http://www.musicthinktank.com/blog/spotiwhy-are-subscription-music-services-a-sustainable-busin.html

Spotiwhy? : Are Subscription Music Services a Sustainable Business Model?

Subscription music services have been dominating the news

recently with the U.S. launch of Spotify and the new IHeartRadio, plus

free offerings from MOG and RDIO, and the recent purchase of Napster by

Rhapsody. There is a sea change occurring in all content industries

moving towards streaming and subscription rather than ownership, and

this transition has been causing a lot of debate and disagreement about

the potential and the fairness of this new model of consumption.

Spotify has been both the most visible and the most vilified of the new companies. First there was the public removal of certain labels’ catalogs from the service. Since then, there has been a rash of artists making their royalty statements public in an effort to show that Spotify is not a viable business partner for a small label or an indie musician. Because these numbers exist in a vacuum there is no way to gauge if these are isolated instances or a pervasive injustice. Spotify’s response has been equally vague, referencing aggregate payouts instead of the individual ones that are being questioned.

There have been a lot of individual experiences and accounting being bandied about, but I have yet to see any hard macro numbers. Looking at all of this I decided to do some analysis into what the potential of subscription music is in the United States. Because of the nature of subscription services it is not necessary to focus on just Spotify. In aggregate all subscription music can be looked at in the same way as long we assume the services charge the same per month per user.

This essay is neither for nor against subscription music services, and will focus on answering four questions.

1) What is the revenue potential for subscription music services?

2) What are the most likely rates per stream?

3) How much money can an artist expect to make from subscription music?

4) Is a compulsory rate a sustainable business model?

What is the revenue potential for subscription music services?

