Banks Are Obsolete: The Entire Parasitic Sector Can Be Eliminated

| February 20, 2014 |

Charles Hugh-Smith of OfTwoMinds blog

What else can we do with the $1.25 trillion we'll save by eliminating these obsolete financial middleman parasites? A lot.

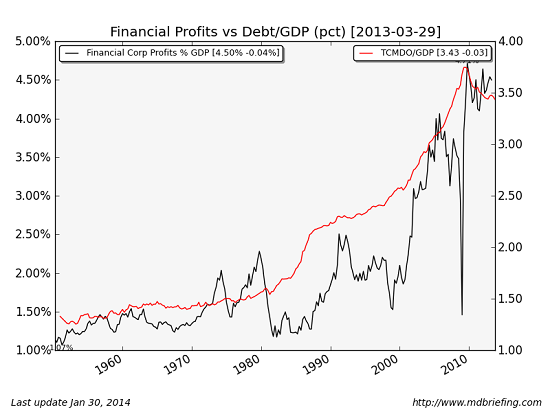

Technology has leapfrogged the banking sector, rendering it as obsolete as buggy whips. So why are we devoting 9% of our economy to an obsolete parasite? Financial sector profits now total a staggering 4.5% of GDP (gross domestic product), while the expenses generated by financial churning account for another 4.5% of the economy.

chart courtesy of Market Daily Briefing

Software and existing non-Wall Street/too-big-to-fail institutions could replace the entire Wall Street/banking sector and drop costs to .5% of GDP, saving us 8+% of our GDP ($1.25 trillion) that is currently siphoned off by parasitic middlemen. The banking sector is Exhibit A in the Middleman-Skimming Economy (February 11, 2014).

The pull of habit and propaganda is so strong that most people haven't even recognized that software and the Web can replace the entire financial/banking sector for a fraction of the cost of the current parasitic system, a system that (as we all know) has captured the regulatory and governance machinery of the central state, making a mockery of democracy.

The benefits of eliminating the financial/banking sector are immense and far-reaching.

What exactly do banks do? Banks perform these basic functions:

1. They hold depositors' money.

2. They act as a clearing house for payments, transferring funds from payor to payee.

3. They issue loans on a fractional reserve basis, i.e. a few dollars in cash deposits supports $100 in loans.

4. They originate and trade derivatives, run high-speed trading desks, operate various money-laundering and embezzlement schemes, influence elected officials with lobbying and campaign contributions and subvert both free market capitalism and democracy at every turn.

This entire parasitic middleman sector could be replaced with automated digital clearing houses and crowdfunded or non-bank loans. Why do we need banks to pay bills online? We don't; any clearing house could charge a small fee for the transaction.

Why do we need banks when loans can be crowdfunded? If we can invest money in start-ups via Kickstarter, Indiegogo, RocketHub, AngelList, etc., why can't we own a piece of someone's auto loan or home mortgage?

The web and software now enable the elimination of the entire middleman skimming operation of banking. Those with capital can invest that capital directly in loans that the investors choose. Risk is distributed throughout the system, and the process of verifying credit scores, income, valuations, assets, and so on--the building blocks of risk assessment and a market for debt and cash--can also be automated.

The entire notion that 100 savers put their money in a bank which then buys a mortgage with their savings and sells it as a security that supports a pyramid of derivatives is obsolete. Each saver can directly own (and sell on a transparent market) a piece of a mortgage, auto loan, business loan, etc. There is no need for a middleman banking sector at all--no skim, no concentration of risk, no opportunities for selling derivatives to unwary investors. All that goes away with the banking sector.

But what about holding deposits? We already have two institutions that could serve this role: credit unions and the post office. If those holding depositors' cash do not issue loans, they have no source of income to defray operating expenses. The solution is obvious: charge fees for holding deposits and payor-payee transactions.

