The Malaysian Airlines MH17 Crash: Financial Warfare against Russia, Multibillion Dollar Bonanza for Wall Street

Moreover, the political threats and insinuations directed against the Russian Federation in the wake of the July 17 disaster, have been coupled with a renewed wave of economic sanctions directed against major Russian corporations and financial institutions.

Inside Information and Foreknowledge

The conduct of speculative operations both prior and in the wake of the July 17 crash, is also a major consideration: In the functioning of World financial markets, terror events, natural disasters as well as major tragedies such as MH17 will invariably have an impact on the short term behavior of financial markets including major stock markets, the foreign exchange market as well the energy and commodities markets.

It should be noted that foreknowledge of a terror event such as the MH17 crash of July 17 over Eastern Ukraine’s warzone, offers an opportunity to the perpetrators as well as those who have advanced knowledge of the terror event to conduct profitable speculative transactions on various financial markets. Cui bono? Wall Street or Moscow’s Financial Establishment?

In other words, those who planned the attack on MH17 (including their political and economic sponsors) had in their possession valuable and confidential information which could be used in large scale speculative undertakings, including options trade on the DJIA, the Moscow Stock exchange (MICEX), foreign exchange markets, not to mention speculative trade (e.g. put options) on airline stocks.

What is described above is routine in the frequent conduct of “risk free” speculative trade by major financial institutions.

Major financial actors who had foreknowledge of the MH17 event of July 17 would have made billions of windfall gains in speculative transactions. With foreknowledge of the crash, institutional speculators would be in a position to accurately “predict” the short term decline of the Dow Jones Industrial Average and other major stock markets, commodity and forex indexes and act accordingly, placing speculative bets through the use of different financial instruments.

Moreover, there is also an overlap between Wall Street and the corporate financial media: Timely news releases by Bloomberg, the Wall Street Journal, the Financial Times, etc. in the wake of a major international event often exert a decisive influence on the actual movement of major financial indicators. At the same time, these powerful financial media –which influence investors’ perceptions regarding future market trends– overlap symbiotically with partner interests on Wall Street which are directly involved in undertaking major transactions. In fact, the corporate financial media are invariably major actors on Wall Street or the City of London. Who are the major shareholders of the WSJ, the Financial Times or the Economist? Is there a conflict of interest?

The New York Stock Exchange

In the wake of the July 17 crash of MH17, the Dow Jones Industrial Average (DJIA) declined from its 17150 peak and subsequently bounced back (see chart below). Foreknowledge of the MH17 would have allowed the reaping of financial gains on the short term movement of the Dow from one day to the next.

Table 1 Down Jones Industrial Average (DJIA)

The London Stock Market on July 17

While the NYSE was open on the 17th after the disaster over Ukraine, the London Market Stock opened up on Friday the 18th and experienced a short term slump in market values, rebounding at the end of trade on the 18th.

London Stock Exchange FTSE All Share Index

The Moscow Stock Exchange

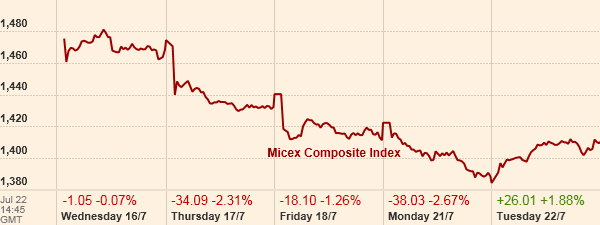

The tragic event of July 17, coupled with immediate accusations directed against Russia, contributed to precipitating the tumble of the Moscow stock exchange (see chart below).

While European stock markets were also affected, the most dramatic decline was recorded on the Moscow Stock Exchange, with Moscow’s MICEX index falling by 2.3 per cent in one day and its dollar-traded related index, the RTS index, dropping by 3.8 per cent. (Reuters, July 18, 2014) (see chart below)

Those who had advanced knowledge of the MH17 crash and the likely accusations directed against Russia by president Obama would no doubt have placed their bets on a decline of both the MICEX and the Russian ruble.

Table 2 Moscow Stock Exchange MICEX Composite Index

Graphs: Source Financial Times, 2014

The Sanctions Regime

The economic sanctions regime initiated by the Obama administration had targeted the Russia’s arms industry, its major energy giants including state owned Gazprom and Rosneft as well as the privately owned gas conglomerate Novatek. Major Russian financial institutions were also the object of sanctions.

