Two recent reports show that

Obama and his Administration lied when they promised to prosecute Wall

Street executives who had cheated outside investors and deceived

homebuyers when selling mortgages to them.

On May 20, 2009, at the

signing into law of both the Helping Families Save Their Homes Act and

the Fraud Enforcement and Recovery Act, President Obama said:

“This bill nearly doubles the FBI’s

mortgage and financial fraud program, allowing it to better target fraud

in hard-hit areas. That’s why it provides the resources necessary for

other law enforcement and federal agencies, from the Department of

Justice to the SEC to the Secret Service, to pursue these criminals,

bring them to justice, and protect hardworking Americans affected most

by these crimes. It’s also why it expands DOJ’s authority to prosecute

fraud that takes place in many of the private institutions not covered

under current federal bank fraud criminal statutes — institutions where

more than half of all subprime mortgages came from as recently as four

years ago.”

Then, in the President’s 24 January 2012 State of the Union Address, he said:

“Tonight, I’m asking my Attorney General

to create a special unit of federal prosecutors and leading state

attorneys general to expand our investigations into the abusive lending

and packaging of risky mortgages that led to the housing

crisis. (Applause.) This new unit will hold accountable those who

broke the law, speed assistance to homeowners, and help turn the page on

an era of recklessness that hurt so many Americans. Now, a return to

the American values of fair play and shared responsibility will help

protect our people and our economy.”

However, two years later, the Inspector General of the U.S. Department of Justice issued on 13 March 2014 its

“Audit of the Department of Justice’s Efforts to Address Mortgage Fraud,” and

reported that Obama’s promises to prosecute turned out to be just a

lie. DOJ didn’t even try; and they lied even about their efforts. The IG

found: “DOJ did not uniformly ensure that mortgage fraud was

prioritized at a level commensurate with its public statements. For

example, the Federal Bureau of Investigation (FBI) Criminal

Investigative Division ranked mortgage fraud as the lowest criminal

threat in its lowest crime category. Additionally, we found mortgage

fraud to be a low priority, or not [even] listed as a priority, for the

FBI Field Offices we visited.” Not just that, but, “Many Assistant

United States Attorneys (AUSA) informed us about underreporting and

misclassification of mortgage fraud cases.” This was important because,

“Capturing such information would allow DOJ to … better evaluate its

performance in targeting high-profile offenders.”

Privately, Obama had told

Wall Street executives that he would protect them. On 27 March 2009,

Obama assembled the top executives of the bailed-out financial firms in a

secret meeting at the White House and he

assured them that he would cover their backs; he promised

“My administration is the only thing between you and the pitchforks”.

It’s not on the White House website; it was leaked out, which is one of

the reasons Obama hates leakers. What the DOJ’s IG indicated was, in

effect, that Obama had kept his secret promise to them.

Here is the context in which he said that (from page 234 of Ron Suskind’s 2011 book,

Confidence Men):

The

CEOs went into their traditional stance. “It’s almost impossible to set

caps [to their bonuses]; it’s never worked, and you lose your best

people,” said one. “We’re competing for talent on an international

market,” said another. Obama cut them off.

“Be

careful how you make those statements, gentlemen. The public isn’t

buying that,” he said. “My administration is the only thing between you

and the pitchforks.”

It was an attention grabber, no doubt, especially that carefully chosen last word.

But

then Obama’s flat tone turned to one of support, even sympathy. “You

guys have an acute public relations problem that’s turning into a

political problem,” he said. “And I want to help. But you need to show

that you get that this is a crisis and that everyone has to make some

sacrifices.” According to one of the participants, he then said, “I’m

not out there to go after you. I’m protecting you. But if I’m going to

shield you from public and congressional anger, you have to give me

something to work with on these issues of compensation.”

No

suggestions were forthcoming from the bankers on what they might offer,

and the president didn’t seem to be championing any specific proposals.

He had none: neither Geithner nor Summers believed compensation

controls had any merit.

After a moment, the tension in the

room seemed to lift: the bankers realized he was talking about voluntary

limits on compensation until the storm of public anger passed. It would

be for show.

He had been lying to the public, all along. Not only would he not

prosecute the banksters, but he would treat them as if all they had was

“an acute public relations problem that’s turning into a political

problem.” And he thought that the people who wanted them prosecuted were

like the KKK who had chased Blacks with pitchforks before lynching.

