair and safe for all participants.”

* * *

FanDuel co-founders Nigel Eccles and Tom Griffiths.

That unassuming office at Union Square is where those suddenly ubiquitous daily fantasy ads that have been crop-dusted across your Sundays—the ones with the lightly-bearded, jockish-looking pitchman shouting million-dollar payouts into your subconscious—were hatched. A who’s who of major corporations, including Comcast, Turner, Time Warner and Google, invested some $363 million so that FanDuel could become the No. 1 advertiser in the country this fall.

The strategy, which has brought a host of positive and negative consequences for both FanDuel and DraftKings, is rooted in the old StubHub game plan. The online ticket-buying industry sprouted around the turn of the century (and the once-shady often illegal practice of “ticket scalping” became the above-board “secondary ticket market”). The sites we now know as the biggest names in that industry spent well beyond their means to advertise all over the map in order to dominate the market.

“You have to capture the mindshare first,” says Griffiths.

Born in Liverpool and schooled in Edinburgh, the 33-year-old knew next to nothing about American football when he and five friends huddled in 2009 to decide what to do with their middling news prediction site, Hubdub.

Says Griffiths: “There was a moment when we realized, ‘Holy s---, I don’t think our current product is going to work.’ ”

• GENERATION DFS: A visit to a small New England college campus offers a snapshot of the novice daily fantasy football player, and illustrates the reasons administrators and parents are concerned about students playing DFS

They rented a house in Austin to attend South by Southwest, the film, media and music festival that attracts entrepreneurs every March, and they gathered one day in the backyard and brainstormed for specific avenues to focus their online contests. They wrote their ideas on post-it notes, stuck them to the wall of a tool shed, and debated the possibilities.

The Unlawful Internet Gambling Enforcement Act of 2006 was a death knell to the world of online poker but provided for the continuation of traditional fantasy sports. There hadn’t been any evolution in fantasy sports since the games went online, and the founders resolved to change that by tapping into the attention-deficit generation with weekly and daily fantasy sports.

Fast-forward six years and FanDuel payouts are the largest they’ve ever been. The industry at large is estimated to generate $2.6 billion in entry fees this year, according to Eilers Research.

People are annoyed with the ads, and Griffiths gets that: “People are complaining about how often they are on. So we’re looking at refreshing the creative and changing it up so people aren’t bombarded with them.”

The marketing push came with one more unintended, and unwanted, consequence.

“Now [the NFL has] invested in fantasy sports,” Congressman Pallone says. “They’ve carved out a niche so they can make money and prohibited everybody else from doing it.”DFS consists of two major kinds of contests (and there’s probably a promo code just for you!). In a football head-to-head game, for instance, players can draft a team from a pool of about 500 NFL players with an allotted portion of cash. A user is given a salary cap and each NFL player is afforded a salary determined by the site. Your lineup then goes up against another user, typically chosen at random, with the entry fee ranging anywhere between 25 cents and $1,000 depending on how much you chose to wager. A tournament follows the same rules, but the pool of users is much larger, and more than one person wins. In some tourneys, the top half of players who enter get something, if not all their money back. FanDuel says seven out of 10 new users eventually win.

This much was explained to viewers in a series of commercials that accompanied NFL games during the first week of the season. One of those mini-infomercials caught the eye of a congressman from New Jersey, democrat Frank Pallone of the state’s sixth district. Fantasy sports had once existed in the good graces of the law as a provision in the UIGEA of 2006, a tack-on to a counter-terrorism bill backed by an NFL-appointed lobbyist and passed in the final hours of a congressional session.

But now Griffiths and his ilk are flashing too much money for Pallone and a handful of legislators across the country who liken daily fantasy to sports betting and want both practices regulated and taxed.

“The tipping point was a few weeks ago when they started spending millions of dollars on advertising,” Pallone told me in a phone conversation during his Amtrak trip between New Jersey and Washington. “I watched one infomercial on Monday night that basically explained to you how to play. The teams are supposedly so concerned about sports betting they don’t want it legalized, but they’re [running] infomercials for fantasy?”

