WARPED, DISTORTED, MANIPULATED, FLIPPED HOUSING MARKET

The report from RealtyTrac

last week proves beyond the shadow of a doubt the supposed housing

market recovery is a complete and utter fraud. The corporate mainstream

media did their usual spin job on the report by focusing on the fact

foreclosure starts in 2013 were the lowest since 2007. Focusing on this

meaningless fact (because the Too Big To Trust Wall Street Criminal

Banks have delayed foreclosure starts as part of their conspiracy to

keep prices rising) is supposed to convince the willfully ignorant

masses the housing market is back to normal. It’s always the best time

to buy!!!

The

talking heads reading their teleprompter propaganda machines failed to

mention that distressed sales (short sales & foreclosure sales) rose

to a three year high of 16.2% of all U.S. residential sales, up from

14.5% in 2012. The economy has been supposedly advancing for over four

years and sales of distressed homes are at 16.2% and rising. The bubble

headed bimbos on CNBC don’t find it worthwhile to mention that prior to

2007 the normal percentage of distressed home sales was less than 3%.

Yeah, we’re back to normal alright. We are five years into a supposed

economic recovery and distressed home sales account for 1 out of 6 all

home sales and is still 500% higher than normal.

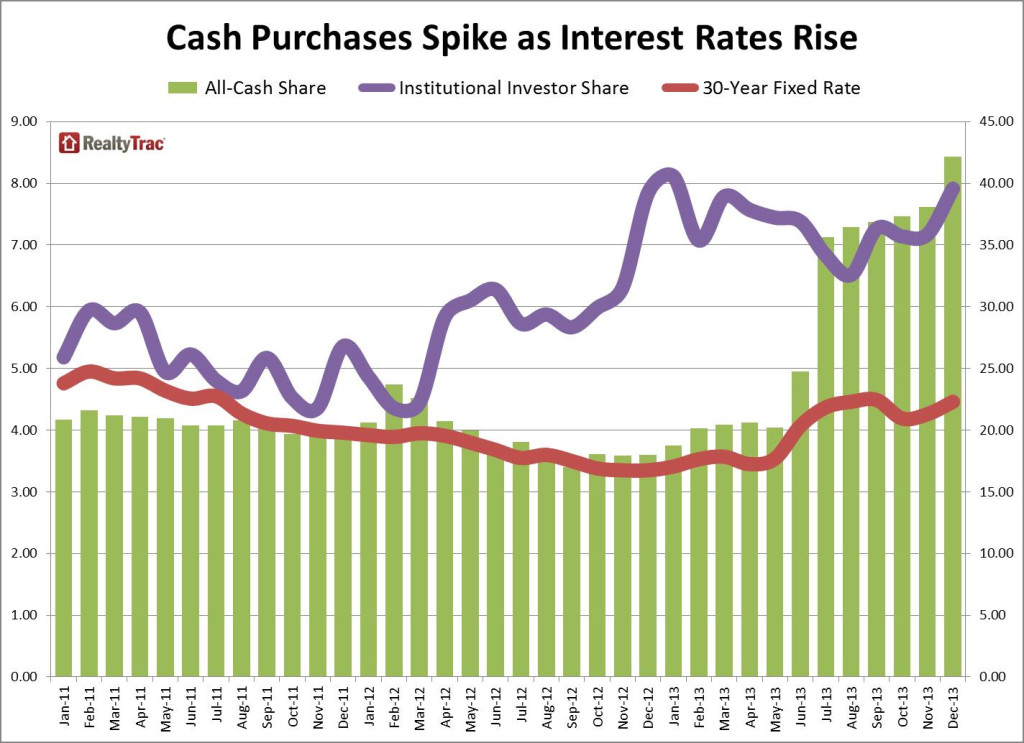

The

distressed sales aren’t even close to the biggest distortion of this

housing market. The RealtyTrac report reveals that all-cash purchases

accounted for 42% of all U.S. residential sales in December, up from 38%

in November, and up from 18% in December 2012. Does that sound like a

trend of normalization? There were five states where all-cash

transactions accounted for more than 50% of sales in December – Florida

(62.5%), Wisconsin (59.8%), Alabama (55.7%), South Carolina (51.3%), and

Georgia (51.3%). In the pre-crisis days before 2008, all-cash sales

NEVER accounted for more than 10% of all home sales. NEVER. This is all

being driven by hot Wall Street money, aided and abetted by Bernanke,

Yellen and the rest of the Fed fiat heroine dealers.

The

fact that Wall Street is running this housing show is borne out by

mortgage applications languishing at 1997 levels, down 65% from the 2005

highs. Real people in the real world need a mortgage to buy a house. If

mortgage applications are near 16 year lows, how could home prices be

ascending as if there is a frenzy of demand? Besides enriching the

financial class, the contrived elevation of home prices and the QE

induced mortgage rate increase has driven housing affordability into the

ground. First time home buyers account for a record low percentage of

27%. In a normal non-manipulated market, first time home buyers account

for 40% of home purchases.

Price

increases that rival the peak insanity of 2005 have been manufactured

by Wall Street shysters and the Federal Reserve commissars. Doctor Housing Bubble sums up the absurdity of this housing market quite well.

The

all-cash segment of buyers has typically been a tiny portion of the

overall sales pool. The fact that so many sales are occurring off the

typical radar suggests that the Fed’s easy money eco-system has created a

ravenous hunger with investors to buy up real estate. Why? The rentier class is chasing yields

in every nook and cranny of the economy. This helps to explain why we

have such a twisted system where home ownership is declining yet prices

are soaring. What do we expect when nearly half of sales are going to

investors? The all-cash locusts flood is still ravaging the housing

market.