If the fee structures are transparent, those who charge too much will disappear as customers go elsewhere. That's the purpose of transparent competition in an open marketplace.

Many other advanced nations have long combined postal and simple banking services: France and Japan come to mind. Here we have a postal service that is struggling to fund its operations in the era of email, and here we have millions of people who prefer to (or have to) do simple banking in person. There is no technical or administrative reason that the post office could not operate as it does in Japan, as a place to deposit funds (including auto-deposit of Social Security checks), take out cash, etc.

US Post Office Could Rack Up Billions By Offering Money Services--NPR (via Joel M.)

Please note that what I am suggesting is a transparent open market for these services provided by a range of enterprises and institutions. Assemble a marketplace of local credit unions, the post office, enterprises that handle payor-payee transactions such as Dwolla and PayPal, and you have a wide spectrum of choices to suit every need.

As for business loans: you can get small-business loans on PayPal right now. It's called Working Capital, and the borrower is given the total amount due right up front.

As for the commercial paper market: there is no technical reason why a transparent exchange couldn't enable borrowers and owners of capital to set short-term loan rates via transparent bidding with automated software.

The obsolescence of banking includes the Federal Reserve--the ultimate middleman skimming operation. But what about providing liquidity in credit panics? Well, to start with, once the banking sector is gone then the concentrations of risk and the obscuring of risk that go hand in hand with banking also disappear-- the forces that generate panics will have been dispersed. Those forces will have vanished along with the middleman financial sector that created all the risks, speculative excesses and panics. If there were a liquidity crisis, the Treasury could create and lend whatever funds were needed.

But what about manipulating interest rates and other forms of financial repression? Interest rates would be set by millions of borrowers and owners of capital in transparent transactions.

What about all those great investing services offered by big banks and Wall Street? As many have observed, automated index funds outperform 99% of fund managers over 10 year time frames. So Wall Street is also obsolete.

Once we get rid of these obsolete middleman parasites--Wall Street, the banking sector and the Federal Reserve--we have a delightful question to answer: what else can we do with the $1.25 trillion we'll save every year by eliminating these obsolete financial middleman parasites? A lot.

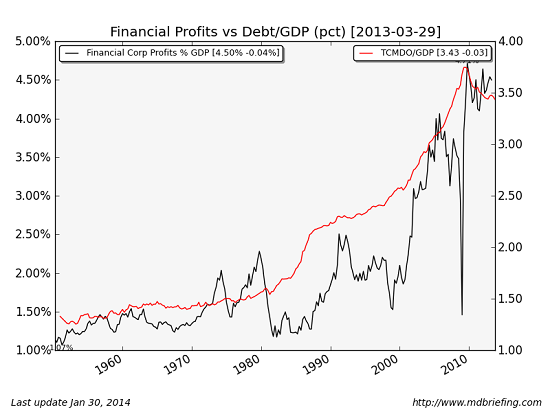

Technology has leapfrogged the banking sector, rendering it as obsolete as buggy whips. So why are we devoting 9% of our economy to an obsolete parasite? Financial sector profits now total a staggering 4.5% of GDP (gross domestic product), while the expenses generated by financial churning account for another 4.5% of the economy.

chart courtesy of Market Daily Briefing

Software and existing non-Wall Street/too-big-to-fail institutions could replace the entire Wall Street/banking sector and drop costs to .5% of GDP, saving us 8+% of our GDP ($1.25 trillion) that is currently siphoned off by parasitic middlemen. The banking sector is Exhibit A in the Middleman-Skimming Economy (February 11, 2014).

The pull of habit and propaganda is so strong that most people haven't even recognized that software and the Web can replace the entire financial/banking sector for a fraction of the cost of the current parasitic system, a system that (as we all know) has captured the regulatory and governance machinery of the central state, making a mockery of democracy.

The benefits of eliminating the financial/banking sector are immense and far-reaching.