In 2011, Pallone successfully campaigned for a referendum allowing sports betting in New Jersey on the promise tax revenues could revitalize places like Atlantic City. State leaders argued they were not in violation of the federal Professional and Amateur Sports Protection Act of 1992, which limited sports betting to Nevada, Oregon, Delaware and Montana. The NCAA and the four major professional leagues sued to prevent the implementation of the state law, and the U.S. Third Circuit Court of Appeals in Philadelphia affirmed the federal ban in 2013 and again last August, striking down New Jersey’s vote.

FanDuel has advertising agreements with 16 NFL teams, and while teams are not permitted to invest in DFS companies, individual owners are. (Jerry Jones and Robert Kraft have stakes in DraftKings.) It’s with good reason. In surveys of users, FanDuel found that DFS participation resulted in 40% more consumption of NFL games, on average. Users went from consuming 17 hours of football and football-related media per week to 24, on average.

“Now they’ve invested in fantasy sports,” Pallone says. “So they’ve carved out a niche so they can make money and prohibited everybody else from doing it.”

Roger Goodell answered a question about the legality of DFS during a press conference on Wednesday.

“States are the ones that make the determinations about whether something is legal or not legal. We feel that a cautious approach is the right way, but we’re protecting our game. Daily fantasy—it’s hard to see the influence that it could have on the outcome of a game because individual players are picking different players from different teams, mashing them up, you might call it, and it’s not based on the outcome of a game, which is what our biggest concern is with sports betting. So our position continues to be that way, but we recognize some states consider it legal, some don’t, and we’ll follow that law and make sure we do.”

Pallone last month called for a congressional review of fantasy sports in relation to gambling, the natural end game being a justice department inquiry into the legality of DFS. At issue is the UIGEA provision that gaming online must require more skill than chance. In many states, that requirement is more stringent. In Arkansas and Tennessee for instance, two of the 45 states where FanDuel and DraftKings currently operate, any element of chance whatsoever is illegal. Legal experts agree an argument could be made that betting on football players who compete at the whim of weather patterns and injury constitutes a considerable degree of chance.

FanDuel, with its abundant coffers, recently commissioned M.I.T. for a yet-to-be-released study that, according to Griffiths, will demonstrate the substantial amount of skill involved in fantasy games.

“With horse racing, you’re picking from a field of eight,” he says. “With us you’re picking nine players from a field of 500. We had the university calculate the number of possibilities; there’s over a trillion. We see the top users repeatedly win, not because they play so many games, but because they have a higher point distribution. Choice equals skill.”

* * *

The leaderboard at the 2014 FanDuel World Fantasy Football Championships last December.

A fantasy player in the traditional sense, Edelman became fascinated with the sprawling path of the industry. American laws in their complexities and hierarchies and imprecision don’t have a clear answer for DFS, which is one of the reasons power hitters like ESPN, a major provider of traditional fantasy games, have yet to go all-in on the industry.

“Current federal and state law is ambiguous about the legality,” Edelman says. “Certain formats are likely legal in certain states, and certain are illegal everywhere, and certain are legal almost everywhere.”

The ambiguity has allowed FanDuel and DraftKings to flourish with near impunity, much like StubHub once did. Now, if ESPN were to jump in, Griffiths says, it couldn’t make a dent: “I think if they could’ve done that two years ago they could’ve beaten us, but the stage and scale we’re at now, six years old, paying out $2 billion… whoever joins [the industry], we’re not too worried.”

The uncertainty that keeps ESPN out also encourages startups to follow in the major players’ footsteps. Last month two Columbia students made news for dropping out of school and collecting $2.2 million in investments for their own DFS venture, Draftpot. There isn’t a clear blueprint for startups like Draftpot, because there aren’t even agreed-upon standards among the top two rivals. DraftKings, for instance, seemingly flouts a UIGEA provision that fantasy games must involve multiple contests, i.e. a week’s slate of NFL games. They offer NASCAR and PGA fantasy matchups. (“Golf and NASCAR are legally aggressive,” Griffiths says. “We don’t need to take that risk.) And before this week’s scandal, despite heavy scrutiny from the Massachusetts attorney general, Robins recently participated in a panel discussion on whether or not fantasy sports is gambling at a gaming conference in, of all places, Las Vegas, leaving some in the industry to wonder if the one of the biggest names in DFS is putting the cart before the horse.

