Underwriting Executive Excess

A recent Government Accountability Office (GAO) study2 offers new figures revealing how much taxpayers are already paying for contractor labor costs—except that we are bankrolling the paychecks of already-wealthy executives instead of supporting more livable wages for American workers struggling to get by. As the country faces record inequality and a CEO to average worker gap that has grown to 273-to-1,3 current law dictates that taxpayers subsidize more than $760,000 per year toward the compensation of contracting executives who often earn millions of dollars annually. This is $360,000 more than we pay the President and nearly $530,000 more than we pay the Vice President.

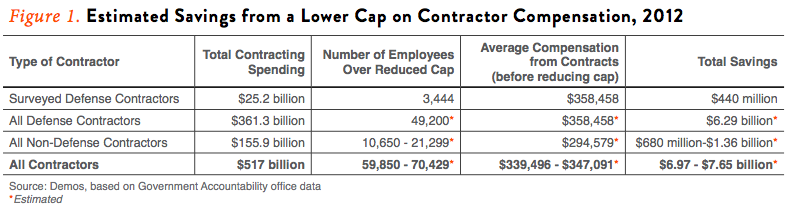

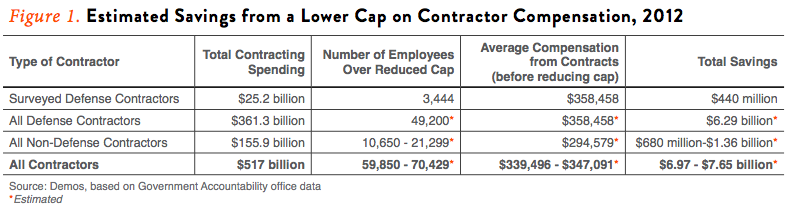

In this brief, we extrapolate from the GAO study to estimate that the federal government is spending an estimated $20.8 to $23.9 billion a year to pay private contractors for the compensation of top executives. $6.97 to $7.65 billion in taxpayer dollars is spent annually on pay that exceeds the U.S. Vice President’s salary of $230,700 a year. Yet this gross misuse of taxpayer dollars is not inevitable. If the government cut the billions of dollars in excessive subsidies it pays for the salaries of executives at contracting companies, those savings could pay the lowest-paid contract workers a more livable wage, all without additional cost to taxpayers. Public officials should also evaluate cases where work can be done more efficiently and effectively by government employees than private contractors.

Infographic: Inside a $7 Billion Dollar Taxpayer Subsidy of Inequality

Key Findings

The federal government spends an estimated $23.9 billion a year paying private contractors for the compensation of top executives. If taxpayer-funded payouts for these executives were capped at $230,700—the salary of the U.S. Vice President—the pay of hundreds of thousands of low-wage federal contract workers could be raised by as much as $6.69 per hour or $13,902 per year for a full-time worker, without costing taxpayers an additional dime.Analysis

This brief uses the results of a recent Government Accountability Office (GAO) study on contracting compensation4 to estimate the amount the government could save if it lowered the cap on the maximum amount of employee compensation that contractors can charge to the federal government. Current law dictates that the federal government must reimburse or price into contracts up to $763,039 in compensation for any one employee—an amount pegged to the salaries of the most highly-paid private sector executives. This maximum, which has risen by 48 percent (adjusted for inflation) since 2004,5 is set to rise to more than $950,000 later this year if no action is taken to change the formula.6Here we consider the savings if the cap were lowered to the amount of the U.S. Vice President’s salary, $230,700 per year, which matches the proposal in the bipartisan Commonsense Contractor Compensation Act of 2013. This amount also represents the maximum that most civilian employees directly employed by the federal government can make in a given year. Firms with federal contracts could continue to pay their executives amounts far exceeding this cap, but taxpayers would no longer reimburse or price these costs into contracts with the affected companies for any amount in excess of $230,700. We estimate that by lowering the cap for all contracting firms to $230,700 annually, the government would save $6.97 to $7.65 billion per year.

