THE BUNDESBANK, DEUTSCHEBANK, AND THAT GOLD ...

Yesterday I blogged about the improbability of the Bundesbank's

gold inventory list being intended to shut down debate within the

German gold repatriation movement. If anything, as I tried to

illustrate, it fueled a detailed criticism and analysis from the very

movement the media would have us believe it was trying to silence.

Indeed, from my high octane speculative point of view, it was designed to do that, and to fuel even more scrutiny of the Bank of France, the Old Lady of Threadneedle Street, and the NY Fed. The Bundesbank

list also indictaed that, no, it now wants to repatriate more of its

gold than originally intended, though at the slow pace of getting half

of it back on German soil by 2020.

Yesterday I blogged about the improbability of the Bundesbank's

gold inventory list being intended to shut down debate within the

German gold repatriation movement. If anything, as I tried to

illustrate, it fueled a detailed criticism and analysis from the very

movement the media would have us believe it was trying to silence.

Indeed, from my high octane speculative point of view, it was designed to do that, and to fuel even more scrutiny of the Bank of France, the Old Lady of Threadneedle Street, and the NY Fed. The Bundesbank

list also indictaed that, no, it now wants to repatriate more of its

gold than originally intended, though at the slow pace of getting half

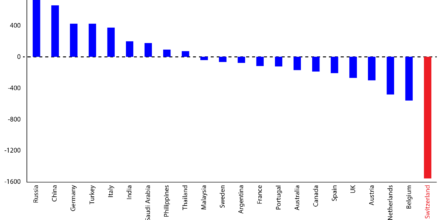

of it back on German soil by 2020.There may be reasons lurking in the background for this, reasons highlighted by the increasing difficulties of Germany's largest bank, Deutschebank, which is awash with bad paper - you guessed it, derivatives - and posting a gigantic 3rd quarter loss of almost $7,000,000,000, in addition to all the fines imposed on the bank by US regulatory authorities. He's the New York Time's take, shared by Mr. V.T.:

Deutsche Bank Forecasts a Loss of Nearly $7 Billion, Taking an Array of Charges

There has been much speculation that with the financial salvos straddling Deutsche Bank, it could become the next Lehman. Under such a scenario, the bank falls under the category of "too big to fail", if one applies the current American way of dealing with banker malfeasance. It therefore would mean its current and previous leaders are "too big to jail"(unless one is in Iceland, of course). Thus, as some regular readers here have commented to me privately, that gold would be a nice thing to have on German soil over the next few years if the German government should think itself required to bail out the big bank. With all that bad paper on its books, no one is going to take "paper gold" reassurances. After all, it's the corruption in the system itself that is coming home to roost right on top of the heads of the banksters.

But there's a curious set of statements in the Times article, the imply perhaps other, deeper, long-term agendas might be in play:

Still, shareholders of Deutsche might take heart from the fact that the third-quarter loss stemmed mostly from a $6.5 billion write down of so-called intangible assets. These can be assets that reflect past paper gains, so reducing their value is not thought to be as serious as slashing the value of, say, financial assets like bonds or loans. Still, the write-downs of intangible assets appeared to be prompted by higher capital requirements by regulators. Since many regulatory capital changes have been known for a while, it is not clear why Deutsche would be taking the charge now.Cutting the value of intangible assets may not have much of an impact on an important regulatory capital measurement, something that Deutsche noted in its news release.In addition, Deutsche said that it would write down its stake in a Chinese bank, Hua Xia Bank, by nearly $700 million. “This reflects an updated valuation triggered by a change of the intent of the holding as Deutsche Bank no longer considers this stake to be strategic,” the bank’s statement said.

When

reading this, I was reminded of the insight of former Assistant

Secretary for Housing and Urban Development Catherine Austin Fitts, that

it appears that what is being done on the west's part of the global

financial stage is that all the liabiliies are being moved into the

public sector - which Deutsche Bank's write down of intangible assets

could conceivably fall under, under certain circumstances - while all

the assets are being moved into the private and largely hidden systems.

But even if my interpretation is not true(and it has its flaws),

Deutsche Bank's move to do so, at precisely this juncture in its

corporate history, and with the growing pressures for bullion

repatriation, and Germany's own participation in China's Asia

Infrastructure Development bank, could be, as the bank itself stated in

its own releases, "strategic" in nature, with its current crisis simply

providing the cover for a massive repositioning. Write-downs of

derivatives - some of its "intangible assets" - could be signaling a

significant withdrawal from the run-amok finance capital of Wall Street,

and a return toward much more prudent investment in tangible things.

Whether

any of this high octane speculation is true or not will depend on how

events unfold over time, and specifically, how much, and what type, of

its intangible assets will be "written down", and how much, if any, of

Germany's gold is repatriated, and how much, if any, pressure is applied

on the west's major central banks to come clean on their gold holdings

and accounts. One way to measure this reading of events will be to watch

if the gold repatriation and audit movements not only in Germany are

given new life, but if in fact they grow in other countries to become

major domestic political memes. In the USA Ron Paul has consistently

called for it, but this has fallen on largely deaf ears. After all, in

the current context of American culture and politics, who would trust

anyone to conduct a genuine audit of the Fed and its gold?

There

is, additionally, one final thing to watch for, if any of this

intensely high octane speculation is true, and that is not only how much

"write down" is done, but whether any of it touches the open festering

sore at Deutsche Bank, the derivatives. And, of

course, one must watch the German government and political parties

themselves, to see if any new laws or regulations curtailing derivatives

trading in any significant degree are going to come up for discussion.

No comments:

Post a Comment