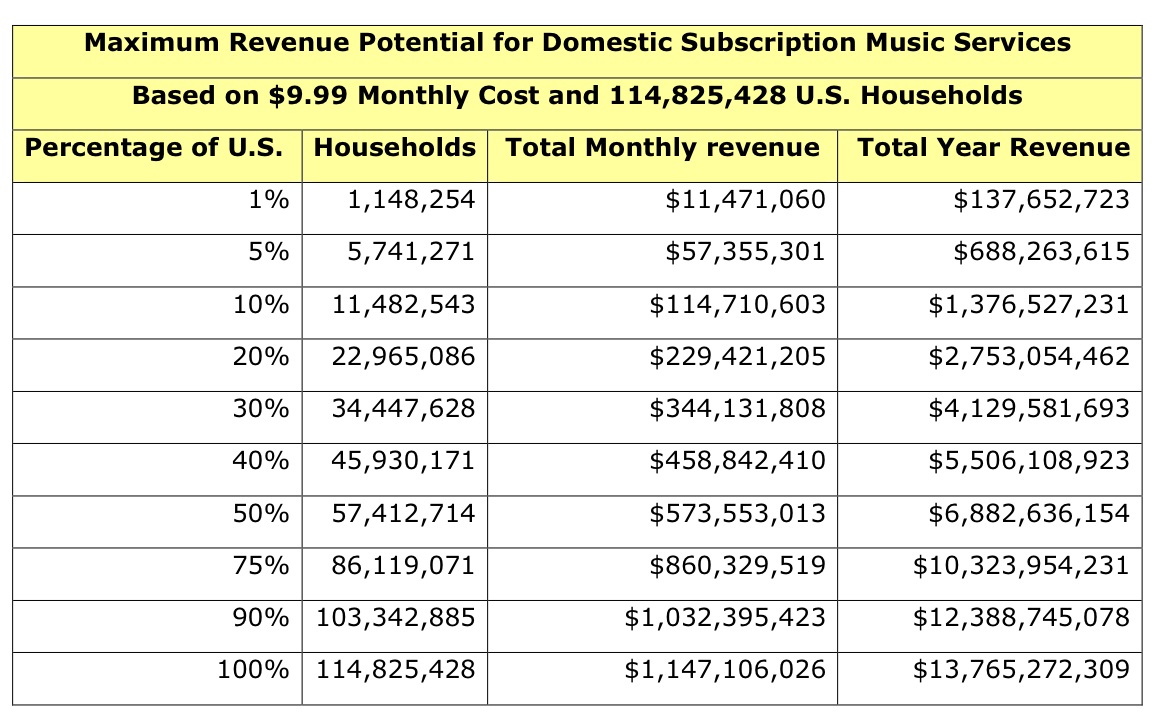

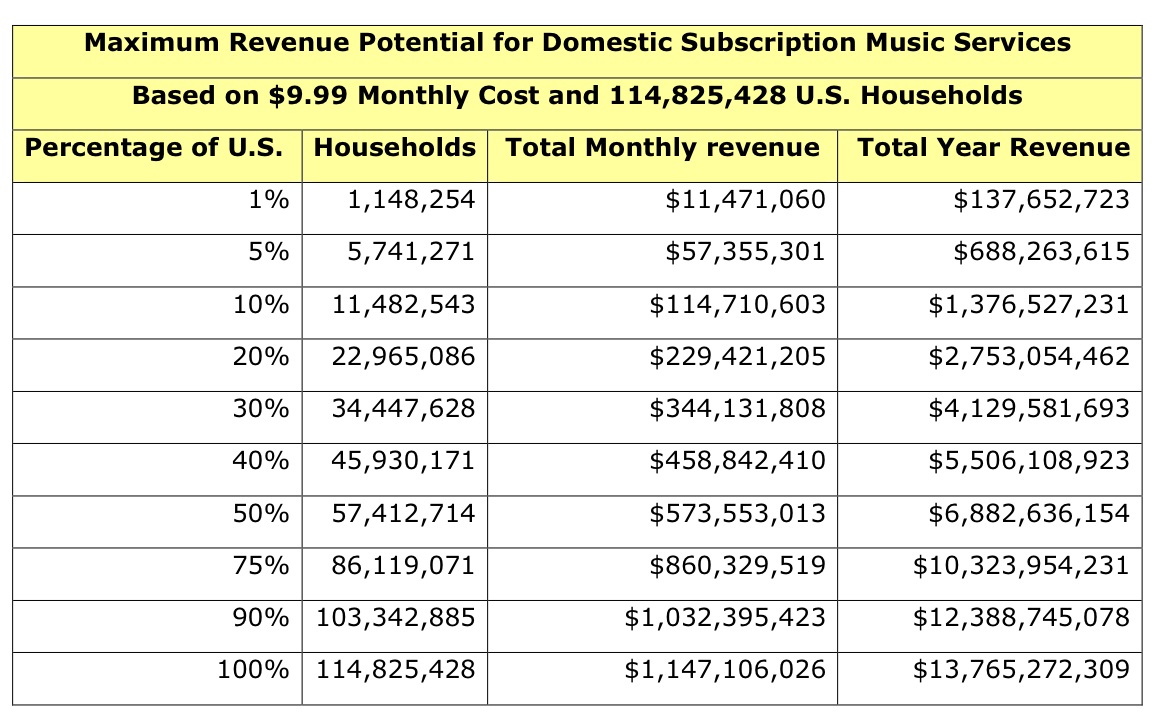

This is a fairly straightforward calculation. The formula for the total possible revenue in a month is the number of accounts using a subscription service multiplied by the monthly cost of the service.

TMR = A x C

The resulting number multiplied by 12 months will give the yearly revenue potential. Using the last accounting of roughly 115 million U.S. Households and an assumption of a 9.99 monthly cost, the total possible revenue for a subscription music service is roughly 13.75 billion dollars.

In 1999 at the height of the CD boom sales of recorded music totaled 14 billion dollars. In theory, subscription music’s 13.75 billion dollar potential returns the music industry to its glory years. It is unlikely though, that paid subscription music will reach 100% household penetration in the near future. Currently Spotify has somewhere between 1 and 2 million paying customers. The combined Rhapsody and Napster, which I’ll tentatively refer to as Rhaspterdy, has about the same. Add in MOG, RDIO and other miscellaneous competitors and the current subscription music base is most likely between 4 and 5 million paid users or approximately 600 million in yearly revenue.

Netflix, which has been the most successful paid subscription model, has roughly 25 million subscribers. If subscription music can reach that same level of cultural adoption then it will generate about 2.75 billion dollars in revenue at critical mass. If all 66% of U.S. households with broadband have a subscription music account then the total revenue will be about 9 billion dollars. These large numbers may seem impressive, but they actually have very little influence In terms of the rate per stream.

What are the most likely rates per stream?

There have been numerous instances where artists have released their royalty statement to show what appears to be paltry payment for streaming. Spotify’s recent assertion is that once the revenue goes up, increased payments will follow. This is obviously true in the aggregate as there is more money, but many people seem to think that this will also result in higher royalties per stream. After running the numbers, I believe this is highly unlikely.

The total revenue will be divided in two ways. The first division is the percentage split between the subscription service and the artist revenue pool. The calculations in this essay are modeled on an assumed 50/50 split for this pool, because I’m a fair guy. The second division is how the artist revenue pool will be split between the individual artists and labels. This is the payment per stream.

In order to know the potential payment per stream, or from the services viewpoint, the cost for each stream handled, the first step is to calculate the total number of streams that a service will stream.

