the gipster

---BREAKAWAY CIVILIZATION ---ALTERNATIVE HISTORY---NEW BUSINESS MODELS--- ROCK & ROLL 'S STRANGE BEGINNINGS---SERIAL KILLERS---YEA AND THAT BAD WORD "CONSPIRACY"--- AMERICANS DON'T EXPLORE ANYTHING ANYMORE.WE JUST CONSUME AND DIE.---

Friday, July 25, 2025

🛑 NFLPA COLLAPSE: COLLUSION, COVER-UPS & THE POWER BEHIND THE SHIELD

How OneTeam Partners, the Management Council, and a Silent Financial Coup Took Control of the Union

By EaglesFanScout / Randy T. Gipe –

Published by Trium Publishing House Limited

⸻

🔥 THE UNRAVELING OF A UNION

The NFL Players Association is in freefall.

What started as quiet frustrations has exploded into an institutional crisis. Following the resignation of Executive Director Lloyd Howell on July 18, 2025, revelations of collusion, secret arbitration deals, and federal investigations have sent shockwaves through the locker room and beyond.

Howell’s departure, triggered by a damning conflict of interest tied to Carlyle Group—a private equity firm actively seeking NFL ownership stakes—has exposed what many now believe to be a hostile takeover of the NFLPA.

This is not just a scandal.

It’s a real-time breakdown of player trust, union legitimacy, and the hidden levers of NFL labor control.

⸻

🧨 1. LLOYD HOWELL’S DOWNFALL

Lloyd Howell was supposed to be a steady hand. Instead, he turned out to be a bridge to Wall Street influence over player labor.

While serving as NFLPA Executive Director, Howell was also consulting for Carlyle Group, a multibillion-dollar private equity firm with financial interests in sports media, data, and team ownership. His dual roles created an “outrageous conflict,” according to multiple union insiders and legal experts.

His resignation came days after reporting revealed he pushed to keep a key arbitration ruling secret—a ruling that found the NFL had “urged” teams to limit guaranteed contracts.

⸻

⚖️ 2. THE SEALED COLLUSION RULING

In March 2022, NFLPA filed a grievance over alleged collusion by NFL owners following the Deshaun Watson fully guaranteed contract. In the 2025 ruling, arbitrator Douglas Droney wrote that:

“The league office did encourage teams to limit guarantees,”

…but ruled there wasn’t enough evidence of formal coordination.

That might sound like a win—but players never saw the ruling.

Because the NFLPA signed a confidentiality agreement with the NFL to seal it.

According to internal sources, Howell himself approved the secrecy—likely to preserve his financial relationships and union power. The ruling only came to light through independent reporting by Pablo Torre and Mike Florio.

Only after public exposure did the NFLPA announce a formal appeal.

⸻

💣 3. THE ONETEAM PARTNERS SCANDAL

At the heart of the corruption is OneTeam Partners—a for-profit licensing firm co-owned by the NFLPA, MLBPA, and RedBird Capital.

Its job?

“Monetize player likeness, licensing, and data across media, games, fantasy, and more.”

But what started as a way to help players has turned into a black box of elite enrichment.

Now under federal investigation by the FBI and U.S. Attorney’s Office, OneTeam is being scrutinized for:

• Bribery laundering

• Conflicted compensation schemes

• Selling player biometric data without consent

Sources say executives—including Howell and former MLBPA chief Tony Clark—are of interest.

In short: the union’s own company may have been turned against its players.

⸻

🧠 APPENDIX: WHAT IS ONETEAM PARTNERS?

Founded in 2019, OneTeam Partners handles:

• Madden video game licensing

• Fantasy football data distribution

• Biometric & AI player modeling

• Group endorsements

• College athlete monetization (via deals with Opendorse and others)

It controls revenue from:

• Player image & likeness rights

• Digital and wearable data

• Real-time on-field performance metrics

Players don’t vote on deals.

They have no representation on its board.

And now it’s under federal investigation.

OneTeam may be the very mechanism that:

• Funded union loyalty through kickbacks

• Suppressed contract guarantees

• Trained AI models using player movement—without full disclosure

The question players now ask:

“Did they sell us out with our own data?”

⸻

😠 4. PLAYER REBELLION BREWING

This isn’t just a story about executives—it’s a grassroots backlash.

• Steelers captain Cam Heyward publicly criticized the union, saying players were learning more from the media than from leadership.