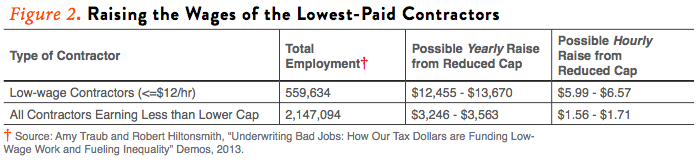

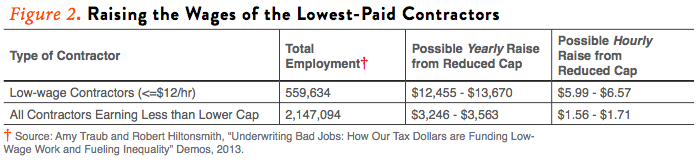

To address the problem of poverty-wage jobs on federal contracts, we then calculate the raise that could be given to lower-paid contract employees with these savings. We find that if the savings from a lower public recognition of executive pay were hypothetically used to give a raise to low-paid contract employees—the 560,000 contractors who earn $12 per hour or less—it could pay for a raise of $13,902 per year, or $6.68 per hour assuming a full-time workload. If we instead used the savings to give raises to all 2.15 million contractors who earn less than $230,700, we could give them each a raise of $3,624 per year, or $1.74 per hour. Cutting the taxpayer subsidy of millionaires’ salaries while raising the wages of ordinary workers would not only be efficient, but would set an example of fairer compensation.

Savings from Reducing the Cap on Contractor Compensation

To estimate the savings that would result from a lower cap on contractor compensation, the GAO surveyed the compensation practices of a stratified, random sample of 30 defense contractors who reflect the contracting universe: two “very large” contractors (contracting obligations over $25 billion), eight large contractors (obligations between $2 billion and $25 billion), ten medium contractors (obligations between $15 million and $2 billion) and ten small contractors (obligations less than $15 million). The GAO asked each of the contractors to provide salary information on the employees who earned more than the vice president’s salary ($230,700, the proposed level of a new lower cap) as well as the number of employees earning over that cap. Twenty-seven of the thirty contractors provided the full range of data requested by the GAO, but the three largest contractors surveyed—The Boeing Company, Lockheed Martin Corporation, and northrop Grumman Corporation—refused to provide either the number of employees earning over the proposed cap, or their salaries. The 27 contractors that replied to the survey received a total of 7 percent of all federal defense contracts in 2012, or $25.2 billion, as shown in Figure 1. They reported 3,444 total employees that received compensation from contracts in 2012 greater than the lower proposed cap.Based on the compensation information provided, the GAO estimated that reducing the cap on compensation recognized by the public to $230,700 would save the federal government a total of $440 million at the 27 surveyed contractors. We use these numbers to estimate the average amount of compensation currently paid by federal contracts under the existing cap. Dividing the $440 million in estimated savings by the reported 3,444 highly-compensated employees at these firms yields an average savings of $127,758 per highly-compensated employee. By adding this figure to the new proposed cap of $230,700, we arrive at an estimate of an average $358,458 per employee that is being paid under the current cap; this estimate is included in Figure 1 as well.

We then use these calculations to produce a total savings estimate from a lower cap, first for all defense contracts and then for all federal contracts. even though the GAO cautions that this study should not be extrapolated to the entire contracting universe, we argue that, despite the refusal of the three largest surveyed contractors to respond to the survey, their sample is in fact representative for three reasons:

-

First, both the contracting universe and the GAO’s sample are

dominated by large contractors: there were 40 contractors who received

$2 billion or more in contracts in 2012, and they accounted for more

than 41 percent of total contracting dollars.

-

Second, the 27 contractors who did respond to the survey account

for 7 percent of all defense contracts (and 5 percent of all contracts);

thus, they alone represent a significant portion of the contracting

universe.

-

Third, considering that the three contractors who refused to

respond to the survey were three of the largest contractors provides

evidence that the GAO’s estimate may be a conservative one, when

extrapolated to the larger contracting universe. It is highly likely

that the reason these large companies refused to provide information is

because they have a very large number of highly-paid employees—in fact,

the GAO finds that in general larger contractors in their sample had 71

percent higher share of employees earning more than $230,700 than

mid-sized contractors. If these three largest contractors had responded,

the GAO’s estimate would have likely been even higher.