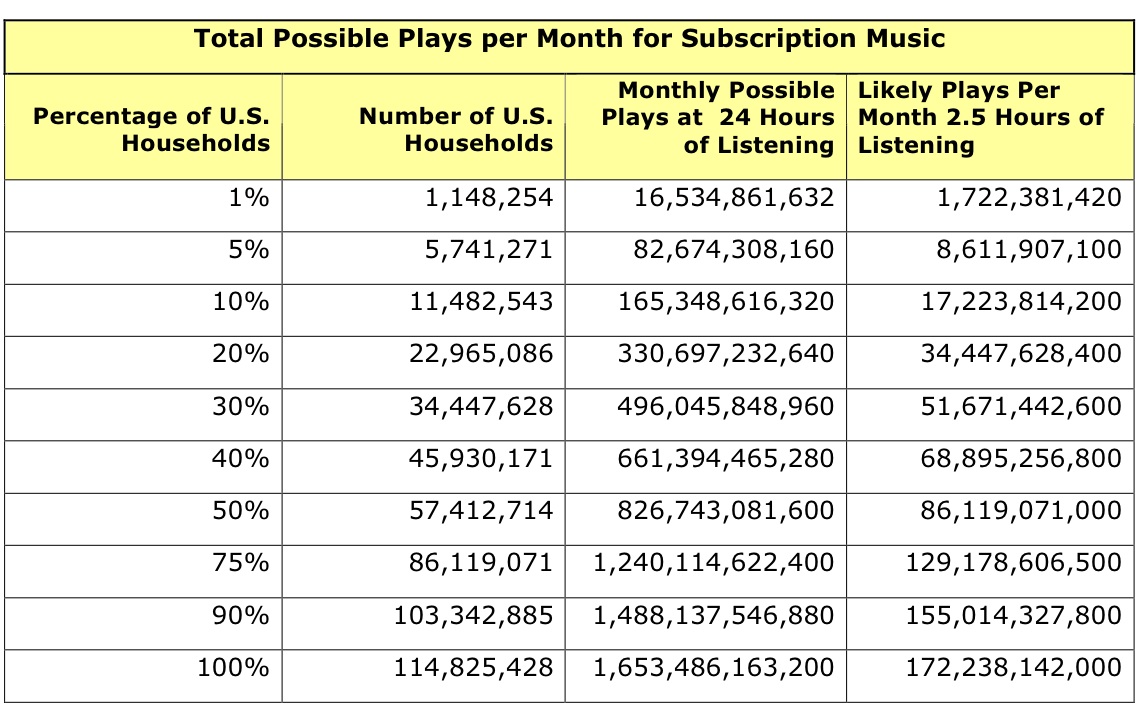

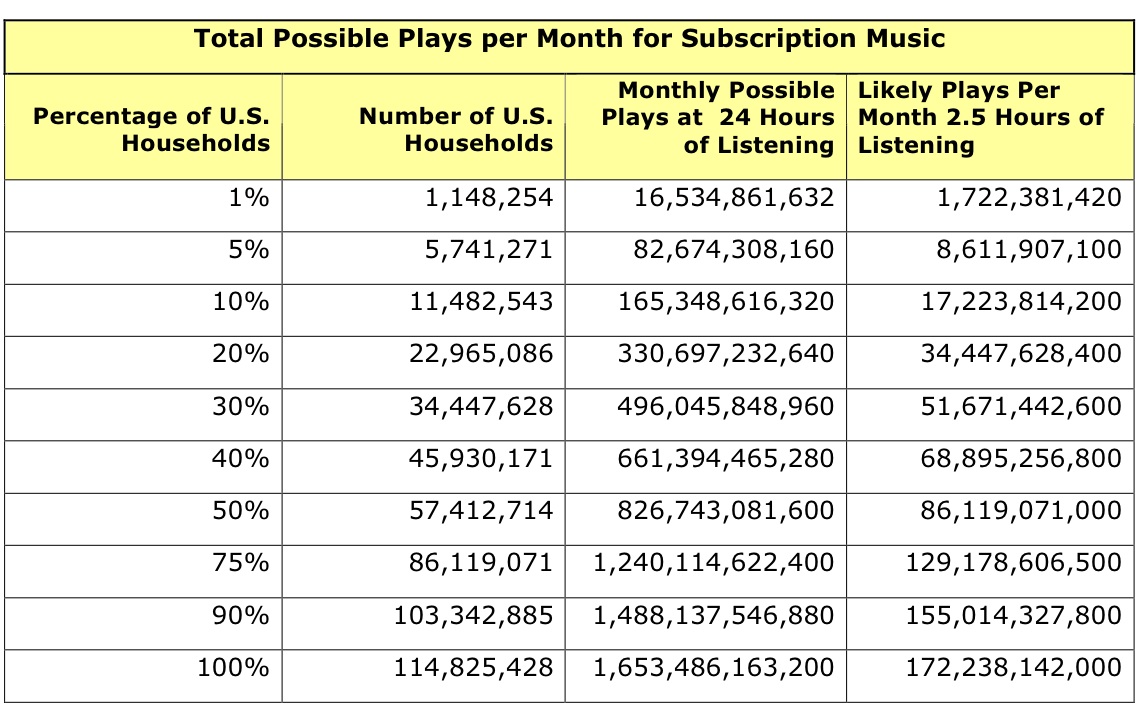

If it is assumed that songs last 3 minutes on average, then a user will stream 20 songs an hour. Extrapolating this formula, a user can stream a maximum of 480 songs a day, and 14,400 songs a month. It is not likely that every user will listen to music twenty-four hours a day. According to a Kaiser Family Foundation study entitled Generation M; the average American teenager listens to 2.5 hours of music a day. This seems like a reasonable number to use as the listening baseline for a subscription music user.