“Words like ‘tournament,’ ‘jackpot,’ ‘head-to-head,’ it all feels very much like poker,” says Fong, a leading expert in gambling addiction. “It can potentially be very addictive.”A legal challenge is coming, and Edelman believes the industry will then face a crossroads that has a precedent.

UIGEA sent online poker into the closet and off of your television screen in the years following its passage. Less than a decade earlier, the online ticket-buying startups faced a similar threat but flourished. The big difference? Poker had few institutional allies. StubHub, like FanDuel and DraftKings, partnered with a bevy of influence-wielding sports leagues and teams.

“On one hand, you take online poker. When they began advertising congress cracked down on them.” Edelman says. “On the other hand, one could look at the model of a company such as StubHub, which was once perceived as being illegal ticket sales, but in time was able to build partnerships with the sports league and build legislative change that saved the industry.”

* * *

Lost in this discussion of advertising budgets, legalities and league

partnerships is the human toll of DFS. For every Saahil Sud, there are

untold hundreds of who sign up and lose, with the potential to lose big.Six years ago, Arnie Wexler was running a treatment center for gambling addicts in West Palm Beach when the first case of an impending pandemic hit his doorstep. Ralph (not his real name) didn’t believe he was an addict; he called himself a poker pro and boasted of playing real poker on television, but his wife threatened to leave him if he didn’t stop gambling online.

“We had an explosion,” Wexler says. “All these young kids were saying, ‘I don’t need to go to college. I am going to become a poker professional and make a lot of money.’ A lot of those kids today are in recovery programs.”

Neither Wexler nor Dr. Timothy Fong, a leading expert on gambling addiction, have seen the first wave of DFS addiction cases yet, but it they expect to.

“It usually takes about two years after the boom to start seeing people who have lost their jobs or their families as a result of addiction,” says Fong, Associate Clinical Professor of Psychiatry and Biobehavioral Sciences at UCLA and co-director of the school’s Gambling Studies Program.

Fong says the language and graphics used to promote DFS is strikingly similar to that of poker during its heyday.

“Words like ‘tournament,’ ‘jackpot,’ ‘head-to-head,’ it all feels very much like poker,” he says, “Similarly, you can keep hunting for games and pour endless hours of strategy into the games. Anecdotally, we know the same people who were playing poker are now playing fantasy. It can potentially be very addictive.”

The new obstacle, Fong says, is the restoration of consumer confidence after the insider info scandal. Naturally, it’s difficult to attract new users if games aren’t perceived to be on the level. But online poker faced similar skepticism at the onset, when confidence in internet financial transactions was lower than it is today and many users wondered if the poker rooms were full of bots instead of people.

“People didn’t trust it at first,” Fong says, “but then they started winning games and winning jackpots and the sites marketed that and built confidence. The payouts were there.”

Wexler, who founded a national gambling addiction hotline (1-888-LASTBET) after quitting gambling 47 years ago, successfully pushed in 1996 for New Jersey’s legislature to require all casino ads to carry the warning, “if you have a gambling problem, call this number.” DraftKings and FanDuel do not carry such warnings on their sites (naturally, because it would be an admission that this is, indeed, a form of gambling), and permission to sign up requires only an unverified birth date and a credit card. The ease of online gaming is what concerns Wexler, and what led to online poker addicts constituting a third of all calls to his hotline several years ago.

“You want to go to a racetrack or a casino, you have travel, put gas in your car,” he says. “Now you have Internet gambling and this is an impulse disorder. You got gamblers that wake up in the middle of the night and they can go sit at their computer in their birthday suit and lose everything.”

Wexler says he’s phoned Congressman Pallone’s office three times in the last week and sent a letter offering his help in having fantasy games defined as gambling and regulated. (He hasn’t received a reply.) Of course, their interests don’t quite align. Wexler wants the games regulated for public health reasons; Pallone will happily tell you his biggest concern is the potential financial benefit to the state of New Jersey.

“They have extended fantasy beyond the law,” Pallone told me on the phone. “Nobody was making money on it when it was a bunch of guys sitting around a living room drafting players.”

