US Corporate Tax Cheats Hiding $1.4 Trillion in Profits in Offshore Accounts ~ hehe Soooo A~merry~ree~ka ...hows that work~in out fer U.S. hows THAT go~in Oops we ALL got the $$$ ta "fix" these "prob's" ....we's ALLLL's just DON'T got the "nades" ta do .....it & we all "wonder" fucking Y ole E.T. cums allllllllll that way ....ta stick "their" "fingers" UP our ass's Oops ...

The biggest tax dodger is technology giant Apple, with $181 billion held offshore. General Electric had the second-largest stash, at $119 billion, enough to repay four times over the $28 billion GE received in federal guarantees during the 2008 Wall Street crash. Microsoft had $108 billion in overseas accounts, with companies like Exxon Mobil, Pfizer, IBM, Cisco Systems, Google, Merck, and Johnson & Johnson rounding out the top ten.

Overseas tax havens have been the focus of recent revelations about tax scams by wealthy individuals, based on the leak of the “Panama Papers,” documents from a single Panama-based law firm, Mossack Fonseca, involving 214,000 offshore shell companies. The firm’s clients included 29 billionaires and 140 top politicians worldwide, among them a dozen heads of government.

But the sums involved in corporate tax scams dwarf those hidden away by individuals. According to the Oxfam report, the offshore manipulations by the 50 largest US corporations cost the US taxpayer $111 billion each year, while robbing another $100 billion annually from countries overseas, many of them desperately poor.

The $111 billion a year in US taxes evaded would be sufficient to eliminate 90 percent of child poverty in America, effectively wiping out that social scourge. It is more than the annual cost of the food stamp program, or unemployment benefits, or the total budget of the Department of Education.

Oxfam timed the release of its report for the April 15 income tax deadline in the United States (actually Monday, April 18 this year), when tens of millions of working people must file their income tax returns or face federal penalties. Working people could face additional tax penalties of up to 2 percent of household income, to a maximum of $975, under the Obamacare “individual mandate,” if they have not purchased private health insurance.

There is a stark contrast between the IRS hounding of working people for relatively small amounts of money—but difficult or impossible to pay for those on low incomes—and the green light given to corporate tax cheats who evade taxation on trillions in income.

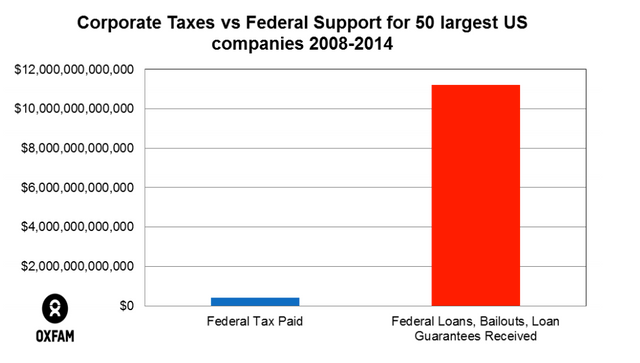

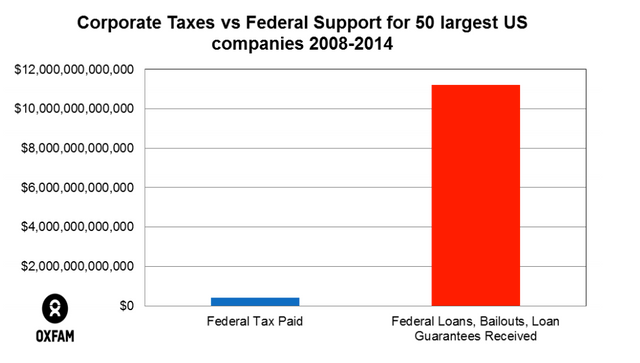

Image: Federal Tax Paid vs Federal Loans, Bailouts, Loan Guarantees Received by 50 largest US companies 2008-2014

“The vast sums large companies stash in tax havens should be fighting poverty and rebuilding America’s infrastructure, not hidden offshore in Panama, Bahamas, or the Cayman Islands.”The Oxfam report, titled “Broken at the Top,” expresses concern that “tax dodging by multinational corporations…contributes to dangerous inequality that is undermining our social fabric and hindering economic growth.”

It continues:

“This inequality is fueled by an economic and political system that benefits the rich and powerful at the expense of the rest, causing the gains of economic growth over the last several decades to go disproportionately to the already wealthy. Among the most damning examples of this rigged system is the way large, profitable companies use offshore tax havens, and other aggressive and secretive methods, to dramatically lower their corporate tax rates in the United States and developing countries alike.”Oxfam collected figures available from the 10-K reports and other financial documents issued by the 50 largest US companies, covering the period since the Wall Street crash, 2008 through 2014, and presented them in an interactivetable. The figures included total profits, federal taxes paid, total US taxes paid (including state and local), lobbying expenses, tax breaks, money held in offshore accounts, and benefits received from the federal government, including loans, loan guarantees and bailouts.

Among the most important findings:

* The top 50 companies made nearly $4 trillion in profits globally, but paid only $412 billion in federal income tax, for an effective tax rate of barely 10 percent, compared to the statutory rate of 35 percent.

* The 50 companies spent $2.6 billion to influence the federal government, while reaping nearly $11.2 trillion in federal support, for an effective return of 400,000 percent on their lobbying expenses.

* The overseas cash stashed by the 50 companies, nearly $1.4 trillion, is larger than the Gross Domestic Product of Russia, Mexico, Spain or South Korea.

* US multinationals reported 43 percent of their foreign earnings from five tax havens, countries that accounted for only 4 percent of their foreign workforce and 7 percent of foreign investment. All told, US companies shifted between $500 billion and $700 billion in profits from countries where economic activity actually took place to countries where tax rates were low.

* In the year 2012 alone, US firms reported $80 billion in profits in Bermuda, more than their combined reported profits in the four largest economies (after the US itself): China, Japan, Germany and France. This figure was nearly 20 times the total GDP of the tiny island country.

The Oxfam report also pointed to an estimated $100 billion in taxes evaded in foreign countries, many of them rich in natural resources extracted by such global giants as Exxon, Chevron and Dow Chemical. According to the report,

“Taxes paid, or unpaid, by multinational companies in poor countries can be the difference between life and death, poverty or opportunity. $100 billion is four times what the 47 least developed countries in the world spend on education for their 932 million citizens. $100 billion is equivalent to what it would cost to provide basic life-saving health services or safe water and sanitation to more than 2.2 billion people.”The report cited former UN Secretary-General Kofi Annan’s assessment that “Africa loses more money each year to tax dodging than it receives in international development assistance.”

Oxfam offered no solution to the growth of inequality and the systematic looting by big corporations that its report documents, except to urge governments around the world to close tax loopholes. The group also pleads with the corporate bosses themselves not to be quite so greedy. Neither capitalist governments nor the CEOs will pay the slightest attention. But the working class should take note of these figures, which provide ample evidence of the bankrupt and reactionary nature of capitalism, and the urgent necessity of building a mass movement, on a global scale, to put an end to the profit system.

The original source of this article is World Socialist Web Site

Copyright © Patrick Martin, World Socialist Web Site, 2016

No comments:

Post a Comment