The following table shows the amount of streams a subscription service will handle per month at both constant usage and the average 2.5 hours of listening.

The two variables necessary for the division of the revenue pool based are now calculated. These are total revenue and total streams. My formula is based on a perfectly even division of revenue based on percentage of total plays a song comprises, because again, I’m a fair guy. The actual formulas the services use are probably slightly more complicated, but the basic concept should be the same.

Stream Payment Formula:

1

__________________ X Revenue Pool = Payment per stream

Total Plays

1% of U.S. Households using subscription music at 2.5 hours of listening a day.

1

__________________ X 5,735,530 = $.0033

1,722,381,420

20% of U.S. Households using subscription music at 2.5 hours listening a day.

1

__________________ X 114,710,603 = $.0033

34,447,628,400

The interesting thing about this equation is that because plays increase by the same factor as revenue, the ratio remains the same. The per-stream royalty is still the same 1/3 of a penny. There are two ways to increase the per stream royalty. The first is the per-stream royalty will increase if as more people adopt the service the number of plays decreases as they do. This would require the service to be used less as it gets more popular. This is the gym membership model. The per-stream royalty can also increase if the distributed revenue increases. This is possible if the overhead required to run a subscription company does not increase at the same rate as subscriber acquisition, and the extra money is added to the revenue pool.

After doing this calculation for numerous plausible scenarios, I’ve found the per-stream payment is almost always a fraction of penny. This will always be the case when dividing millions in revenue by billions of streams or billions in revenue by trillions of streams.

What can an artist or label expect to make from subscription music?

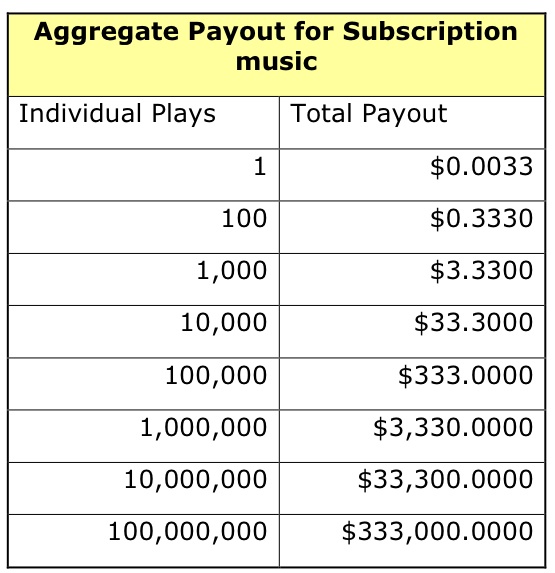

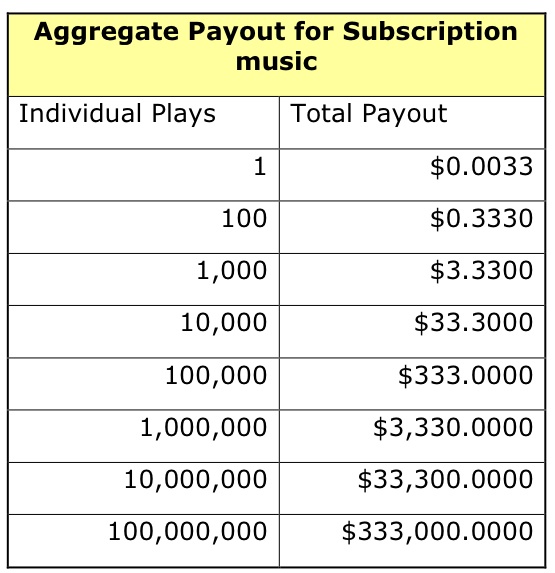

If the per-stream payment is a fraction of a penny, what does that mean for a song’s total revenue potential? To illustrate this the following table looks at potential aggregate payouts at 3 tenths of a penny.

It takes 200 streams to equal the wholesale payout for one download. It takes ten million plays of a song to equal the revenue that 51,000 single downloads currently generate.

A fun game to play is to take the current singles numbers of hit songs and see how many subscription plays it would take to equal that same number. The Black Eyed Peas best selling song is “I Gotta Feeling,” which was downloaded 7.5 million times. This would generate $4,875,000 in revenue. To generate the same revenue through subscription play the song would need to be played 1.6 billion times.

This seems like a lot, but lets look at it another way. Using subscription music, what is the possibility of a song getting played 1.6 billion times in a year? At 20% adoption, every month there are roughly 35 billion plays across the services. This equates to roughly 420 billion plays a year. This means that one out of every 262 plays would have to be that song. Judging from how many time I’ve heard the Black Eyed Peas this year that may be possible.

Another way to look at it is to ask the question, “What if every person who used subscription music listened to a song once a day?” These are your hits songs, the ones you cannot escape. This is “Stairway to Heaven” in 1971. This is “Candle in the Wind” in 1997. This is “Hey Ya” in 2003.

The following table shows what the potential is for massive hit song with very moderate listening by everyone in the country.