In a bitter irony, late Wednesday July 16th (ET), one day before the MH17 tragedy, the Obama administration announced a new set of sweeping sanctions directed against the Russian Federation:

[L]ate Wednesday [July 16, 2014] , President Barack Obama had announced fresh sanctions targeting Russia’s large-cap companies that included bellwether energy and banking companies. … “We have to see concrete actions, and not just words that Russia in fact is committed to trying to end this conflict along the Russia-Ukraine border,” Obama stated at the White House after announcing fresh sanctions on Russia’s large-caps. (MH17 Crash, Fresh US Sanctions: Beware of Funds with Russia Exposure, Zaks, July 18, 2014It is worth noting that Rosneft has a gas deal with Exxon Mobil. The endgame of the sanctions regime is economic conquest, namely to weaken Russia’s energy giants with a view to ultimately modifying their ownership structure:

That the United States went for such a big company [i.e. sanctions] shows that it means business. Rosneft has outstanding debts of about $70 billion, close to its market capitalization, forcing it to seek persistent refinancing — and, leaving aside some Russian and Chinese financing, only the international dollar markets can provide sufficient financing.Following Obama’s timely announcement on the 16th of July, confirming a new wave of sanctions, the decline of stock values on Moscow’s Stock Exchange started at the opening of trade on July 17th prior to the crash of MH17.

Rosneft will have to reduce its capital expenditures because of the U.S. sanctions.” (Anders Aslund, U.S. responded to MH17 before airliner was shot down, Sanctions imposed after Russia delivered arms that brought down plane, Market Watch, July 18, 2014)

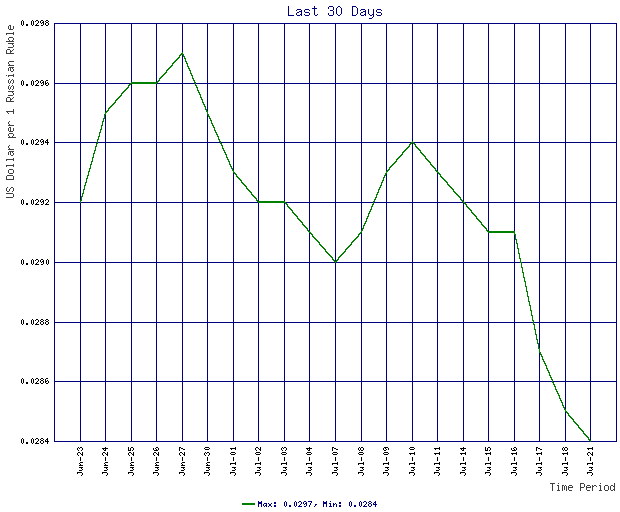

Currency Markets: Decline of the Ruble

Currency markets were also affected. While the event did not precipitate a significant decline of the Malaysian ringgit, the Russian ruble fell by 1.8 per cent against the US dollar, its biggest one-day decline since June 2013. (Reuters, July 18, 2014). In the wake of the July 17 crash in Ukraine, the Russian ruble has continued to decline (see chart below).

Ongoing threats pertaining to Russia’s alleged role in the downing of MH17 not to mention the implementation of new sanctions against Russia announced on the 16 of July, have resulted in a significant decline of the Russian ruble. It should be understood the Russian central bank to prevent a further decline of the ruble, most probably used its forex reserves to counteract the speculative attack against the Russian ruble, leading to a significant capital outflow of Russia’s dollar reserves.

Table 3 Russian Ruble (RUB) US Dollar Exchange Rate (June 21, 2014 – July 21, 2014)

Decline in Airline StocksThere was a significant decline in airline stock values quoted on NASDAQ on July 17th following the crash of MH17 (see chart below) characterized by a dip on the 17th and a recovery on the 18th. Those who had foreknowledge of the MH17 crash could have placed safe speculative bets reaping substantial profits.

As outlined at our introduction the issue of foreknowledge is of crucial significance. By definition the criminal perpetrators of the MH17 crash had foreknowledge which could have been used by partner financial entities involved in speculative trade. This particular dimension of MH17 foreknowledge –reminiscent of the short selling of airline stock in the days preceding 9/11–requires further analysis and investigation. It should be a component of the criminal investigation into the July 17 crash itself.

NYSE Airline Index (XAL), July 15-21, 2014

The Fate of Malaysian Airlines

With the mysterious disappearance of MH370 in March, the number of MH passengers had dropped by 60 per cent. Malaysian Airline System’s (MAS) financial situation had become increasingly fragile.

Following the MH17 crash, Malaysian Airlines System is up for complete privatization. “MAS is almost 70 per cent owned by the government investment vehicle Kazanah Nasional, which earlier this year expressed interest in offloading part of its holding.” (ABC New Australia, July 21, 2014)

The annual decline in MAS stock is of the order of 25.8 (see chart below)

Table 4 Malaysian Airlines MAS Stock Values (July 2013- July 2014)

Source: Bloomberg, 2014

No comments:

Post a Comment