* * *

Saahil Sud, aka “maxdalury.”

Four years ago he tried out daily fantasy on a whim. He entered a $100 head-to-head college football fantasy game and drafted Michigan phenom Denard Robinson, the LSU defense and several other stars. His opponent picked no-names and a few Texas A&M role players, and promptly trounced Sud. Fresh out of Amherst with a degree in math and economics, Sud realized simply being a dedicated fan wasn’t good enough to get rich; this was a math problem more than anything. Anticipating he might one day value his privacy, he picked a screen name that was only tangentially related to himself.

Max Dalury—the real Max Dalury—also lives in Boston and does not earn millions playing DFS. He was a squash player at Tufts whom the 5-foot-9 Sud had battled numerous times previously in high school in Brampton, New Jersey. (“I don’t even know why I chose his name. I don’t know what I would do if I saw him on the street. I’d be like, ‘Sorry man!’ ”) Nowadays the real Dalury’s online footprint is shadowed by maxdalury chatter among the DFS blogosphere.

Sitting on his couch in the lab, I asked Sud why he chose to do an interview with me, forfeiting whatever shred of anonymity he held onto after numerous blog posts and stories revealed his true identity in recent months.

“I wanted to clear up some misconceptions,” he says.

He refers to a Bloomberg article from Sept. 10 quoting Sud sparingly and carrying the headline, You Aren't Good Enough to Win Money Playing Daily Fantasy Football: Is that a problem for DraftKings and FanDuel?

The article highlighted the many ways pros like Sud use complex analytics programs and programming scripts to optimize lineups and enter hundreds of games per day. According to data collected by Rotogrinders for Bloomberg, “the top 100 ranked players enter 330 winning lineups per day, and the top 10 players combine to win an average of 873 times daily. The remaining field of approximately 20,000 players tracked by Rotogrinders wins just 13 times per day, on average.”

“One could look at the model of StubHub,” Edelman says, “which was once perceived as being illegal ticket sales, but in time was able to build partnerships with the sports league and build legislative change that saved the industry.”FanDuel and DraftKings walk a tightrope in this regard. Both have introduced games that are off limits for veteran players, allowing first-timers to compete with one another, and both sites have capped entries from the same user to large tournaments, but both sites also capitulated to pros who run scripts that allow them to adjust multiple lineups rapidly in response to, say, a change in weather patterns. Sud takes issue with the popular notion that sharks don’t know when to hold back. He says he stays away from $1 games, which are usually populated by woefully inadequate novices and can be very profitable for pros, and he doesn’t initiate head-to-head games (occasionally players invite him to a game for the novelty of it, something like wanting to sit at a poker table with Phil Ivey). He believes the biggest challenge facing daily fantasy would be a perception that minnows can’t win.

“One of their biggest issues is if you put in $10 and you lose right away, you don’t want to come play again,” Sud says. “On DraftKings people can block me in head-to-head games. It makes sense from the company’s perspective. I want to make as much money as I can within the bounds of the ecosystem. I think there’s some type of line there where I know it’s not good for the long-term future if I cross it.”

One of the pitfalls of online poker was the unchecked opportunity for sharks to feed on novices. Wexler’s first online poker addict, Ralph, described coordinating with two or three friends to join the same online rooms and coordinate their bets over cell phones, leaving the fish at a distinct disadvantage. In DFS, it’s not that simple. Griffiths is confident that any two accounts running similar algorithms or fielding similar lineups can be detected.

“We have complete control over who sees what contest, and I think we’ll have more controls,” Griffiths says. “We limit those guys who play and win a lot because we care about the health of the ecosystem.”

But very few people possess the skills, talent or dedication to win like maxdalury. He doesn’t own a car, spends eight hours a day programming during the offseason, watches sports religiously on two different TVs in-season, and splurges only on vacations with his friends or girlfriend (Las Vegas, Colombia, Belize and Jamaica so far in 2015).

Sud shows me the output of the program he’s built to beat the game. By pulling in data from box scores, weather sites, analytics sites like Pro Football Focus and using his own intuition, he says he’s risking about $140,000 a day and profiting 8%, with outliers like Week 3 in which he clears six figures. He estimates that he loses money on 30% of days.