When there is a song that pervades pop culture, the potential numbers start lining up with the current revenue, and as subscription music attains larger percentages of the U.S. population, the numbers for a potential hit become significantly more than a hit song currently. Of course, the flip side of this is that there are no album sales on top of these numbers like there is currently. As subscription music becomes dominant this becomes the only recorded revenue stream.

Is a compulsory rate a sustainable business model?

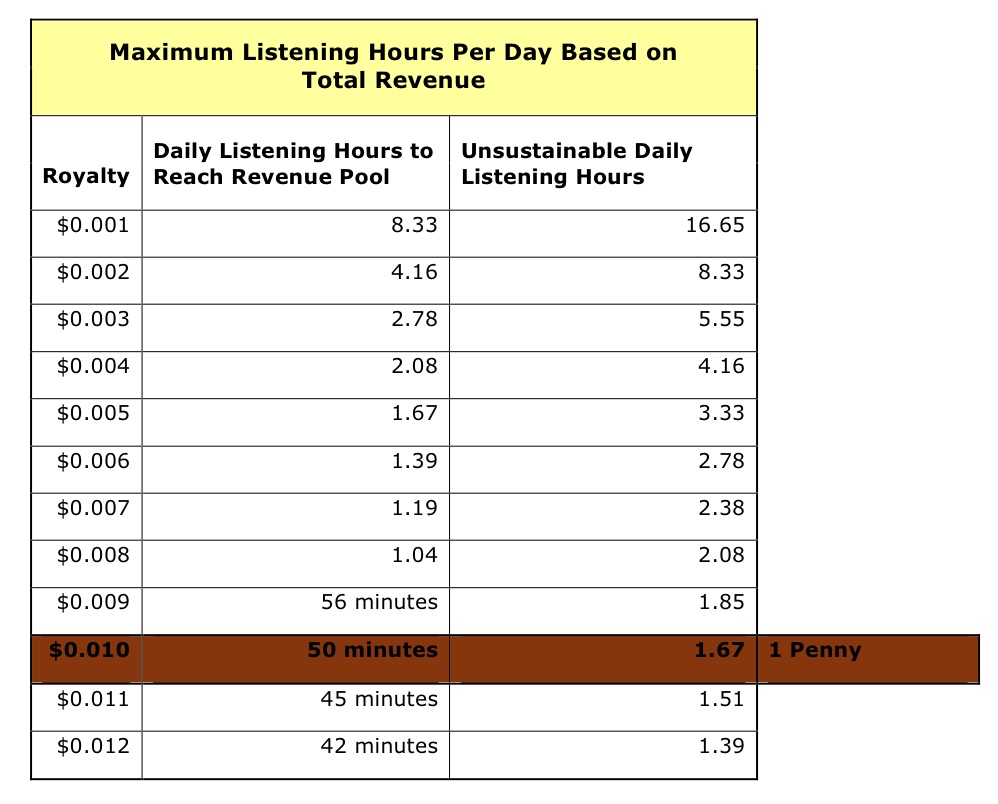

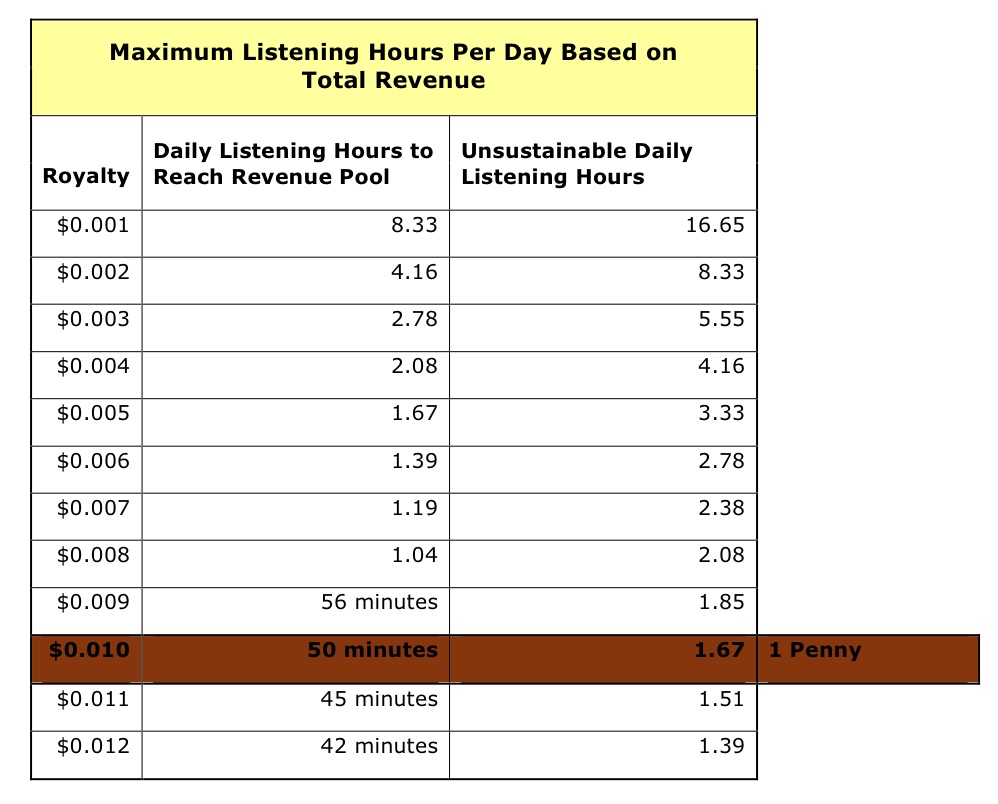

The call from musicians is for more than 3 tenths of a cent, and the music industry has a history of embracing compulsory rates. One penny is the rate I have most commonly heard as fair for a stream. The next table examines what the maximum per stream royalty a subscription service can handle at different listening frequencies assuming a 100% payout. This is the maximum that a service can handle. After this point the service would be paying out more revenue than it would take in, and would shortly become unsustainable.

If a compulsory rate of 1 penny is mandated, then the averaging listening time for a consumer needs to be around 50 minutes a day to sustain a 50% revenue pool share. After about 1hour and 40 minutes a day the mandated royalties are more than the revenue brought in by the 10 dollars a month in fees. Another way to look at this is to think how much revenue can be paid if there was only one subscriber, and a mandated one penny per stream royalty.

9.99 subscription fee = 999 songs per month = 33 songs a day = 99 minutes of listening time. This is 1 hour and 39 minutes or 1.67 hours as the chart above indicates.

Looking at no other overhead or costs, this is the point where a subscription service can no longer physically pay out fees, although it would have went bankrupt well before then. Looking at this chart and the others, and knowing that the average listening time for music is 2.5 hours a day, .003 cents still seems to be the most likely candidate for the payment per stream.

Anything above this at the current cost per month, would bankrupt any subscription music service. To sustain a compulsory rate of one penny, subscription music services would have to increase the monthly cost to 60 dollars listeners must not exceed 2.5 hours of listening or 50 songs a day.

Conclusion

At the beginning of this essay I set out to answer 4 questions about the potential revenue and costs as the music industry switches to subscription streaming. After exploring the various scenarios, the conclusion that can be drawn is that there is significant revenue that can be generated by the services as a whole, but the individual stream payments will remain in fractions of a cent and will only decrease as the services become more popular.

Devils Advocate: Possible arguments against my claims and my responses.

Q: This does not take into account advertising revenue.

This is because premium versions of subscription services, the 10-dollar a month kind, are built on the premise of no advertising. The ad supported networks will generate even less revenue. Ads are generally sold on CPM. If an ad was sold on every play (which is not the case) a CPM of 79.82 would be required at 2.5 hours of listening to equal the same revenue as subscription services. This is extremely high for a passive audience.