Finally, we extend this reasoning to non-defense (civilian) contracts to produce our savings estimate for all federal contracts. The challenge is that there is little information about the costs of compensation for highly-paid employees at civilian contractors. Therefore, we make a series of conservative assumptions: first, we assume that the proportion of civilian contract employees who make more than the proposed cap ranges from the same number as defense contractors (21,299 employees) to just half as many (10,650 employees). We also assume that these highly-paid employees of civilian contractors earn just half as much over the proposed cap as their defense counterparts do. This produces an estimated taxpayer savings from a lower cap of $680 million to $1.36 billion for non-defense contractors. Adding this to the $6.29 billion in estimated savings from defense contractors from a lower cap yields $6.97—$7.65 billion in total savings from the lower cap for all federal contractors; these estimates are shown in Figure 1 as well.

Would a lower pay cap negatively affect contracting firms’ ability

to recruit and retain executives seeking higher salaries? not

necessarily: contractors could and most likely would continue to pay top

employees at any rate they deem to be competitive—taxpayers would

simply not be subsidizing so much of the bill.

A Lower Cap Could Pay for a Big Raise for the Lowest-Paid Contractors

Instead of spending $7 billion or more per year of our tax dollars

to subsidize the salaries of high-paid contracting employees, many of

whom are multi-millionaires, we could instead use the savings from a

lower cap to give a large raise to the hundreds of thousands of contract

employees who are struggling to make ends meet. As shown in Figure 2,

if we used this savings to increase the wages of the nearly 560,000

contractors currently earning $12 per hour or less, it could pay for a

raise of $13,902 per year for each of these contractors. If this were

spread over a standard full-time work year of 2,080 hours, it would

translate to a raise of $6.68 per hour. If instead the savings were

redirected to give a raise to all of the more than 2.1 million estimated

contractors who earn less than the proposed lower cap, it could pay for

a raise of $3,624 per year or, using the same standard work year, $1.74

per hour.

Policy Recommendations

Lower the Cap on Contractor Compensation—Congress should pass the Commonsense Contractor Compensation Act of 2013, a bipartisan bill sponsored by Senators Joe Manchin (D-WV), Barbara Boxer (D-CA), Chuck Grassley (R-IA) and Congressman Paul Tonko (D-NY) that would cap the maximum amount taxpayers reimburse or price into all defense and civilian government contractors for their salaries at the same amount as the Vice President’s salary, currently $230,700. To the maximum extent possible, President Obama should also direct contracting officers to limit pay for contractors to the level of the Vice President’s salary.Raise Standards for Low-wage Contract Employees—President Obama should issue an executive order requiring federal agencies to take all possible steps to raise workplace standards for federal contractors. For example, the government could use fair wages and benefits as an evaluation factor in selecting federal contractors. This would follow the precedent of Lyndon Johnson’s Executive Order 11246, mandating equal employment opportunity and affirmative action for all individuals working for federal contractors.

Stop Doing Business with Irresponsible Contractors—At minimum, the executive branch must act to ensure that the United States does not sign contracts with companies that regularly violate wage and hour laws, workplace health and safety regulations, or other employment protections.

Include Concession Workers in the Service Contract Act— Due to an accident of history, employees of federal concessionaires, such as the food service workers at restaurants in the Smithsonian who went on strike recently, are not covered by the Service Contract Act that provides a wage floor for federal contract employees. The Department of Labor should act to include these workers.

Consider In-Sourcing—Federal agencies should

evaluate when work can be done more efficiently and effectively by

government employees than private companies. As agencies like U.S.

Customs and Border Protection and the Internal Revenue Service have

already found, bringing previously contracted services back into the

public domain can save money, providing a better value for taxpayers.7

Many political leaders have suggested setting a more reasonable cap on the amount U.S. taxpayers pay to highly paid contractors. The United States Senate recently passed legislation that would cap compensation at companies under contract with the Department of Homeland Security and the national Guard at the Vice President’s salary.8 President Obama has also submitted a proposal to Congress to lower the cap. Yet the contractor lobby has so far held back efforts to limit the extent to which taxpayers bankroll their pay.