• THE RISE OF PRO FOOTBALL FOCUS: An Englishman who never played the game abandoned a profitable business to run an NFL advanced stats website. Now, PFF is helping to transform the league.

His mom doesn’t understand DFS. His dad does. Both would rather he get rich doing something else, but this isn’t a point of contention as long as he’s winning. Wearing a cornflower-blue dress shirt with a rumpled collar and some ratty old tennis shoes, he doesn’t seem much different from the kid who blew $100 on Denard Robinson and the LSU defense four years ago. His bank account, however, indicates otherwise.

“People say guys like me bastardized fantasy,” Sud says, “I’m sure that people have said the same thing about the stock market when algorithmic trading came out. They’re cheating. I can understand where they are coming from, but any time there is money to be made, people are going to find the fastest and smartest ways to do it, whatever way that is."

The same can be said for two companies that emerged seemingly from nowhere in the past few years to exploit an untapped market. For better or worse, the involvement of the most powerful entities in sports—the leagues and the broadcasters—has provided FanDuel and DraftKings with the means to get where they are today. But this is now uncharted territory in a fast-moving industry with billions of dollars at stake. And no one knows where it’s headed.

Kalyn Kahler and Emily Kaplan contributed reporting to this story.http://mmqb.si.com/mmqb/2015/10/08/fanduel-draftkings-scandal-daily-fantasy-football-dfs

For daily fantasy sports operators, the curse of too much skill

Published July 27, 2015, Page 15

|

But investors are overlooking a fundamental operating challenge: the risk that the skill element of daily fantasy is so high that DFS pros will wipe out recreational players in short order. For a real-money contest to achieve sustained popularity, it needs the right balance of skill versus luck. Chess is popular but almost no one plays it for money, because it’s far too skill-based; the better player wins almost every time. Poker thrives because an amateur can beat the best players in the world. Indeed, on June 13 at the World Series of Poker, a 51-year-old football coach from Jupiter, Fla., defeated seven pros in the final table of a $5,000 tournament to win $567,000. Another tournament in May set a record for the largest live poker tournament ever, with 22,374 entrants, pros and weekend warriors alike.

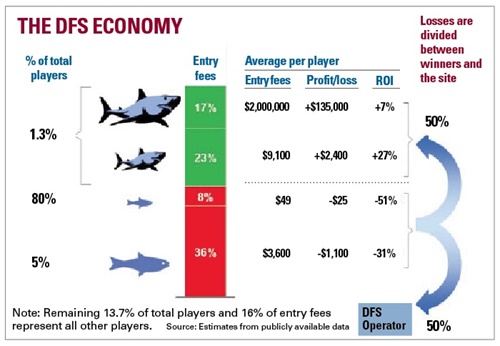

DFS affords a huge advantage to skilled players. In the first half of the 2015 MLB season, 91 percent of DFS player profits were won by just 1.3 percent of players.

The sharks split into two groups (see chart):

■ The top 11 players paid on average $2 million in entry fees and profited $135,000 each. They accounted for 17 percent of all entry fees. The winningest player in our sample profited $400,000 on $3 million in entry fees.

■ The rest of the top 1.3 percent of players paid on average $9,100 in entry fees and profited $2,400 each, for a 27 percent ROI, which is extremely impressive. These contestants accounted for 23 percent of all entry fees and 77 percent of all profits.

|

■ 5 percent of players are the big fish; they lost $1,100 on entry fees of $3,600 on average.

■ 80 percent of players were the minnows; they lost $25 on entry fees of $49 on average.

Hence, the DFS economy depends heavily on retaining the big fish. They had a staggering loss rate of 31 percent of what they paid in entry fees and accounted for 75 percent of all losses. Each minnow loses less than $10 per month and may happily continue to play forever, but each big fish loses more than $4,000 per year. The entire DFS economy depends on these few players.

■ DFS strategy

The object of DFS seems obvious: pick the players who will hit home runs or score touchdowns in a given day of games. But in large tournaments with headline-grabbing prizes, payouts are skewed heavily to the top 1 percent of participants. Therefore, the goal is to create a lineup that will produce extreme outcomes (good and bad) more often than the average lineup.