Q: This doesn’t use the exact formulas the subscription services currently employ.

The formulas in this essay are based on the mathematically fairest division out there. This is the perfect scenario. The actual case will be slightly different, but as shown in numerous calculations the per-stream payment will almost always be in fractions of a cent at the current monthly cost.

Q: You are not taking into account the promotional aspect. Streaming promotes other revenue streams.

This argument is true at the lower levels of household adoption, but begins to fall apart as more people use the service. This is because as subscription music becomes the dominant medium for music consumption, there will be less and less physical or file sales to benefit from the supposed promotion. To put it another way, if everyone is getting their music from subscription music services then the only thing you are promoting is other subscription music. In regards to merchandise, tickets or any of the other ancillary revenue streams, it is true that streaming will promote them, but the current and former methods of music consumption also did that. I’d be interested to see any proof that streaming music is somehow a more efficient promoter of these other revenue streams.

Q: These calculations are based on a 50/50 split. If we increase artist revenue the per-stream payments will go up.

Yes and no. This could be true, but it again depends on the ratio. If the plays go up at a faster pace than the revenue pool is increased then the per-stream payments will not go up and possibly could go down. The compulsory sustainability section was based upon a 100% revenue pool and this is the absolute maximum that a subscription company could pay out at the current monthly costs. Looking at that you can see that subscription music is practically unsustainable after a penny a play.

About:

Frank Woodworth is a ten year veteran of the music industry and the founder of www.glacialconcepts.com. He has previously been selected to “30 under 30” music executives by Billboard magazine, and has twice spoken at the CMJ Music Festival.

Spotify has been both the most visible and the most vilified of the new companies. First there was the public removal of certain labels’ catalogs from the service. Since then, there has been a rash of artists making their royalty statements public in an effort to show that Spotify is not a viable business partner for a small label or an indie musician. Because these numbers exist in a vacuum there is no way to gauge if these are isolated instances or a pervasive injustice. Spotify’s response has been equally vague, referencing aggregate payouts instead of the individual ones that are being questioned.

There have been a lot of individual experiences and accounting being bandied about, but I have yet to see any hard macro numbers. Looking at all of this I decided to do some analysis into what the potential of subscription music is in the United States. Because of the nature of subscription services it is not necessary to focus on just Spotify. In aggregate all subscription music can be looked at in the same way as long we assume the services charge the same per month per user.