According to the DOJ,

their Financial Fraud Enforcement Task Force (FFETF) was “established

by President Barack Obama in November 2009 to wage an aggressive,

coordinated and proactive effort to investigate and prosecute financial

crimes.” But, according to the Department’s IG, it was all a fraud: a

fraud that according to the DOJ itself had been going on since at least

November 2009.

The IG’s report continued by pointing out the Attorney General’s

lies, noting that on 9 October 2012, “the FFETF held a press conference

to publicize the results of the initiative,” and:

“The Attorney General announced that

the initiative resulted in 530 criminal defendants being charged,

including 172 executives, in 285 criminal indictments or informations

filed in federal courts throughout the United States during the previous

12 months. The Attorney General also announced that 110 federal civil

cases were filed against over 150 defendants for losses totaling at

least $37 million, and involving more than 15,000 victims. According to

statements made at the press conference, these cases involved more than

73,000 homeowner victims and total losses estimated at more than $1

billion.

“Shortly after this press conference,

we requested documentation that supported the statistics presented. …

Over the following months, we repeatedly asked the Department about its

efforts to correct the statistics. … Specifically, the number of

criminal defendants charged as part of the initiative was 107, not 530

as originally reported; and the total estimated losses associated with

true Distressed Homeowners cases were $95 million, 91 percent less than

the $1 billion reported at the October 2012 press conference. …

“Despite being aware of the serious

flaws in these statistics since at least November 2012, we found that

the Department continued to cite them in mortgage fraud press releases. …

According to DOJ officials, the data collected and publicly announced

for an earlier FFETF mortgage fraud initiative – Operation Stolen Dreams

– also may have contained similar errors.”

Basically, the IG’s report said that the Obama Administration had

failed to enforce the Fraud Enforcement and Recovery Act of 2009. This

bill had been passed overwhelmingly, 92-4 in the Senate, and 338-52 in

the House. All of the votes against it came from Republicans. The law

sent $165 million to the DOJ to catch the executive fraudsters who had

brought down the U.S. economy, and it set up the Financial Crisis

Inquiry Commission, and had been introduced and written by the liberal

Democratic Senator Patrick Leahy. President Obama signed it on 20 May

2009. At that early stage in his Presidency, he couldn’t afford to

display that he was far to the right of every congressional Democrat, so

he signed it.

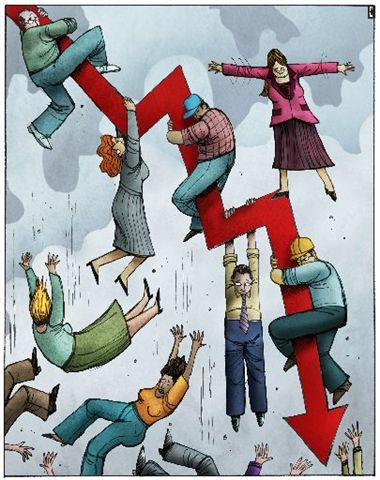

Already on 15 November 2011, Syracuse University’s

TRAC Reports had headlined

“Criminal Prosecutions for Financial Institution Fraud Continue to Fall,” and

provided a chart showing that whereas such prosecutions had been

running at a fairly steady rate until George W. Bush came into office in

2001, they immediately plunged during his Presidency and were

continuing that decline under Obama, even after the biggest boom in

alleged financial fraud cases since right before the Great Depression.

And, then, on 24 September 2013,

TRAC Reportsbannered

“Slump in FBI White Collar Crime Prosecutions,” and

said that “prosecutions of white collar criminals recommended by the

FBI are substantially down during the first ten months of Fiscal Year

2013.” This was especially so in the Wall Street area: “In the last

year, the judicial District Court recording the largest projected drop

in the rate of white collar crime prosecutions — 27.8 percent — was the

Southern District of New York (Manhattan).”

Another recent report documents lying by the Administration regarding

its promised program to force banks to compensate cheated homeowners

for fraud in their mortgages, and sometimes even for evictions that were

based on those frauds. The investigative journalist David Dayen

headlined on 19 March 2014,

“Just 83,000 Homeowners Get First-Lien Principal Reductions from National Mortgage Settlement, 90 Percent Less Than Promised.” He

documented that, “the Secretary of Housing and Urban Development sold

the settlement on a promise of helping 1 million homeowners, and the

final number missed the cut by over 916,000. That … shows the

essential dishonesty [Obama’s HUD Secretary Shaun] Donovan displayed in

his PR push back in 2012. … We’re used to the Obama Administration

falling far short of their goals for homeowner relief, whether because

of a lack of interest or a desire to foam the runway for the banks or

whatever. Even still, the level of duplicity is breathtaking.”