For example, a casual player might pick Mike Trout, Hanley Ramirez and Paul Goldschmidt in an MLB contest because they are star sluggers. A sharp player might instead choose Curtis Granderson, Wilmer Flores and Lucas Duda because choosing players from the same team creates covariance, the Mets are at Wrigley, the Cubs have a right-handed flyball pitcher on the mound, the wind will be gusting out to right field, and the Mets are a road favorite.

■ Inefficient pricing

Sports betting has thrived despite a large skill gap between the average sports fan and the sharp bettor. The reason is that the lines are set by a large, liquid market. You can walk up to a betting window in Las Vegas, select a team at random and still win almost 50 percent of the time. Betting randomly, you will lose money over time, but your average loss will be only slightly over the 4.5 percent vigorish.

When you create a DFS lineup, you get a fixed salary cap and buy players at prices set by the site. Trout might cost you $5,500 out of your $50,000 cap, while Granderson might cost just $3,500. But these prices don’t reflect player values perfectly. For example, on some sites, they do not take into account the opposing starting pitcher or game-day lineup changes. Finding underpriced players among 800 active MLB options can be overwhelming to the novice, but sharks use sophisticated models to optimize their lineups.

■ No protection for novices

In poker, there is a large skill gap between the best players and the typical, recreational player. But fortunately for the recreational player, the best players won’t be found at their tables. The sharks focus their energies on the tables with $5,000 buy-ins and higher. You can sit at a $50 buy-in table and be safely insulated from the best of the best, because it’s not worth their time to try to take your money.

In DFS, the top players can enter every contest. One player, maxdalury on DraftKings, every day enters nearly every MLB contest on the site, from the $10,600 buy-in contests to the $1 buy-in tournaments. Indeed, sharp players often enter each small buy-in tournament dozens or even hundreds of times. The novice player is like Neo in “The Matrix Reloaded,” fighting hundreds of Agent Smiths simultaneously.

■ Potential fixes

There are ways to mitigate these problems and give the game a better shot to thrive long term. Salary cap pricing could be made more accurate using algorithms that exist today. Third-party fantasy sports analytics sites such as Rotoviz.com and Razzball.com publish game-by-game player projections that price players more accurately than the salaries used by the DFS site operators.

Sites could float proposed salaries on an overnight market where, in a game within a game, sports fans could “buy” or “sell” players at their market salaries using play money. These trades would then succeed or fail based on the players’ performances in the next day’s games. The reward for successful traders might be, along with bragging rights, the ability to convert play money into free tournament entries or site merchandise. The reward for the sites would be salaries priced more efficiently by the wisdom of the crowd.

Limits (e.g., no more than two players from the same MLB team) could be placed on lineup construction to make optimal strategies more intuitive. Sharp players could be restricted from playing with more casual players. For example, FanDuel has limited the number of entries per day to prevent players from entering every single contest. More radical changes to the game, including dropping the salary cap model entirely or offering bracket-style tournaments (like the NCAA basketball tournament), are also possible.

FanDuel CEO Nigel Eccles points out that, “Sports fans are passionate; they participate in fantasy leagues because DFS makes watching sports more exciting.” The rapid growth of DFS confirms his view. But at some point, will the bottom 5 percent of DFS players stop saying (like a 1950s Brooklyn Dodgers fan) “wait til next year?” http://www.sportsbusinessdaily.com/Journal/Issues/2015/07/27/Opinion/From-the-Field-of-Fantasy-Sports.aspx

Ed Miller is an MIT-trained engineer and has written numerous best-selling poker strategy books including “The Course: Serious Hold ’Em Strategy For Smart Players.” Daniel Singer is senior advisor and leader of the McKinsey & Company Global Sports and Gaming Practice.