This essay is neither for nor against subscription music services, and will focus on answering four questions.

1) What is the revenue potential for subscription music services?

2) What are the most likely rates per stream?

3) How much money can an artist expect to make from subscription music?

4) Is a compulsory rate a sustainable business model?

What is the revenue potential for subscription music services?

This is a fairly straightforward calculation. The formula for the total possible revenue in a month is the number of accounts using a subscription service multiplied by the monthly cost of the service.

TMR = A x C

The resulting number multiplied by 12 months will give the yearly revenue potential. Using the last accounting of roughly 115 million U.S. Households and an assumption of a 9.99 monthly cost, the total possible revenue for a subscription music service is roughly 13.75 billion dollars.

In 1999 at the height of the CD boom sales of recorded music totaled 14 billion dollars. In theory, subscription music’s 13.75 billion dollar potential returns the music industry to its glory years. It is unlikely though, that paid subscription music will reach 100% household penetration in the near future. Currently Spotify has somewhere between 1 and 2 million paying customers. The combined Rhapsody and Napster, which I’ll tentatively refer to as Rhaspterdy, has about the same. Add in MOG, RDIO and other miscellaneous competitors and the current subscription music base is most likely between 4 and 5 million paid users or approximately 600 million in yearly revenue.

Netflix, which has been the most successful paid subscription model, has roughly 25 million subscribers. If subscription music can reach that same level of cultural adoption then it will generate about 2.75 billion dollars in revenue at critical mass. If all 66% of U.S. households with broadband have a subscription music account then the total revenue will be about 9 billion dollars. These large numbers may seem impressive, but they actually have very little influence In terms of the rate per stream.

What are the most likely rates per stream?

There have been numerous instances where artists have released their royalty statement to show what appears to be paltry payment for streaming. Spotify’s recent assertion is that once the revenue goes up, increased payments will follow. This is obviously true in the aggregate as there is more money, but many people seem to think that this will also result in higher royalties per stream. After running the numbers, I believe this is highly unlikely.

The total revenue will be divided in two ways. The first division is the percentage split between the subscription service and the artist revenue pool. The calculations in this essay are modeled on an assumed 50/50 split for this pool, because I’m a fair guy. The second division is how the artist revenue pool will be split between the individual artists and labels. This is the payment per stream.

In order to know the potential payment per stream, or from the services viewpoint, the cost for each stream handled, the first step is to calculate the total number of streams that a service will stream.

If it is assumed that songs last 3 minutes on average, then a user will stream 20 songs an hour. Extrapolating this formula, a user can stream a maximum of 480 songs a day, and 14,400 songs a month. It is not likely that every user will listen to music twenty-four hours a day. According to a Kaiser Family Foundation study entitled Generation M; the average American teenager listens to 2.5 hours of music a day. This seems like a reasonable number to use as the listening baseline for a subscription music user.

The following table shows the amount of streams a subscription service will handle per month at both constant usage and the average 2.5 hours of listening.

The two variables necessary for the division of the revenue pool based are now calculated. These are total revenue and total streams. My formula is based on a perfectly even division of revenue based on percentage of total plays a song comprises, because again, I’m a fair guy. The actual formulas the services use are probably slightly more complicated, but the basic concept should be the same.

Stream Payment Formula:

1

__________________ X Revenue Pool = Payment per stream

Total Plays

1% of U.S. Households using subscription music at 2.5 hours of listening a day.

1

__________________ X 5,735,530 = $.0033

1,722,381,420

20% of U.S. Households using subscription music at 2.5 hours listening a day.

1

__________________ X 114,710,603 = $.0033

34,447,628,400

The interesting thing about this equation is that because plays increase by the same factor as revenue, the ratio remains the same. The per-stream royalty is still the same 1/3 of a penny. There are two ways to increase the per stream royalty. The first is the per-stream royalty will increase if as more people adopt the service the number of plays decreases as they do. This would require the service to be used less as it gets more popular. This is the gym membership model. The per-stream royalty can also increase if the distributed revenue increases. This is possible if the overhead required to run a subscription company does not increase at the same rate as subscriber acquisition, and the extra money is added to the revenue pool.

After doing this calculation for numerous plausible scenarios, I’ve found the per-stream payment is almost always a fraction of penny. This will always be the case when dividing millions in revenue by billions of streams or billions in revenue by trillions of streams.

What can an artist or label expect to make from subscription music?

If the per-stream payment is a fraction of a penny, what does that mean for a song’s total revenue potential? To illustrate this the following table looks at potential aggregate payouts at 3 tenths of a penny.

It takes 200 streams to equal the wholesale payout for one download. It takes ten million plays of a song to equal the revenue that 51,000 single downloads currently generate.

A fun game to play is to take the current singles numbers of hit songs and see how many subscription plays it would take to equal that same number. The Black Eyed Peas best selling song is “I Gotta Feeling,” which was downloaded 7.5 million times. This would generate $4,875,000 in revenue. To generate the same revenue through subscription play the song would need to be played 1.6 billion times.