• Union reps are privately drafting a constitutional overhaul.

• Some players are even discussing union decertification if trust cannot be restored.

With the 2031 CBA negotiations looming, a leaderless, distrusted NFLPA is a ticking time bomb.

⸻

💥 5. BILL POLIAN JUST BLEW UP THE NFL’S DEFENSE

On July 19, former Colts GM and longtime NFL insider Bill Polian gave an interview that changed everything.

“On occasion, the Management Council will step in.”

That single quote directly contradicts sworn testimony from:

• Giants owner John Mara

• NFL lawyers during arbitration

• And Roger Goodell, who claimed the Council merely “advises” teams

Polian revealed that the NFL Management Council enforces contractual uniformity:

• Pressuring teams during holdouts

• Blocking fully guaranteed deals

• Silencing player-friendly trends

“When the Management Council encourages something,” Polian said,

“You ignore it at your own risk.”

That’s not guidance.

That’s collusion by design.

⸻

⚖️ LEGAL FALLOUT: COLLUSION CASE REIGNITED

The 2025 arbitration ruling cleared owners based on denials that the Management Council pressures teams.

Polian’s quote now opens the door to:

• Perjury risk (for Kraft, Mara, Goodell)

• Legal reexamination of the ruling

• Potential involvement by DOJ or FTC if union suppression is proven systemic

DeMaurice Smith had testified that Roger Goodell asked Robert Kraft to block guarantees post-Watson.

Kraft denied it.

Polian just confirmed the pattern.

⸻

📺 MEDIA SILENCE: STRATEGIC BLACKOUT?

Despite the implications, major networks like ESPN and NFL Network have barely covered Polian’s statement.

Mike Florio called it:

“A strategic blackout to protect the league’s legal narrative.”

Meanwhile, independent outlets and blogs are doing the work legacy media won’t:

Connecting the dots.

⸻

💰 6. REAL-WORLD IMPACT ON PLAYER CONTRACTS

After Watson’s deal in 2022, these QBs faced Management Council suppression:

• Lamar Jackson – Forced to negotiate through the tag system

• Kyler Murray – Accepted partial guarantees

• Russell Wilson – Took a traditional deal before collapsing in Denver

All were potential trendsetters.

All were pushed back in line.

Meanwhile, holdout fines under the current CBA are now $50K/day with no waivers for veterans, giving teams unprecedented leverage.

⸻

⏳ 7. 2031 CBA: THE REAL DEADLINE

The current Collective Bargaining Agreement expires in March 2031.

The league knows it.

The owners are preparing.

If the NFLPA enters those negotiations:

• Divided

• Distrusted

• Under investigation

• Led by more proxies of private capital

…then everything is on the table:

• An 18-game season

• Reduced medical protections

• AI training clauses

• Further suppression of guarantees

Players must act now—not in 2029.

⸻

🧩 8. THE BIGGER TRUTH: A FINANCIAL COUP

What we’re seeing isn’t a single scandal.

It’s the outline of a systemic power structure built to:

• Monetize player data

• Suppress labor solidarity

• Expand ownership control

• Use “licensing” as a front for surveillance capitalism

OneTeam.

Carlyle.

Management Council.

The collusion ruling.

The silence.

It’s not chaos—it’s architecture.

This isn’t just a leadership failure.

It’s a hostile takeover of the union.

⸻

📝 FINAL WORD

The NFLPA doesn’t just need a new Executive Director.

It needs a reckoning.

A forensic audit.

And a player-driven revolt.

Because if Bill Polian is right—and the Council steps in behind the scenes—then the system isn’t broken.

It’s working exactly as designed.

⸻

📎 Follow-up reporting:

• NFLPA Plunges into Crisis – Original Exposé

• [What Is OneTeam Partners? And Why You Should Care

Sunday, November 7, 2021

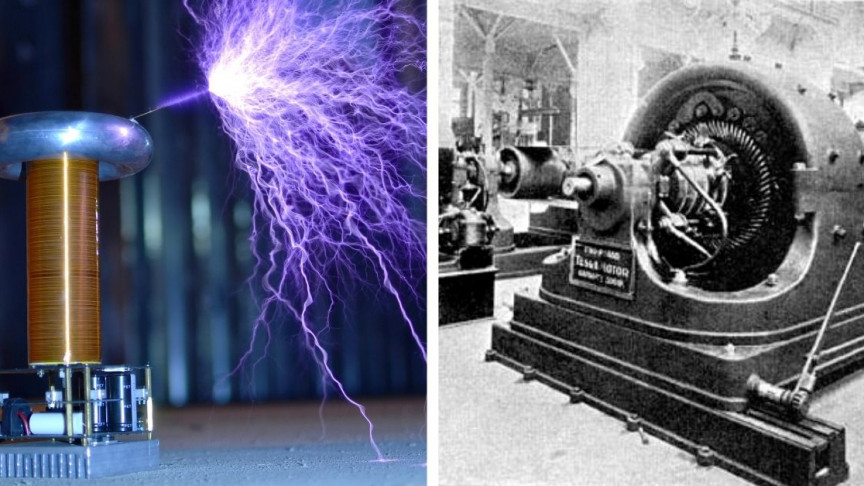

Tesla’s “Global Wireless Energy Network”

Posted by Ami Tiel | Sep 19, 2020 | https://americandigitalnews.com/index.php/2020/09/19/telsas-global-wireless-energy-network/

Post by @anony_fa-mous Threadreader LINK

⚡️The Global Wireless Energy Network⚡️

Nikola Tesla’s dream for the world was for everyone to be able to tap into a wireless energy grid for free.

He might have gotten that idea from a Ancient Civilization.

In 1905, Nikola Tesla creates patent 787,412, the art of transmitting electrical energy through the natural medium.

He wanted to create worldwide generators that could tap into the ionosphere, which is sparkling with energy and could easily be tapped.

Planet Earth is a gigantic electrical generator, according to Tesla. It is spinning between two poles where limitless energy can be harnessed.

By harnessing the Earth’s conductivity (standing waves) you can send electricity around the world like invisible water.

He built the Wardenclyffe tower in Long Island, New York on top of an aquifer, which discharged the negative ions from the Aquifer to the top of the tower.

Then, to receive the energy, receivers would be built so other people could use that energy.

So in essence, he wanted to grab the energy from the ionsphere, make it pulse into the Earth with a certain vibration that could be read by the other receivers.

Tesla also had many other interests in different fields of research, some quite esoteric.

One of the most unusual was his preoccupation with Egyptian pyramids, one of humanity’s most mysterious and magnificent constructions.

The pyramids of Egypt are the most mysterious structures in the world. People don’t know when, how, why they were built and who built them.

6 million tons

2.3 million stones

80 ton stones transported from 500 miles away

Tesla believed they served a higher purpose and was investigating them throughout his life.

What did he find so alluring about the pyramids? He wondered if they weren’t giant transmitters of energy that sent energy wireless….

Yes, seriously

Tesla

inventions are responsible for 80% of today’s technologies. He

perfected the Alternating Current and has invented many modern day tech.

Electric Engine, radio, the laser, radar, etc.👇

interestingengineering.com/10-of-the-most…

What he says should be taken seriously.

Many people believe the pyramids are tombs for the pharaohs of ancient Egypt but did you know there hasn’t been a single mummy found in one.

They have all been found in the Valley of the Kings.

The pyramids also lack the inscription art that ancient Egypt is known for.

This has lead many to believe that the pyramids were made for a more functional purpose.

This what the inside of pyramids look like. The limestone inside the pyramid contains quartz and granite, which is highly conductible.

The pryamids used to have white limestone covering them that was so tightly compacted that you couldn’t fit a razorblade between them.

It has high insulating properties and doesn’t contain magnesium. This prevented the electricity from being released from the inside.

The Giza Plateau is above old underground water channels / aquifers. The Nile used to run very close to the pyramids and used to run underneath them creating an electric current.

This is known as physio-electricity. The electricity moves up the pyramid through the granite stones inside to the gold capstone at the top of the pyramid.

Gold is also a great electrical conductor. This would send the negative ions to the ionosphere.

The inside of the Great Pyramid of Giza has a very mechanical design.

Water would rush into the below chambers and exit creating a pump that would vibrate the pyramids.

This vibration would hit the Kings chamber with a precise frequency.

They were Geo-mechanical devices that vibrated with the energies of the Earth and converted the energies of the Earth into electromagnetic energy.

The Ancient builders built the pyramids and the obelisks to make up an ancient global wireless energy network.

