An Infographic to Help Jobless Grads Navigate America’s Decay Before the Collapse and World War 3

Wednesday, June 12, 2013 17:26

The lumpy, uneven outlook for college graduates in America is dubious at best. Total student loan debt is in the $1 trillion range ($1,000,000,000,000) and the 90 day delinquency rate has surpassed that of credit card debt. Approximately $3 billion in student loan debt was written off in the first 3 months of 2013 and the trend is continuing in the same direction.

It should be clear from visiting the Economic Collapse page that the US and global economic system is beyond repair in its current state. The video below is sufficient explanation to the beginner as to why the recovery is an illusion (for the visually inclined) and we are headed for a global war and concurrent economic collapse.

This is an uncomfortable reality but the sooner it is understood, you can prepare for it. Become a prepper as it may be a way to avoid the eventual further decline in US dollar’s value by purchasing real goods that can help you as you develop self sufficiency skills. Your money is earning a negative rate in a checking/savings account due to inflation, so it’s literally rotting anyway, right? The 21st century economy will be different than most of the population expects due to job losses from new advancements, robotics and automation. Developing skills in preparation for the new global scramble for prosperity is something to begin now, like learning a language or mechanical skills.

With that said, SuperScholar.org put together an infographic that can help grads navigate the next steps in the interim.

Source: SuperScholar.org

More helpful stats, courtesy of SuperScholar.org

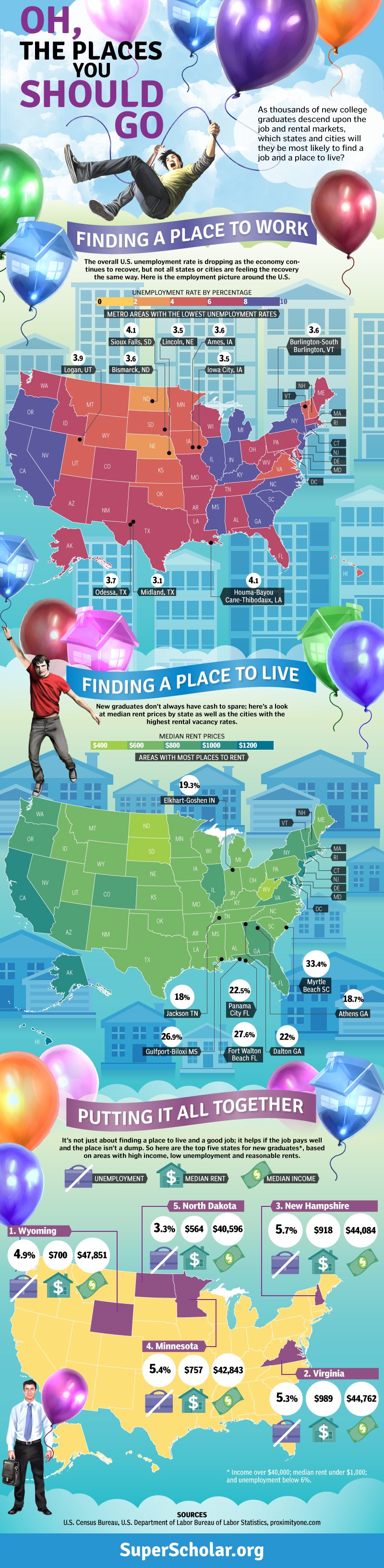

Oh, The Places You Should Go

As thousands of new college graduates descend upon the job and rental markets, which states and cities will they be most likely to find a job and a place to live?

Finding a Place to Work

The overall U.S. unemployment rate is dropping as the economy continues to recover, but not all states or cities are feeling the recovery the same way. Here is the employment picture around the U.S.:

North Dakota 3.3

Nebraska 3.8

Vermont 4.1

South Dakota 4.3

Iowa 4.9

Utah 4.9

Wyoming 4.9

Oklahoma 5.0

Hawaii 5.1

Virginia 5.3

Minnesota 5.4

Kansas 5.6

Montana 5.6

New Hampshire 5.7

Alaska 6.2

Idaho 6.2

Louisiana 6.2

Massachusetts 6.4

Texas 6.4

Maryland 6.6

Missouri 6.7

New Mexico 6.9

West Virginia 7.0

Colorado 7.1

Maine 7.1

Ohio 7.1

Wisconsin 7.1

Alabama 7.2

Arkansas 7.2

Delaware 7.3

Washington 7.3

Florida 7.5

Arizona 7.9

Pennsylvania 7.9

Tennessee 7.9

Connecticut 8.0

Kentucky 8.0

New York 8.2

Oregon 8.2

Georgia 8.4

South Carolina 8.4

District of Columbia 8.5

Michigan 8.5

Indiana 8.7

New Jersey 9.0

Rhode Island 9.1

North Carolina 9.2

California 9.4

Mississippi 9.4

Illinois 9.5

Nevada 9.7

Metro areas

Midland, TX 3.1

Iowa City, IA 3.5

Lincoln, NE 3.5

Ames, IA 3.6

Bismarck, ND 3.6

Burlington-South Burlington, VT 3.6

Odessa, TX 3.7

Logan, UT 3.9

Houma-Bayou Cane-Thibodaux, LA 4.1

Sioux Falls, SD 4.1

Finding a Place to Live

New graduates don’t always have cash to spare; here’s a look at median rent prices by state as well as the cities with the highest rental vacancy rates:

HI 1,293

CA 1,155

MD 1,108

NJ 1,108

DC 1,059

AK 1,007

CT 1,006

NV 993

VA 989

MA 988

NY 984

FL 952

DE 949

NH 918

WA 911

RI 890

AZ 859

CO 851

VT 829

IL 828

OR 819

GA 800

UT 793

TX 788

MN 757

PA 738

ME 722

NC 720

MI 716

LA 715

WI 708

SC 706

WY 700

ID 694

IN 687

TN 682

NM 680

KS 671

OH 670

MO 668

AL 657

MS 644

NE 644

OK 636

MT 627

KY 613

IA 611

AR 606

ND 564

SD 562

WV 552

Most Places to Rent:

Myrtle Beach SC 33.4%

Fort Walton Beach FL 27.6%

Panama City FL 22.5%

Dalton GA 22%

Gulfport-Biloxi MS 26.9%

Elkhart-Goshen IN 19.3%

Cape Coral-Fort Myers FL 19.2%

Athens GA 18.7%

Jackson TN 18%

Putting It All Together

It’s not just about finding a place to live and a good job; it helps if the job pays well and the place isn’t a dump. So here are the top five states for new graduates*, based on areas with high income, low unemployment and reasonable rents.

1. Wyoming

Unemployment 4.9%

Median rent $700

Median income $47,851

2. Virginia

Unemployment 5.3%

Median rent $989

Median income $44,762

3. New Hampshire

Unemployment 5.7%

Median rent $918

Median income $44,084

4. Minnesota

Unemployment 5.4%

Median rent $757

Median income $42,843

5. North Dakota

Unemployment 3.3%

Median rent $564

Median income $40,596

* Income over $40,000; median rent under $1,000; and unemployment below 6%.

SOURCES:

U.S. Census Bureau, U.S. Department of Labor Bureau of Labor Statistics, proximityone.com

No comments:

Post a Comment