We propose not only a lower cap for highly-paid contractors but also a raise that would better enable the lowest-paid contract employees to support their families. As this analysis illustrates, it would be possible to pay the lowest wage contract workers fairly without costing taxpayers a dime. What’s more, better pay could be achieved without action on the part of Congress. President Obama has repeatedly cited the country’s growing inequality as one of the greatest threats to both our social fabric and our country’s growth. In his landmark economic address on July 24, the President vowed that “whatever executive authority I have to help the middle class, I’ll use it.”9 One of the most powerful steps the President could take would be to require that contractors raise the wages of their low-paid employees.

Conclusion

Our earlier study, “Underwriting Bad Jobs” found that nearly two million private sector employees working on behalf of America earn wages too low to support a family, making $12 or less per hour. Approximately 560,000 of these workers are employed by federal contractors. now we find that an estimated $6.97 to $7.65 billion a year in taxpayer funds is spent to offer highly-paid contracting executives hundreds of thousands of dollars more than the most highly-compensated public officials are paid.Many political leaders have suggested setting a more reasonable cap on the amount U.S. taxpayers pay to highly paid contractors. The United States Senate recently passed legislation that would cap compensation at companies under contract with the Department of Homeland Security and the national Guard at the Vice President’s salary.8 President Obama has also submitted a proposal to Congress to lower the cap. Yet the contractor lobby has so far held back efforts to limit the extent to which taxpayers bankroll their pay.

We propose not only a lower cap for highly-paid contractors but also a raise that would better enable the lowest-paid contract employees to support their families. As this analysis illustrates, it would be possible to pay the lowest wage contract workers fairly without costing taxpayers a dime. What’s more, better pay could be achieved without action on the part of Congress. President Obama has repeatedly cited the country’s growing inequality as one of the greatest threats to both our social fabric and our country’s growth. In his landmark economic address on July 24, the President vowed that “whatever executive authority I have to help the middle class, I’ll use it.”9 One of the most powerful steps the President could take would be to require that contractors raise the wages of their low-paid employees.

Endnotes

-

Amy Traub and Robert Hiltonsmith, “Underwriting Bad

Jobs: How Our Tax Dollars are Funding Low-Wage Work and Fueling

Inequality” Demos, 2013. http://www.demos.org/publication/underwriting-bad-jobs-how-our-tax-dollars-are-funding-low-wage-work-and-fueling-inequali

-

“Defense Contractors: Information on the Impact of

Reducing the Cap on Employee Compensation Costs,” United States

Government Accountability Office, June 2013. http://www.gao.gov/products/GAO-13-566

-

Lawrence Mishel and natalie Sabadish, “CEO Pay in

2012 Was Extraordinarily High Relative to Typical Workers and Other High

Earners,” Economic Policy Institute, 2013. http://www.epi.org/publication/ceo-pay-2012-extraordinarily-high/

-

“Defense Contractors,” GAO.

-

“Office of Federal Procurement Policy Cost

Accounting Standards Board Executive Compensation, Benchmark Maximum

Allowable Amount,” White House Office of Management and Budget. http://www.whitehouse.gov/omb/procurement_index_exec_comp

-

Joe Jordon, “Stopping Excessive Payments for Contractor Compensation,” May 30 2013. http://www.whitehouse.gov/blog/2013/05/30/stopping-excessive-payments-contractor-compensation

-

Pratap Chatterjee, “Insourcing: How Bringing Back

Essential Federal Jobs Can Save Taxpayer Dollars and Improve Services,”

Center for American Progress, 2012. http://www.americanprogress.org/wp-content/uploads/issues/2012/03/pdf/insourcing.pdf

-

S.Amdt. 1268 to S. 744: To provide for common sense

limitations on salaries for contractor executives and employees

involved in border security. Approved by the Senate on June 19, 2013.

-

“Remarks by the President on the economy -- Knox College, Galesburg, IL,” White House Office of the Press Secretary, 2013. http://www.whitehouse.gov/the-press-office/2013/07/24/remarks-president-economy-knox-college-galesburg-il

http://www.demos.org/publication/underwriting-executive-excess-0

No comments:

Post a Comment