Obelisks are used to harness the energy from the pyramid generators. Obelisks are made from Granite that contains quartz.

Quartz has the ability to convert the Earth vibrations into usable energy known as Piezoelectricity.

Obelisks were used so smaller electronic devices could be used locally, such as lamps / bulbs.

The Egyptians used handheld bulbs, called Dendera lights, that they show in their instriptions.

If this sounds ridiculous then explain why there is no fire soot on the ceiling in the Tombs of the Kings.

This means they didn’t use fire torches / candles in the tunnels underground.

Tesla showed a similar version to this in the Chicago fair where he held a bulb and lit it with his own body.

Here is a mini Tesla Coil from Today using wireless energy on a very small scale.

Tesla coil lighting a lightbulb pic.twitter.com/zy1y0CIt8A

— Chemical Reactions (@ChemistryReacts) May 2, 2020

Tesla may have cracked the Ancient Builder code.

In 2018, a group of researchers have determined that the pyramid is still focusing electromagnetic energy.👇

phys.org/news/2018-07-r…

The location of the Giza Plateau also lays on the Ley Lines of the World. These are high points of energy or high concentrations of electrical charge.

They take information or energy and carry them around the world, spreading knowledge and wisdom to all inhabitants.

These intersecting points are also coincidentally home to some of the most sacred temples and monuments in the world including the Egyptian Pyramids, Machu Picchu, Stonehenge, Angkor Wat, etc.

Most ancient cultures around the world seem to have some understanding of Ley Lines:

China – Dragon Lines

South America – Spirit Lines

Australia – Dream Lines

West – Ley Lines

There is a symmetrical system / pattern to all major ancient pyramids and other megalithic structures👇

geolines.ru/eng/publicatio…

One major pyramid complex that has high significance and electromagnetic evidence is Teotihuacan in Mexico

This complex has underground tunnels that contain water, pyrite, mercury, and radon gas👇

ancient-origins.net/ancient-places…

The most interesting fact about the complex is that it’s almost identical to a computer circuit board when you look at it from above.

There is evidence of electromagnetic energy in all of these major ancient landmarks, which means there is a possibility there was a ancient civilization that harnessed energy from the ionosphere to create technologies we could only dream of…

Maybe that day is sooner than we realize…

— Vincent Kennedy (@VincentCrypt46) September 11, 2020

Feature Image Credit and Additional Resources: Earth Resonance Project

Sunday, October 10, 2021

The undetected team of serial killers stalking America

...& other county's ???

I’m not big on conspiracy theories. They sound interesting but the moment you start digging for actual facts you are almost certainly going to be disappointed. There is one so-called conspiracy theory that has been digging at me for a long time, something I’ve been following on a surface level at least for many years. It is commonly referred to as the Smiley Face killers theory.

Retired NYPD detectives Anthony Duarte and Kevin Gannon held a press conference in 2008 to make the public aware of a dozens of deaths that are officially listed as accidental drownings, deaths that the two former cops allege are actually murders linked to one another. “I believe we’re looking at an organized group that has a hierarchy and is involved in murder and other criminal activity,” Gannon said. Such a revelation would, if true, re-write a large portion of what we think we know about criminology. Experts would tell us that serial killers don’t work together in teams, in fact in extremely rare instances we have only seen them work in pairs.

Unless of course these are not serial killers per se but rather something else entirely.

Starting around 1997, a statistically odd number of educated white males have died in and around the water mostly focused around the Great Lakes region of North America (to include Canada) and Eastern Coastal cities like New York and Boston. Other similar deaths pop up in Arizona and the pacific northwest. Taken together, our sample size encompasses over a hundred individuals meeting the criteria listed above. According to law enforcement agencies, these are not murders but accidental drownings that involve inebriated young men falling into the water and drowning.

There is a multitude of reasons why this explanation makes absolutely no sense and to understand one really has to begin digging into the case studies. The main resource for this is “Missing 411: A sobering coincidence” by David Paulides whose fact-based research sets a standard for this investigation, one that eschews speculation and conspiracy theory. Now fair warning, Paulides is a retired police officer who became a Sasquatch researcher prior to getting interested in missing persons cases, but his research sticks to the facts and is helpful for investigating this subject.