NSA Partner in Crime? Microsoft Admits Windows 10 Auto-Spying Can't Be Disabled

|

|

~ hehe o my fucking god & ALL ameri~kan zomb's ...just yawn humm ... & yet we 'wonder' y fucking E.T> cums ALLLL that fucking way 2 probe U.S. up the ...ass's Oooooops

~ hehe o my fucking god & ALL ameri~kan zomb's ...just yawn humm ... & yet we 'wonder' y fucking E.T> cums ALLLL that fucking way 2 probe U.S. up the ...ass's Oooooops

November 4, 2015 By 21wire

21st Century Wire says…

Much has been made about NSA spying and bulk data collection of American citizens, as well as an increasing loss of privacy in the face of the new digital Big Brother State – but amazingly, few are really aware of the fact that even the NSA needs working partners in crime to carry out their assault on American freedoms guaranteed in the US Constitution, specifically those enshrined in the 4th Amendment.

One such partner in crime appears to be Microsoft Corporation based in Redmond, near Seattle. Upon further examination, it appears that Microsoft’s new “operating” (policing) system, Windows 10, has given itself permission to watch your every move through its built-in spying feature.

You have to ask yourself: how out of touch is Microsoft that, in light of the Edward Snowden revelations and the rest too – that it would have the outright gall to build a back door into its latest OS and make it a nonnegotiable clause in the customer’s the Terms and Conditions?

Techworm confirms the brazen move by Gatestown product engineers:

“As more and more users are jumping the queue to download the Windows 10 through the Windows Insider Program, almost all of them have forgotten to check the Privacy Policy and Terms and Conditions users accept while downloading the Windows 10. If you study the privacy policy you will be startled at the amount of freedom you are giving Microsoft to spy on you.”

According to its Terms and Conditions, Microsoft has all but invited itself into your private domain 24/7:

“Microsoft collects information about you, your devices, applications and networks, and your use of those devices, applications and networks. Examples of data we collect include your name, email address, preferences and interests; browsing, search and file history; phone call and SMS data; device configuration and sensor data; and application usage.”According the Forbes writer Gordon Kelly, “.. despite offering some options to turn elements of tracking off, core data collection simply cannot be stopped.”

Speaking to PC World, Microsoft VP Joe Belfiore admitted, “In the cases where we’ve not provided options, we feel that those things have to do with the health of the system,” he said.

“In the case of knowing that our system that we’ve created is crashing, or is having serious performance problems, we view that as so helpful to the ecosystem and so not an issue of personal privacy, that today we collect that data so that we make that experience better for everyone.”

Now you have to ask yourself the question: how tight is Microsoft’s top brass with spy chiefs at the NSA?

Earlier this summer, we learned how NSA spying relies on AT&T’s “extreme willingness to help”, which should give us an idea of the scale of corporate collusion with the NSA.

In the wake of the early Snowden releases, The Guardian laid the foundation to this narrative:

“One slide in the undated PowerPoint presentation, published as part of the Guardian’s NSA Files: Decoded project, illustrates the number of intelligence reports being generated from data collected from the companies. In the five weeks from June 5 2010, the period covered by the document, data from Yahoo generated by far the most reports, followed by Microsoft and then Google. Between them, the three companies accounted for more than 2,000 reports in that period – all but a tiny fraction of the total produced under one of the NSA’s main foreign intelligence authorities, the Fisa Amendments Act (FAA).”

In addition to all this, you have the issue of whether or not Microsoft has embedded a heavy-handed ‘TPP‘ backdoor access clause in its privacy terms as well. The following was brought to light by a Reddit user recently:

“As more and more users are jumping the queue to download the Windows 10 through the Windows Insider Program, almost all of them have forgotten to check the Privacy Policy and Terms and Conditions users accept while downloading the Windows 10. If you study the privacy policy you will be startled at the amount of freedom you are giving Microsoft to spy on you.”

According to its Terms and Conditions, Microsoft has all but invited itself into your private domain 24/7:

“Microsoft collects information about you, your devices, applications and networks, and your use of those devices, applications and networks. Examples of data we collect include your name, email address, preferences and interests; browsing, search and file history; phone call and SMS data; device configuration and sensor data; and application usage.”According the Forbes writer Gordon Kelly, “.. despite offering some options to turn elements of tracking off, core data collection simply cannot be stopped.”

Speaking to PC World, Microsoft VP Joe Belfiore admitted, “In the cases where we’ve not provided options, we feel that those things have to do with the health of the system,” he said.