This seems like a lot, but lets look at it another way. Using subscription music, what is the possibility of a song getting played 1.6 billion times in a year? At 20% adoption, every month there are roughly 35 billion plays across the services. This equates to roughly 420 billion plays a year. This means that one out of every 262 plays would have to be that song. Judging from how many time I’ve heard the Black Eyed Peas this year that may be possible.

Another way to look at it is to ask the question, “What if every person who used subscription music listened to a song once a day?” These are your hits songs, the ones you cannot escape. This is “Stairway to Heaven” in 1971. This is “Candle in the Wind” in 1997. This is “Hey Ya” in 2003.

The following table shows what the potential is for massive hit song with very moderate listening by everyone in the country.

When there is a song that pervades pop culture, the potential numbers start lining up with the current revenue, and as subscription music attains larger percentages of the U.S. population, the numbers for a potential hit become significantly more than a hit song currently. Of course, the flip side of this is that there are no album sales on top of these numbers like there is currently. As subscription music becomes dominant this becomes the only recorded revenue stream.

Is a compulsory rate a sustainable business model?

The call from musicians is for more than 3 tenths of a cent, and the music industry has a history of embracing compulsory rates. One penny is the rate I have most commonly heard as fair for a stream. The next table examines what the maximum per stream royalty a subscription service can handle at different listening frequencies assuming a 100% payout. This is the maximum that a service can handle. After this point the service would be paying out more revenue than it would take in, and would shortly become unsustainable.

If a compulsory rate of 1 penny is mandated, then the averaging listening time for a consumer needs to be around 50 minutes a day to sustain a 50% revenue pool share. After about 1hour and 40 minutes a day the mandated royalties are more than the revenue brought in by the 10 dollars a month in fees. Another way to look at this is to think how much revenue can be paid if there was only one subscriber, and a mandated one penny per stream royalty.

9.99 subscription fee = 999 songs per month = 33 songs a day = 99 minutes of listening time. This is 1 hour and 39 minutes or 1.67 hours as the chart above indicates.

Looking at no other overhead or costs, this is the point where a subscription service can no longer physically pay out fees, although it would have went bankrupt well before then. Looking at this chart and the others, and knowing that the average listening time for music is 2.5 hours a day, .003 cents still seems to be the most likely candidate for the payment per stream.

Anything above this at the current cost per month, would bankrupt any subscription music service. To sustain a compulsory rate of one penny, subscription music services would have to increase the monthly cost to 60 dollars listeners must not exceed 2.5 hours of listening or 50 songs a day.

Conclusion

At the beginning of this essay I set out to answer 4 questions about the potential revenue and costs as the music industry switches to subscription streaming. After exploring the various scenarios, the conclusion that can be drawn is that there is significant revenue that can be generated by the services as a whole, but the individual stream payments will remain in fractions of a cent and will only decrease as the services become more popular.

Devils Advocate: Possible arguments against my claims and my responses.

Q: This does not take into account advertising revenue.

This is because premium versions of subscription services, the 10-dollar a month kind, are built on the premise of no advertising. The ad supported networks will generate even less revenue. Ads are generally sold on CPM. If an ad was sold on every play (which is not the case) a CPM of 79.82 would be required at 2.5 hours of listening to equal the same revenue as subscription services. This is extremely high for a passive audience.

Q: This doesn’t use the exact formulas the subscription services currently employ.

The formulas in this essay are based on the mathematically fairest division out there. This is the perfect scenario. The actual case will be slightly different, but as shown in numerous calculations the per-stream payment will almost always be in fractions of a cent at the current monthly cost.

Q: You are not taking into account the promotional aspect. Streaming promotes other revenue streams.

This argument is true at the lower levels of household adoption, but begins to fall apart as more people use the service. This is because as subscription music becomes the dominant medium for music consumption, there will be less and less physical or file sales to benefit from the supposed promotion. To put it another way, if everyone is getting their music from subscription music services then the only thing you are promoting is other subscription music. In regards to merchandise, tickets or any of the other ancillary revenue streams, it is true that streaming will promote them, but the current and former methods of music consumption also did that. I’d be interested to see any proof that streaming music is somehow a more efficient promoter of these other revenue streams.

Q: These calculations are based on a 50/50 split. If we increase artist revenue the per-stream payments will go up.

Yes and no. This could be true, but it again depends on the ratio. If the plays go up at a faster pace than the revenue pool is increased then the per-stream payments will not go up and possibly could go down. The compulsory sustainability section was based upon a 100% revenue pool and this is the absolute maximum that a subscription company could pay out at the current monthly costs. Looking at that you can see that subscription music is practically unsustainable after a penny a play.

About:

Frank Woodworth is a ten year veteran of the music industry and the founder of www.glacialconcepts.com. He has previously been selected to “30 under 30” music executives by Billboard magazine, and has twice spoken at the CMJ Music Festival.

No comments:

Post a Comment