Disastrous Financial State of American Households. Result of Unemployment, Low Wages ~ so what's the plan ,folks? just gonna wait UNTIL it's ALLLLL ...pissed away ,huh that it !

Federal Reserve study

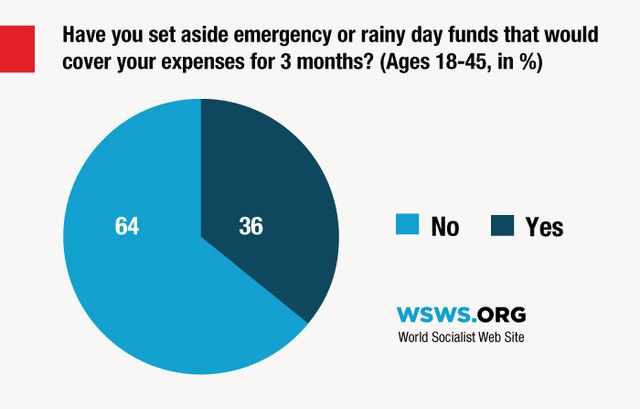

According to the report, nearly two-thirds of those under 45 did not have funds set aside to cover their expenses for a three-month period.

The survey helps expose the fictitious character of the economic “recovery,” which has supposedly been going on for five years. Seventy percent of respondents said they were no better off than they were in 2008, during the depth of the worst downturn since the Great Depression. From this the report draws the extraordinarily understated conclusion that the recovery has been “uneven.”

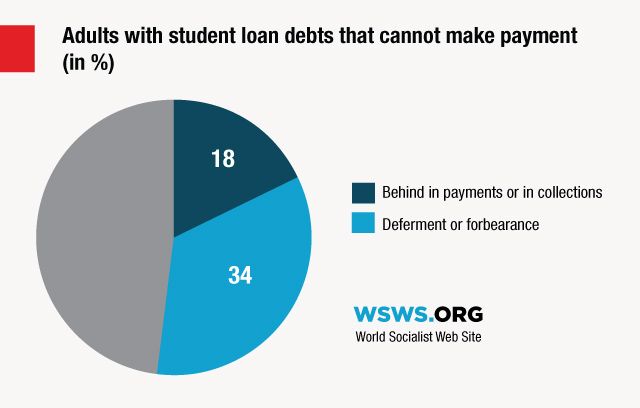

One quarter of the population holds student loan debt, according to the survey, averaging $27,840. Eighteen percent of those who owe on student loans said they were either behind on their payments or had gone into collection. Another 34 percent indicated that “they had one or more loans in deferment or forbearance.” More than half of the respondents with student loans, in other words, had difficulty making payments on them, or were unable to.

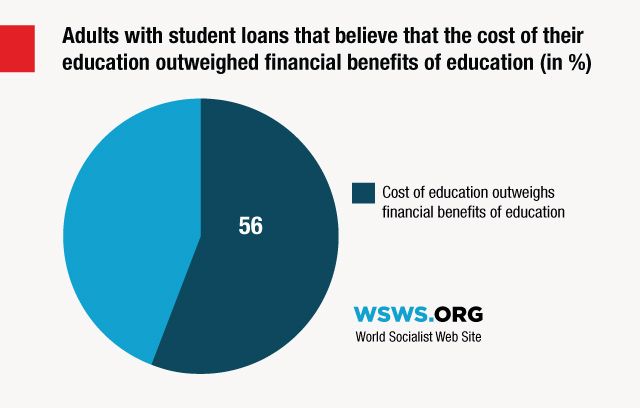

Fifty-four percent of survey respondents who took out student loans for their own education were forced to cut back on spending to pay them, and a remarkable 56 percent said they “believe that the costs of the education outweighed any financial benefits they received from the education.”

The report presents a picture of a society in which wide layers of the population have low incomes and, as a result, little access to credit. Of survey participants who had applied for credit in the previous year, one-third were turned down or given less credit than they requested. Twenty-six percent of survey participants said they had put off applying for some form of credit “because they thought they would be turned down.”

Renters, who make up about one-third of the households surveyed, were asked to give their reasons for renting rather than owning their home. The most common responses were that “they can’t afford a down payment to buy a home (45 percent), can’t qualify for a mortgage (29 percent), find it more convenient to rent (24 percent), or find it cheaper to rent than own (23 percent).” Young renters, those 18 to 29, were far more likely to indicate they couldn’t afford a down payment on a house.

The report found that Americans—through no fault of their own, of course—were largely unprepared for retirement. “Almost half of respondents had not planned financially for retirement, with 24 percent saying they had given only a little thought to financial planning for their retirement and another 25 percent saying they had done no planning at all,” the report concludes. Thirty-one percent reported they had no retirement savings or pension, “including 19 percent of those ages 55 to 64, and 25 percent didn’t know how they will pay their expenses in retirement.”

The disastrous condition of household finances is an expression of the continued prevalence of mass unemployment and the expansion of low-wage labor. The share of the US population that is employed remains at 59 percent, down from nearly 65 percent at the beginning of 2000.

In April, the National Employment Law Project reported that since the financial crash of 2008, 1.9 million high- and average-paying jobs in the private sector have been eliminated and replaced with some 1.8 million low-wage jobs. Partly as a result, real median household income fell from $55,600 in 2007 to $51,017 in 2012—a decrease of nearly ten percent in just five years. All of this has taken place as the wealth of the super-rich has more than doubled since 2008.

The disastrous condition of US households is the result of the deliberate policies of the Obama administration, which has provided the banks and financial corporations with trillions of dollars in free cash, while encouraging companies to slash wages and offering no meaningful assistance to homeowners or student loan borrowers in distress.

No comments:

Post a Comment