Here is a quick rundown of some very odd reasons why the accident or suicide theory does not add up, aside from the obvious demographic pattern represented by the victims. Many of the men did not die in the water as coroner’s reports reveal. In some cases they were missing for a week, but were only actually in the water for 48-hours prior to their remains being discovered. In other words, they were being held captive before being drowned. Some of the victims appear to have been drugged prior to their disappearance and have tested positive for the “date-rape” drug post-mortem.

Coinciding with the fact that many did not actually die in the water, nearly twenty victims were found by police or search parties in areas which had been previously searched, indicating that the victim did not die in that location.

The Smiley Faced killers theory gets its name because smiley face graffiti sometimes appears at the scene of where the remains are found. What this actually means is inconclusive, as graffiti frequently appears in cities, under overpasses, and so on. While this piece of evidence may or may not link the victims with a perpetrator, the other pieces of evidence are far more compelling. It appears that the police have been strongly denying any insinuation that there is a serial killer on the loose, even though some of the drownings have now been re-classified as homicides.

Many theories have been advanced, including the argument that none of this is actually happening and it is just a lot of hot air and hysteria. The FBI’s ViCAP (Violent Criminal Apprehension Program) office that gathers statistics on homicides nationwide claims that there is nothing odd going on here, although ViCAP has historically had a less than stellar success rate, much of which is due to poor reporting methods and inter-agency bureaucracy. To really get the full argument for and against the so-called Smiley Face killers theory, one really needs to read the Paulides book as the evidence is too lengthy to cover in an adequate manner in this article.

Having examined the publicly available data myself and assessed various explanations offered, it is my opinion that there is in fact something nefarious taking place around these deaths. I would further offer that there are bad actors involved and some form of institutionalized intelligence is orchestrating the murders. By analyzing the murders themselves, we can draw some inferences as to the organizational structure behind the killings.

The choice of victims indicates a fetishization behind what would be mission-based murders. The killers usually choose well-educated white males as their victims for an ideological or religious reason. There appear to be no political linkages between victims or institutional bonds between them aside from that many are college students. Two victims in Boston both served in the Navy, some stayed at the same hotel, some disappeared within a week of each other, but these links seem circumstantial, the only thing that would link them together is the killer(s) and the manner in which he, she, or they targeted the victims.

The killers are also hyper-competent. Whoever they are, they represent something that we haven’t seen yet, something that is not yet described by criminal psychology. Perhaps, there is a small sub-set of serial killers that is in fact predisposed to working together and whose behavior is not oriented towards a deep-seated desire to be viewed by the public, discovered by law enforcement, or a hope of being caught. The level of competence, tight operational security, and seeming occult leanings suggested by the choice of victims leads me to believe that these are absolutely not serial killers of the variety that we are familiar with such as John Wayne Gacy or Ed Gein.

This leads us to another uncomfortable question: what group of people have the institutional knowledge required to pull off a long running string of murders while cunningly avoiding CCTV cameras, leaving behind no physical evidence, and alluding the detection of law enforcement? Granted, I have my own cognitive bias based on my experience and history. A rogue operator is not out of the question. The possibility that someone from the intelligence community, special operations, or even within law enforcement itself has gone off the reservation cannot be discounted out of hand. Such a case would not be unprecedented as former Delta Force operator Marshall L. Brown was discovered to be a fairly prolific serial rapist who used his urban climbing and lock picking skills to break into women’s homes.

However, it would also be a huge mistake as well as arrogant to think that only members from our own community could be competent. One need not have insider knowledge or be a highly trained government operative to elude police. Reading textbooks and case studies on forensic science, evidence collection, and criminology would suffice. A rogue operator could be plausible, but a group of rogue operators turned serial killers seems extremely improbable. Some of us are more moral than others, but we are all institutionalized by the system, and wholesale unsanctioned murder within America is something alien to us.

Another question is why these murders begin to appear in clusters largely beginning in 1997? Similar murders in the Great Lakes region actually date back to the 1700’s but the big surge begins in ’97 and continues to this day. Why? I would hypothesis that the game changer that took place here was the internet. The internet existed previously for a long time and pedophiles were using dial-up modems to trade child pornography in the 1980’s. Yet, it wasn’t until the mid-to-late 1990’s that the internet truly became popular for the masses. This advancement in communications technology would allow previously isolated individuals with similar ideas to suddenly find each other and gather into semi-clandestine cliques.