What exactly do banks do? Banks perform these basic functions:

1. They hold depositors' money.

2. They act as a clearing house for payments, transferring funds from payor to payee.

3. They issue loans on a fractional reserve basis, i.e. a few dollars in cash deposits supports $100 in loans.

4. They originate and trade derivatives, run high-speed trading desks, operate various money-laundering and embezzlement schemes, influence elected officials with lobbying and campaign contributions and subvert both free market capitalism and democracy at every turn.

This entire parasitic middleman sector could be replaced with automated digital clearing houses and crowdfunded or non-bank loans. Why do we need banks to pay bills online? We don't; any clearing house could charge a small fee for the transaction.

Why do we need banks when loans can be crowdfunded? If we can invest money in start-ups via Kickstarter, Indiegogo, RocketHub, AngelList, etc., why can't we own a piece of someone's auto loan or home mortgage?

The web and software now enable the elimination of the entire middleman skimming operation of banking. Those with capital can invest that capital directly in loans that the investors choose. Risk is distributed throughout the system, and the process of verifying credit scores, income, valuations, assets, and so on--the building blocks of risk assessment and a market for debt and cash--can also be automated.

The entire notion that 100 savers put their money in a bank which then buys a mortgage with their savings and sells it as a security that supports a pyramid of derivatives is obsolete. Each saver can directly own (and sell on a transparent market) a piece of a mortgage, auto loan, business loan, etc. There is no need for a middleman banking sector at all--no skim, no concentration of risk, no opportunities for selling derivatives to unwary investors. All that goes away with the banking sector.

But what about holding deposits? We already have two institutions that could serve this role: credit unions and the post office. If those holding depositors' cash do not issue loans, they have no source of income to defray operating expenses. The solution is obvious: charge fees for holding deposits and payor-payee transactions.

If the fee structures are transparent, those who charge too much will disappear as customers go elsewhere. That's the purpose of transparent competition in an open marketplace.

Many other advanced nations have long combined postal and simple banking services: France and Japan come to mind. Here we have a postal service that is struggling to fund its operations in the era of email, and here we have millions of people who prefer to (or have to) do simple banking in person. There is no technical or administrative reason that the post office could not operate as it does in Japan, as a place to deposit funds (including auto-deposit of Social Security checks), take out cash, etc.

US Post Office Could Rack Up Billions By Offering Money Services--NPR (via Joel M.)

Please note that what I am suggesting is a transparent open market for these services provided by a range of enterprises and institutions. Assemble a marketplace of local credit unions, the post office, enterprises that handle payor-payee transactions such as Dwolla and PayPal, and you have a wide spectrum of choices to suit every need.

As for business loans: you can get small-business loans on PayPal right now. It's called Working Capital, and the borrower is given the total amount due right up front.

As for the commercial paper market: there is no technical reason why a transparent exchange couldn't enable borrowers and owners of capital to set short-term loan rates via transparent bidding with automated software.

The obsolescence of banking includes the Federal Reserve--the ultimate middleman skimming operation. But what about providing liquidity in credit panics? Well, to start with, once the banking sector is gone then the concentrations of risk and the obscuring of risk that go hand in hand with banking also disappear-- the forces that generate panics will have been dispersed. Those forces will have vanished along with the middleman financial sector that created all the risks, speculative excesses and panics. If there were a liquidity crisis, the Treasury could create and lend whatever funds were needed.

But what about manipulating interest rates and other forms of financial repression? Interest rates would be set by millions of borrowers and owners of capital in transparent transactions.

What about all those great investing services offered by big banks and Wall Street? As many have observed, automated index funds outperform 99% of fund managers over 10 year time frames. So Wall Street is also obsolete.

Once we get rid of these obsolete middleman parasites--Wall Street, the banking sector and the Federal Reserve--we have a delightful question to answer: what else can we do with the $1.25 trillion we'll save every year by eliminating these obsolete financial middleman parasites? A lot.

No comments:

Post a Comment