The

Case-Shiller Index has shown price surges over the last two years that

exceed the Fed induced bubble years of 2001 through 2006. Does that make

sense, when new homes sales are at levels seen during recessions over

the last 50 years, and down 70% from the 2005 highs? Even with this

Fed/Wall Street induced levitation, existing home sales are at 1999

levels and down 30% from the 2005 highs. So how and why have national

home prices skyrocketed by 14% in 2013 after a 9% rise in 2012? Why are

the former bubble markets of Las Vegas, Los Angeles, San Diego, San

Francisco and Phoenix seeing 17% to 27% one year price increases? How

could the bankrupt paradise of Detroit see a 17.3% increase in prices in

one year? In a normal free market where individuals buy houses from

other individuals, this does not happen. Over the long term, home prices

rise at the rate of inflation. According to the government drones at

the BLS, inflation has risen by 3.6% over the last two years. Looks like

we have a slight disconnect.

This

entire contrived episode has been designed to lure dupes back into the

market, artificially inflate the insolvent balance sheets of the Too Big

To Trust banks, enrich the feudal overlords who have easy preferred

access to the Federal Reserve easy money, and provide the propaganda

peddling legacy media with a recovery storyline to flog to the willingly

ignorant public. The masses desperately want a feel good story they can

believe. The ruling class has a thorough understanding of Edward

Bernays’ propaganda techniques.

“The

conscious and intelligent manipulation of the organized habits and

opinions of the masses is an important element in democratic society.

Those who manipulate this unseen mechanism of society constitute an

invisible government which is the true ruling power of our country. …We

are governed, our minds are molded, our tastes formed, our ideas

suggested, largely by men we have never heard of.”

Ben

Bernanke increased his balance sheet by $3.2 trillion (450%) since

2008, and it had to go somewhere. We know it didn’t trickle down to the

99%. It was placed in the firm clutches of the .1% billionaire club.

Bernanke sold his QE schemes as methods to benefit Main Street

Americans, when his true purpose was to benefit Wall Street crooks. 30

year mortgage rates were 4.25% before QE2. 30 year mortgage rates were

3.5% before QE3. Today they stand at 4.5%. QE has not benefited average

Americans. They are getting 0% on their savings, mortgage rates are

higher, and their real household income has fallen and continues to

fall.

But

you’ll be happy to know banking profits are at all-time highs,

Blackrock and the rest of the Wall Street Fed front running crowd have

made a killing in the buy and rent ruse, and record bonuses are being

doled out to the men who have wrecked our financial system in their

gluttonous plundering of the once prosperous nation. Their felonious

machinations have added zero value to society, while impoverishing a

wide swath of America. Bernanke, Yellen and their owners have used their

control of the currency, interest rates, and regulatory agencies to

create the widest wealth disparity between the haves and have-nots in

world history. Their depraved actions on behalf of the .1% will mean

blood.

Just

as Greenspan’s easy money policies of the early 2000’s created a

housing bubble, inspiring low IQ wannabes to play flip that house,

Bernanke’s mal-investment inducing QEternity has lured the get rich

quick crowd back into the flipping business. The re-propagation of Flip

that House shows on cable is like a rerun of the pre-bubble bursting

frenzy in 2005. RealtyTrac’s recent report details the disturbing lemming like trend among greedy institutions and dullard brother-in-laws across the land.

- 156,862 single family home flips — where a home is purchased and subsequently sold again within six months — in 2013, up 16% from 2012 and up 114% from 2011.

- Homes flipped in 2013 accounted for 4.6% of all U.S. single family home sales during the year, up from 4.2% in 2012 and up from 2.6% in 2011

The

easy profits just keep flowing when the Fed provides the easy money.

What could possibly go wrong? Home prices never fall. A brilliant Ivy

League economist said so in 2005. The easy profits have been reaped by

the early players. Wall Street hedge funds don’t really want to be

landlords. Flippers need to make a quick buck or their creditors pull

the plug. Home prices peaked in mid-2013. They have begun to fall. The

35% increase in mortgage rates has removed the punchbowl from the party.

Anyone who claims housing will improve in 2014 is either talking their

book, owns a boatload of vacant rental properties, teaches at Princeton,

or gets paid to peddle the Wall Street propaganda on CNBC.

Reality

will reassert itself in 2014, with lemmings, flippers, and hedgies

getting slaughtered as the housing market comes back to earth with a

thud. The continued tapering by the Fed will remove the marginal dollars

used by Wall Street to fund this housing Ponzi. The Wall Street

lemmings all follow the same MBA created financial models. They will all

attempt to exit the market simultaneously when their models all say

sell. If the economy improves, interest rates will rise and kill the

housing market. If the economy tanks, the stock market will plunge,

creating fear and killing the housing market. Once it becomes clear that

prices have begun to fall, the flippers will panic and start dumping,

exacerbating the price declines. This scenario never grows old.

Real

household income continues to fall and nearly 25% of all households

with a mortgage are still underwater. Young people are saddled with $1

trillion of government peddled student loan debt and will not be buying

homes in the foreseeable future. Dodd-Frank rules will result in fewer

people qualifying for mortgages. Mortgage insurance is increasing.

Obamacare premium increases are sucking the life out of potential middle

class home buyers. Retailers have begun firing thousands. The financial

class had a good run. They were able to re-inflate the bubble for two

years, but the third year won’t be a charm. In a normal housing market

85% of home sales would be between individuals using a mortgage, 10%

would be all cash transactions, less than 5% of sales would be

distressed, and 40% would be first time buyers. In this warped market

only 40% of home sales are between individuals using a mortgage, 42% are

all cash transactions, 16% are distressed sales, 5% are flipped, and

only 27% are first time buyers. The return to normalcy will be painful

for shysters, gamblers, believers, paid off economists, Larry Yun, and

CNBC bimbos.

No comments:

Post a Comment