Cullen Fortney was nearly a victim, but survived and was interviewed by Kevin Gannon. One moment the 21-year-old was having a drink in a bar. Then, after a prolonged period of missing time that lasted from 2AM to 6:45AM, he woke up floating downstream in the freezing Mississippi river. Swimming to shore, he staggered up to the street and by some miracle was right in front of a hospital which he entered at about 7AM. If he had been in the water, or exposed to the elements much longer, he certainly would have died. These are not normal accidental drownings, Cullen was drugged and thrown into the water with the intention of drowning him.

At this point you are no doubt wanting me to reveal who the killers are and solve the mystery for you, but I can’t. The best I can offer is speculation as to who the killers are. As I noted previously, their method of operation and the data points gathered over a long period of time indicate a well-organized, competent, and intelligent small group of people. Their actions are planned in detail and rehearsed ahead of time. They have not made any big mistakes over the course of two decades, indicating discipline and unit cohesion. There is a central belief system that binds these individuals together, although I cannot be sure of what it is.

I would speculate that the killers are a type of cult. Technically, they are serial killers but not the kind we are used to dealing with. They may be a cult, but also not the type of cult we are used to thinking of, such as the Branch Davidians or Heaven’s Gate cults. This cult may be a subset of an existing cult or religion, one that has a two-tiered belief system, one which is for public consumption and one which is only for a small group of hardcore believers within the organization. The well-educated and athletic young men that are chosen as victims are probably seen as ritual sacrifices to this group’s god, gods, demons, or whatever it is they believe in. What is done to the victims during the “lost time” between the when they are drugged and when they are thrown into the water remains unknown. Sometimes it is a period of hours, sometimes it is days.

Furthermore, I would speculate that a portion of this group’s organization exists above the surface and has public visibility. This would help ensure the group’s social camouflage, better allowing it to blend in and providing plausible deniability to the killers for being near each other at certain locations at certain times.

This cult is likely to have been in existence for a long period of time, or members of the cult have a long history of murder behind them. The organization carries with it an institutional knowledge that is passed down from the elders to the younger generation. How recruiting and induction is initiated, I can’t possibly know; although I would stick to my thesis that it began on the internet in the mid-1990’s or at least ramped up at that time. What the core beliefs of the cult are and what motivations individual members have can also only be hypothesized, but I believe that there are occult beliefs represented.

It all sounds like an episode of True Detective, and the amount of red herrings such as the occult references and smiley faces make cases like this that much harder to sift through. It is easy to pass from a fact-based investigation, to a wild conspiracy theory, to outright hysteria resembling the Salem witch trials all in the blink of an eye. For instance, I’m old enough to recall the insane grumbling of Ted Gunderson, wild claims about Dungeons and Dragons, and TV talk shows having guests on talking about how Satanists were abducting children from a daycare center via a secret tunnel for ritualistic abuse. One has to be extremely careful about wandering down the rabbit holes.

I would also speculate that an intelligent serial killer or killers would float obscene occult evidence in front of our eyes intentionally, in order to distract the public and throw law enforcement off their scent. For now, there are only alcohol related accidental drownings with no connection to one another. There is no such thing as Smiley Face killers according to the authorities.

Perhaps that means that everything is going according to plan.

If I were assigned to investigate these murders, one hypothesis that I would look at is whether or not there was a specific special target within the grouping of so-called accidental drownings. In other words, I would be asking if there was not a high value target hidden within the cluster of murders. The killers could very well be inoculating the police and the public to killings that fit a certain profile, and with that accomplished they are then going to move on to their high priority target knowing that his murder will be overlooked as they have reshaped our culture and desensitized their area of operations. The serial killer thesis has already been beta-tested in the media and has been rejected by the authorities, giving a green light for those looking to take advantage of the situation.

Serial killers usually don’t present a national security threat, but one day they might.

