“The Banksters Did It”: The Central Banks Have Engineered This Financial Collapse ~ could it B "they" R "shedding" the old sys~tum & replacing IT ...wit the "new" ...1 ...folks where's the $$$ go~in/gone ...it just doesn't go fucking ...puff !

- The staggering $5 trillion wipeout of funny money paper promise “wealth” since the yuan deflation began ($2.7 trillion on Monday alone).

- The all-time record spike on the volatility index (aka the “Fear Index”).

- The 1000 point Dow plunge off the opening bell on Monday morning.

- The halting of every major US index during the market mayhem.

- The 4500 mini crash events that forced indices worldwide to halt and unhalt at a dizzying pace.

- The amazing magic levitating act courtesy of our friends at the Plunge Protection Team that brought about the largest intraday point swing in Dow history.

OK, enough sarcasm. Readers of this column will know by now that the phony baloney stock markets, manipulated as they are from top to bottom and juiced as they are on the Fed’s QE heroin, are no longer reflective of economic reality. The only question is how far this particular dead cat market will bounce, and whether it will be helped along with more heroin from the Fed.

But there is already one vitally important take away from these events that the independent media must articulate now, before it’s too late. Namely: This crisis was engineered by the central banks. It is their fault.

Let me repeat that again in case you missed it: This crisis was engineered by the central banks.

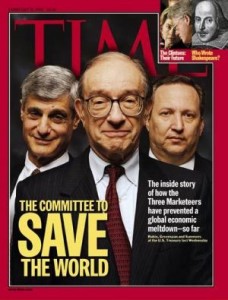

This point is not even controversial. It has been the universal consensus of institutions ranging from the Bank for International Settlements to the Official Monetary and Financial Institutions Forum, and from OECD officials toformer Fed Governors and even Alan “Bubbles” Greenspan himself.

This point is not even controversial. It has been the universal consensus of institutions ranging from the Bank for International Settlements to the Official Monetary and Financial Institutions Forum, and from OECD officials toformer Fed Governors and even Alan “Bubbles” Greenspan himself.In fact, analyst after analyst and pundit after pundit–including the most mainstream of mainstream publications–have been sounding the alarm on the stock market bubble for much of the past year.

This tells us two things: the current market mayhem was perfectly predictable (and predicted), and the central banks not only stayed the course but actually doubled down with more and more QE injections.

It is the central banks that have created this mess, and what’s more they have created this mess in the full knowledge that their actions would lead to disaster. And now, one can be sure, the same central bankers and their political puppet mouthpieces will use this crisis to continue the construction of the “New World Order” that they called for in the wake of the 2008 collapse.

Anyone who can’t see the endgame now–global government by the bankers, of the bankers and for the bankers–is either blind or wilfully ignorant.

It is especially important to state these obvious truths now, because we can already see a false narrative underway. This narrative has two main thrusts: one is to paint China as the culprit for the global downturn and the other is to assume that only central banks can save the day (with even greater liquidity injections and even deeper rate cuts).

The China-as-economic-villain narrative ranges from the subdued (“China’s ‘Black Monday’ sends markets reeling across the globe“) to the blatant (“Chinese Economy Causes Markets to Fall“) to the silly (“Don Yuan Causes Heartbreak“), but they all convey the same message: China has brought this on the world all by itself. It’s not that China is reacting to a global monetary environment created by the Fed and fostered by other central banks, or a global economic slowdown that is biting into a heavily export-driven economy, or the conflicting pressures on the country as it tries to navigate its way toward global reserve currency status. Nope, it’s just a bull in a china shop (or is that a China in a bull market?) knocking things over and causing mayhem (Trump was right!).

The

only-central-banks-can-save-us narrative is even more infantile, but

also more dangerous. We are told that the crash came because China’s

central bank failed to act. We are told that it’s now up to Turkey’s central bank to bolster the flagging lira. We are told that the Lehman collapse occurred because of too little central bank intervention. We are told that only the European Central Bank is capable of “riding to the rescue” and preventing a market rout.

The

only-central-banks-can-save-us narrative is even more infantile, but

also more dangerous. We are told that the crash came because China’s

central bank failed to act. We are told that it’s now up to Turkey’s central bank to bolster the flagging lira. We are told that the Lehman collapse occurred because of too little central bank intervention. We are told that only the European Central Bank is capable of “riding to the rescue” and preventing a market rout.In other words the very same institutions that engineered this crisis are the only ones that can save us.

It is the height of insanity that anyone would believe this nonsense, but then again the world fell for it after Lehman, and they’re likely to fall for it again. Unless we spread the word.

The banksters did it. And unless we derail their agenda, they’re going to do it again.

Copyright © James Corbett, The Corbett Report, 2015

No comments:

Post a Comment