Financial crisis revealed and resolved in the world of

Bitcoin

By Adam B. Levine

Contributing writer for End the

Lie

(Image credit: Adam Crowe/Flickr)

Monday, March 11th saw calamity

strike at the core of the Bitcoin system – over the last 3 years the number of

users has increased exponentially, and the value along with it. In the

past we’ve seen large public thefts, but Monday’s event was fundamentally

different.

Note: be sure to read Adam’s

previous article, “Ulterior motives behind the Copyright Alert System“

Bitcoin is basically one big public

distributed ledger (known as The Blockchain) where the ownership of every

Bitcoin ever created is tracked, accounted for, and verified automatically by

various participants in the system. Transactions can be detected within a

few seconds, but merchants generally take the hour or so to gather 6

confirmations to ensure the payment cannot be reversed.

Other participants, upon receiving

news of the ownership transfer (payment), check the payer’s account to ensure

that they haven’t already spent them publicly. A confirmation is the

return message saying “Yes, this all seems to be in order, the value is truly

available to be transferred to the intended recipient and we’ve updated our

ownership records to reflect that.”

With that background in mind, on

Monday the blockchain split in two without warning.

Why’d it happen?

Call it growing pains – Berkeley

Database (BDB) was used for versions of the Bitcoin software .7 and below and

as luck would have it, will accept a maximum number of changes per block.

The protocol’s self adjusting difficulty seeks to issue a block every 10

minutes. As Bitcoin usage has increased, so have the number of

transactions contained in the average block.

So what happened?

On Monday, a single block went

through the system containing 1700 transactions, and was rejected by the

participants still running on .7 due to how many changes it made. Had

everyone been running .7, the block would have been rejected and the

transactions processed in (hopefully) smaller blocks.

Because an upgrade to .8 was rolled

out several months ago that switched to a different database system without the

same limitation, we found ourselves with two separate blockchains (ledgers)

each disagreeing with the other’s interpretation of reality. Those

running .7 saw too-large blocks as invalid, while to those running .8,

everything was normal and the larger blocks were acceptable and built upon.

Cause and effect

An alert went out immediately (at

1:30am UTC) from the mostly volunteer open source development team letting

merchants know to not accept Bitcoins for the next few hours while the system

sorted itself out. To miners, they asked that everyone revert back to .7

so no incompatible blocks will be generated. The average user was unaffected.

Crisis isn’t good for anyone, so

participants quickly fell in line wanting to resolve the issue as soon as

possible. Within 8 hours things were back to normal; If you

live in America, chances are pretty good you slept through the whole thing,

including the 23% drop in price, which vanished by morning.

Schrödinger’s Bitcoin

The “Double Spend” is the bogeyman of digital currency

world. Since Bitcoins are just data and data can be copied, what’s to protect a

merchant from being paid with money already spent elsewhere? This is the

function of the blockchain, which represents the network consensus of reality.

When that consensus broke down due

to the fork, it created a state best represented by the Schrödinger’s Cat thought experiment – one in which

a single entity simultaneously and paradoxically exists in two states, only one

of which can eventually be real.

During the disruption, one large

Double Spend actually occurred and was paid out in

US Dollars. When the faulty blockchain was abandoned, the

reality consensus settled on the backwards compatible ledger. In this

case, payment processor OKPAY was left without the Bitcoins they thought they

received, and were also still out the nearly $10,000 they exchanged for them.

This is the most valuable instance

of a successful Double Spend in the Bitcoin ecosystem, which can only occur

under the Schrödinger’s Bitcoin scenario described above.

Luckily this story has a happy ending. Both

parties “did the right thing” and have refunded each other. But will things

work so well next time? Will there be a next time, is this situation

repeatable?

I asked Gavin Andresen, Lead

Developer on the Bitcoin project about the risks moving forward:

Question: Are “Double Spends”

possible under normal circumstances?

Gavin: Double-spend risk is not a

“yes or no” — like most risks, it is “more risky” or “less risky”, down to “So

little risk I won’t worry about it. One of the reasons I still tell people

“bitcoin is an experiment” is because everybody is still figuring out where the

edge-case risks are.

Q: So for the average user or

merchant, how much risk is there in every-day use?