(lead picture courtesy of the author)

Saturday, October 9, 2021

PROGRAMMABLE CENTRAL BANK DIGITAL “CURRENCY

For some time now, people like former Assistant Secretary of Housing and Urban Development Catherine Austin Fitts and many others - including yours truly - have been warning about the dangers of crypto-currencies, and more especially, of Central Bank Digital Currencies or CBDCs. Our warnings have consistently centered around three basic dangers they carry with them: (1) they are not energy efficient, and as electronically based systems can be subject to outages such as electro-magnetic pulse and so on, and additionally as cyber-systems, suffer from the lack of integrity in such systems. Indeed, when I first heard about them, one of my own personal warnings was that in spite of claims to the contrary, they could be hacked. Stories have finally appeared to this effect. (2) Contrary to claims of privacy and to the early claims that crypto-currencies spelled the end of central bank private money monopolies, such technologies in the hands of central banks, with the power to mandate their use and to outlaw others, would spell the end of privacy. Finally and most importantly (3) such currencies in the hands of central banks, coupled with social credit scoring systems, would effectively not be a currency at all, but more like corporate coupons whose value (or lack thereof) could be adjusted on a case-to-case basis, depending on your behaviour and your thinking.

These may seem like outlandish ideas, but the following article shared by V.T. provides confirmation of these basic theses:

“Programmable Digital Currency”: The next stage of the new normal?

Kit Knightly Building on the bitcoin model, central banks are planning to produce their own “digital currencies”. Removing any and all remaining privacy, granting total control over every transaction, even limiting what ordinary people are allowed to spend their money on. From the moment bitcoin and other cryptocurrencies first emerged, sold as an independent and … Continue reading “Programmable Digital Currency”: The next stage of the new normal?

Let us be clear about the developments outlined in this article: while these "currencies" may be new, they are not normal nor are they currencies. Note the following statements:

For those who have never heard of them, “Central Bank Digital Currencies” (CBDCs) are exactly what they sound like, digitized versions of the pound/dollar/euro etc. issued by central banks.

Like bitcoin (and other crypto), the CBDC would be entirely digital, thus furthering the ongoing war on cash. However, unlike crypto, it would not have any encryption preserving anonymity. In fact, it would be totally the reverse, potentially ending the very idea of financial privacy.

Now, you may not have heard much about the CBDC plans, lost as they are in the tangle of the ongoing “pandemic”, but the campaign is there, chugging along on the back pages for months now. There are stories about it from both Reuters and the Financial Times just today. It’s a long, slow con, but a con nonetheless.

The countries where the idea progressed the furthest are China and the UK. The Chinese Digital Yuan has been in development since 2014, and is subject to ongoing and widespread testing. The UK is nowhere near that stage yet, but Chancellor Rishi Sunak is keenly pushing forward a digital pound that the press are calling “Britcoin”.

Other countries, including New Zealand, Australia, South Africa and Malaysia, are not far behind.

The US is also researching the idea, with Jerome Powell, head of Federal Reserve, announcing the release of a detailed report on the “digital dollar” in the near future.

And here's the rub, and it directly confirms the warnings of Catherine Fitts and others regarding the true nature of CBDC's: they are not money nor currency in any sense:

The proposals for how these CBDCs might work should be enough to raise red flags in even the most trusting of minds.

Most people wouldn’t like the idea of the government monitoring “all spending in real-time”, but that’s not the worst it.

By far the most dangerous idea is that any future digital currency should be “programmable”. Meaning the people issuing the money would have the power to control how it is spent.

The article then links a video of Agustin Carstens, head of the Bank of International Settlements (BIS), and in case one missed it, actually cites him a little later in the article:

Here’s that quote again, with some emphasis added:

The key difference [with a CBDC] is that the central bank would have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and the have the technology to enforce that.”

…which tells you not only that they want and are seeking this power, but how they justify it to themselves. They transform other people’s money into an “expression of their liability”, and so consider it’s only right that they control it.

An article in the Telegraph, back in June, was just as candid [our emphasis]:

Digital cash could be programmed to ensure it is only spent on essentials, or goods which an employer or Government deems to be sensible

The article goes on to quote Tom Mutton, a director at the BoE:

You could introduce programmability […] There could be some socially beneficial outcomes from that, preventing activity which is seen to be socially harmful in some way.

It does not take a particle physicist to understand that if central banks can program their digital "currency" on a case-by-case individual basis to be spent only on certain things, the same capability also gives them the ability to determine the value of that "currency" on a case-by-case individual basis. In short, the same technology enables both the end of financial privacy and makes the "currency" into a corporate coupon. This is a one way mirror behind which the banksters can operate with impunity, and is tailor-made for even more financial fraud.

Q.E.D.

So how does one combat this? There are two simple solutions: do not bank with the big banks, use cash as much as possible in transactions, and start building networks with the realization that sooner or later, those networks might have to create currencies of their own.

Subscribe to:

Posts (Atom)