G: For the, average user or merchant

delivering a physical product to customers: I’d say very close to zero

risk after 3 confirmations. Exchanges or merchants that deliver

“cash-like” high-value products or services have their own particular set of

risks, and they need to be more careful. merchants that deliver services that

have a zero marginal cost to them (e.g. “Subscribe to my e-magazine”) have even

less risk than users or merchants delivering physical products.

And all of that is modified if you

have some trust in the person you’re transacting with. I recently sold a

couple thousand dollars worth of bitcoin to a friend who promised to send me a

check in the mail, and I was happy to do that.

Q: In your worst case scenario, where

you flat out do not trust the person but want to do business with them, what

would you recommend?

G: For ultimate trust transacting a

huge amount of value to somebody who I think will try to rip me off– 24 hours

would be the “100% safe” time. It really is confirmations and not time,

but unless something wacky is happening those two are equal after 6

confirmations or so.

I pick 24 hours because that would

be 120+ confirmations. I can’t conceive of a situation where “we” (the shared

consensus of the bitcoin network) would allow a 120-block fork to happen that

double-spent

Q: Now that the issue has been

resolved for a day, any lessons learned or things that will be improved on?

G: actually one really stupid/simple

thing ‘we’ should have done long ago: make it easy for bitcoin services

to get alerts sent to their email/SMS/etc. We’ll be concentrating on

things like improving communication during crises, because no two crises are

exactly alike.

Regarding specific tasks:

implementing a -alertnotify=<run some command> is very high on my

TODO list. That’s easy to do, and is the thing I’m kicking myself for not doing

sooner

Q: What does that mean?

G: That means “if you get an alert,

run this command to tell me about it” where “this command” is specified by the service

operator — send email, send sms, whatever

Moving forward

History would have us believe

Bitcoin scandal leads to big losses in the trading value of the currency, but

this time was different. Despite the currency itself seeming at risk and

the impossible momentarily made real, the price immediately bounced back up to

near all-time highs.

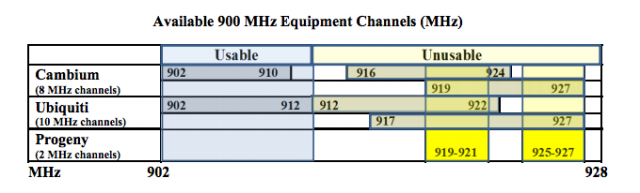

Bitcoin may be small as currencies

go, but the hourly chart below speaks volumes given that every 1K Bitcoins

represents about $50,000 USD.

So here we are, less than 72 hours

after the event, and we’re basically back to where we started. The system

is stable, the fork abandoned and the consensus reality once again agreed upon.

And all this with a basically volunteer development team who has no real

ability to make anybody do anything, outside of telling them it’s a good idea.

Compare that to the ongoing crisis

in currencies controlled by central banks, who have the unilateral authority

not only to make all decisions related to their respective monetary policy, but

also the ability to issue more bills at will, should the need arise.

Lacking such an option, Bitcoin is

forced to deal with its problems and try as quickly as possible to return to a

state of normality. So does it work? For now, the answer is a definitive “yes,”

but since it was just created in 2009, only time will tell.

From where I’m sitting this was just

about as good an outcome as anyone could hope for. No value was lost,

even though the system prides itself on irreversible transactions (which once

you’ve dealt with Paypal’s merchant Chargebacks,

you begin to see the appeal of).

The development team isn’t hiding

the cause of the recent issue and is instead using this as a reason to dig into

the response with work being done on an internal, comprehensive post-mortem.

They’ve taken the whole thing as a

learning opportunity and have pledged to implement a more agile

communication-alert system so if this does happen again, users will be alerted

and large users will take appropriate precautions.

I like to see people with power

admit they are not omniscient, and in this world of centrally planned money

it’s too rare a thing.

One thing is certain: Bitcoin isn’t

suffering for lack of its own Bernanke, and that should give us all reason to

hope.

Adam writes about new technology at Mind

to Matter and forestry, photography and custom wood products at NapaWood.

You can contact Adam here.

Edited by Madison Ruppert

Did I forget anything or miss any

errors? Would you like to make me aware of a story or subject to cover? Or

perhaps you want to bring your writing to a wider audience? Feel free to

contact me at admin@EndtheLie.com with your concerns, tips,

questions, original writings, insults or just about anything that may strike

your fancy.